Insiders At Citychamp Watch & Jewellery Group Sold HK$375m Of Stock Potentially Indicating Weakness

Even though Citychamp Watch & Jewellery Group Limited (HKG:256) stock gained 15% last week, insiders who sold HK$375m worth of stock over the past year are probably better off. Selling at an average price of HK$0.50, which is higher than the current price, may have been the wisest decision for these insiders as their investment would have been worth less now than when they sold.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we do think it is perfectly logical to keep tabs on what insiders are doing.

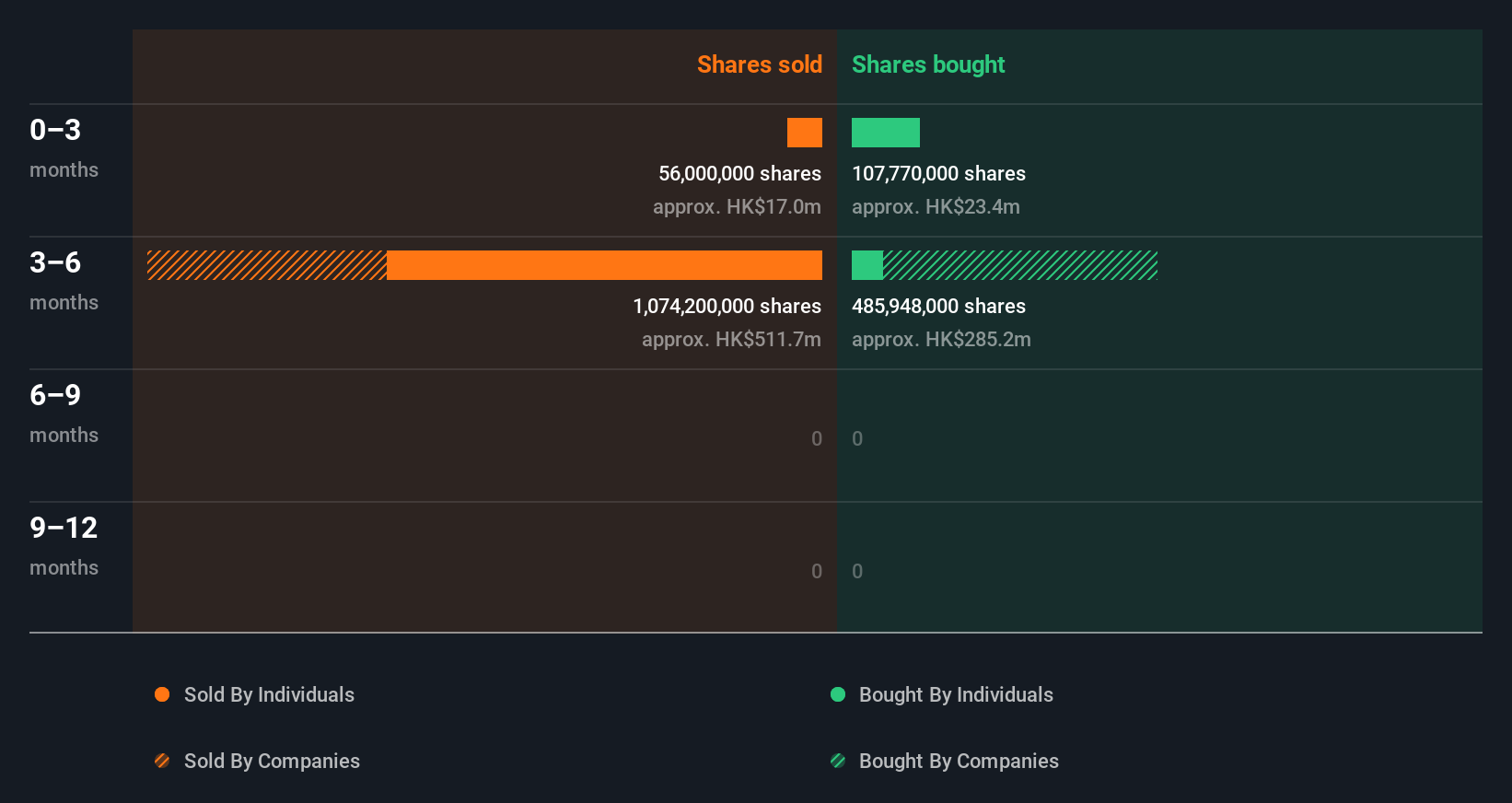

Citychamp Watch & Jewellery Group Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the Executive Chairman, Kwok Lung Hon, for HK$133m worth of shares, at about HK$0.70 per share. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. It's of some comfort that this sale was conducted at a price well above the current share price, which is HK$0.19. So it may not shed much light on insider confidence at current levels. The only individual insider seller over the last year was Kwok Lung Hon. Notably Kwok Lung Hon was also the biggest buyer, having purchased HK$49m worth of shares.

Kwok Lung Hon divested 748.90m shares over the last 12 months at an average price of HK$0.50. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Check out our latest analysis for Citychamp Watch & Jewellery Group

I will like Citychamp Watch & Jewellery Group better if I see some big insider buys. While we wait, check out this free list of undervalued and small cap stocks with considerable, recent, insider buying.

Insiders At Citychamp Watch & Jewellery Group Have Bought Stock Recently

At Citychamp Watch & Jewellery Group,over the last quarter, we have observed quite a lot more insider buying than insider selling. Executive Chairman Kwok Lung Hon spent HK$24m on stock. On the other hand, Executive Chairman Kwok Lung Hon netted HK$17m by selling. Insiders have spent more buying shares than they have selling, so on balance we think they are are probably optimistic.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Citychamp Watch & Jewellery Group insiders own about HK$450m worth of shares (which is 54% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At Citychamp Watch & Jewellery Group Tell Us?

It's certainly positive to see the recent insider purchase. On the other hand the transaction history, over the last year, isn't so positive. The recent buying by an insider , along with high insider ownership, suggest that Citychamp Watch & Jewellery Group insiders are fairly aligned, and optimistic. While it's good to be aware of what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. For instance, we've identified 2 warning signs for Citychamp Watch & Jewellery Group (1 is a bit unpleasant) you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:256

Citychamp Watch & Jewellery Group

An investment holding company, manufactures, sells, and distributes watches and timepieces in Hong Kong, the People’s Republic of China, Switzerland, the United Kingdom, Liechtenstein, and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success