- Hong Kong

- /

- Consumer Durables

- /

- SEHK:464

Revenues Not Telling The Story For China In-Tech Limited (HKG:464) After Shares Rise 36%

China In-Tech Limited (HKG:464) shareholders would be excited to see that the share price has had a great month, posting a 36% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 69%.

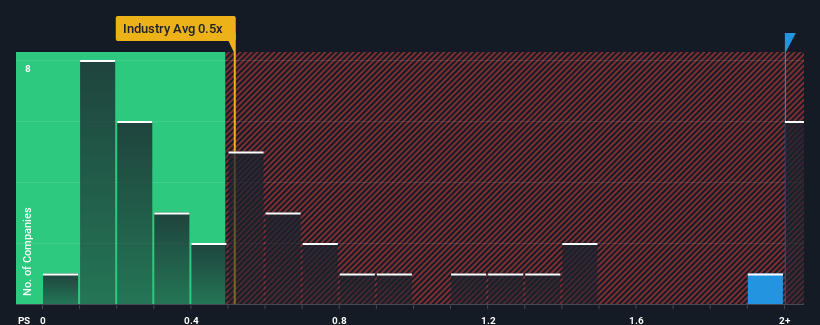

Following the firm bounce in price, when almost half of the companies in Hong Kong's Consumer Durables industry have price-to-sales ratios (or "P/S") below 0.5x, you may consider China In-Tech as a stock probably not worth researching with its 2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for China In-Tech

How Has China In-Tech Performed Recently?

For instance, China In-Tech's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China In-Tech will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For China In-Tech?

China In-Tech's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 42%. The last three years don't look nice either as the company has shrunk revenue by 67% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 34% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that China In-Tech is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From China In-Tech's P/S?

China In-Tech shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that China In-Tech currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - China In-Tech has 3 warning signs we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:464

China In-Tech

An investment holding company, designs, manufactures, and sells electrical haircare and healthcare products, and other small household electrical appliances in Asia, Europe, North and South America, and Australia.

Low risk with imperfect balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026