China Healthwise Holdings Limited (HKG:348) Looks Inexpensive After Falling 26% But Perhaps Not Attractive Enough

Unfortunately for some shareholders, the China Healthwise Holdings Limited (HKG:348) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 59% loss during that time.

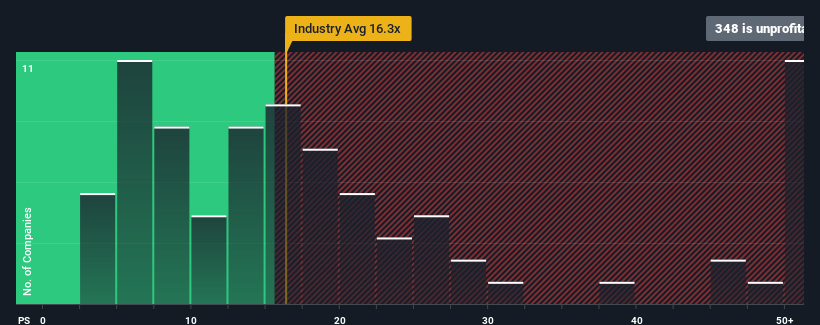

In spite of the heavy fall in price, China Healthwise Holdings may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of -1.5x, since almost half of all companies in Hong Kong have P/E ratios greater than 10x and even P/E's higher than 21x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings growth that's exceedingly strong of late, China Healthwise Holdings has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for China Healthwise Holdings

How Is China Healthwise Holdings' Growth Trending?

In order to justify its P/E ratio, China Healthwise Holdings would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 47% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 25% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that China Healthwise Holdings' P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Key Takeaway

Having almost fallen off a cliff, China Healthwise Holdings' share price has pulled its P/E way down as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that China Healthwise Holdings maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for China Healthwise Holdings (1 makes us a bit uncomfortable!) that you need to be mindful of.

You might be able to find a better investment than China Healthwise Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:348

China Healthwise Holdings

An investment holding company, sells Chinese health products in Hong Kong and The People’s Republic of China.

Slight and fair value.

Similar Companies

Market Insights

Community Narratives