- Hong Kong

- /

- Consumer Durables

- /

- SEHK:3882

While shareholders of Sky Light Holdings (HKG:3882) are in the black over 1 year, those who bought a week ago aren't so fortunate

Sky Light Holdings Limited (HKG:3882) shareholders have seen the share price descend 17% over the month. But that doesn't change the fact that the returns over the last year have been spectacular. In that time, shareholders have had the pleasure of a 673% boost to the share price. So it is not that surprising to see the stock retrace a little. The real question is whether the fundamental business performance can justify the strong increase over the long term. We love happy stories like this one. The company should be really proud of that performance!

While the stock has fallen 14% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for Sky Light Holdings

While Sky Light Holdings made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Sky Light Holdings grew its revenue by 11% last year. That's not great considering the company is losing money. So it's truly surprising that the share price rocketed 673% in a single year. It's great to see that some have made big profits, but we aren't so sure that the increase is justified. This is an example of the huge profits some lucky shareholders occasionally make on growth stocks.

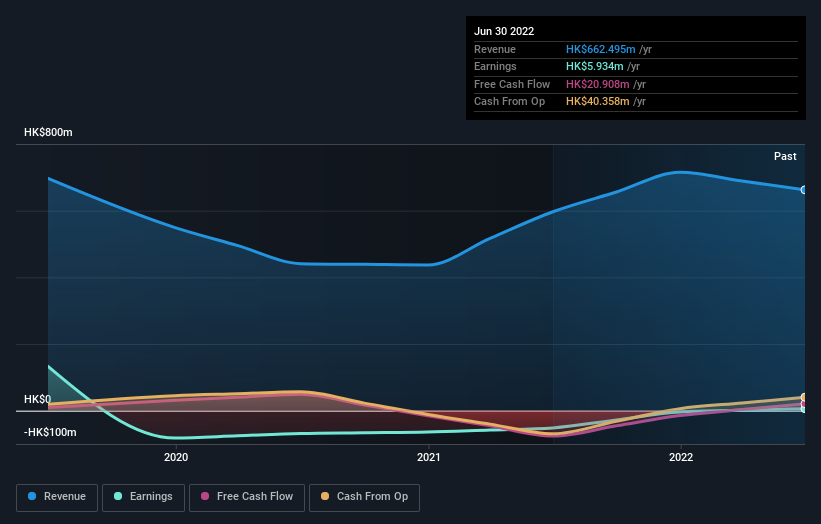

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Dive deeper into the earnings by checking this interactive graph of Sky Light Holdings' earnings, revenue and cash flow.

A Different Perspective

It's good to see that Sky Light Holdings has rewarded shareholders with a total shareholder return of 673% in the last twelve months. That's better than the annualised return of 2% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Sky Light Holdings , and understanding them should be part of your investment process.

Sky Light Holdings is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3882

Sky Light Holdings

An investment holding company, manufactures and distributes home surveillance cameras, digital imaging products, and other related products.

Excellent balance sheet minimal.

Market Insights

Community Narratives