China Anchu Energy Storage Group Limited's (HKG:2399) CEO Compensation Looks Acceptable To Us And Here's Why

Key Insights

- China Anchu Energy Storage Group to hold its Annual General Meeting on 30th of May

- Total pay for CEO Hon Fung Kwok includes CN¥541.0k salary

- The overall pay is 69% below the industry average

- Over the past three years, China Anchu Energy Storage Group's EPS grew by 78% and over the past three years, the total loss to shareholders 54%

Performance at China Anchu Energy Storage Group Limited (HKG:2399) has been rather uninspiring recently and shareholders may be wondering how CEO Hon Fung Kwok plans to fix this. At the next AGM coming up on 30th of May, they can influence managerial decision making through voting on resolutions, including executive remuneration. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. In our opinion, CEO compensation does not look excessive and we discuss why.

See our latest analysis for China Anchu Energy Storage Group

How Does Total Compensation For Hon Fung Kwok Compare With Other Companies In The Industry?

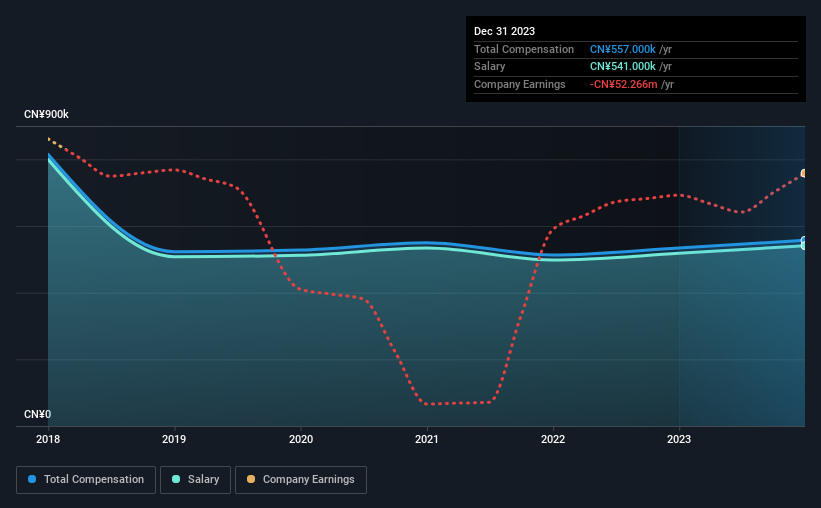

According to our data, China Anchu Energy Storage Group Limited has a market capitalization of HK$837m, and paid its CEO total annual compensation worth CN¥557k over the year to December 2023. That's a fairly small increase of 4.3% over the previous year. Notably, the salary which is CN¥541.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the Hong Kong Luxury industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was CN¥1.8m. That is to say, Hon Fung Kwok is paid under the industry median. What's more, Hon Fung Kwok holds HK$58m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥541k | CN¥518k | 97% |

| Other | CN¥16k | CN¥16k | 3% |

| Total Compensation | CN¥557k | CN¥534k | 100% |

On an industry level, around 94% of total compensation represents salary and 6% is other remuneration. China Anchu Energy Storage Group is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at China Anchu Energy Storage Group Limited's Growth Numbers

Over the past three years, China Anchu Energy Storage Group Limited has seen its earnings per share (EPS) grow by 78% per year. Its revenue is up 6.8% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has China Anchu Energy Storage Group Limited Been A Good Investment?

With a total shareholder return of -54% over three years, China Anchu Energy Storage Group Limited shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Hon Fung receives almost all of their compensation through a salary. The fact that shareholders have earned a negative share price return is certainly disconcerting. This diverges with the robust growth in EPS, suggesting that there is a large discrepancy between share price and fundamentals. A key question may be why the fundamentals have not yet been reflected into the share price. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 4 warning signs for China Anchu Energy Storage Group (of which 2 are a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from China Anchu Energy Storage Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2399

China Anchu Energy Storage Group

Designs, an investment holding company, manufactures and wholesales a range of menswear products under the FORDOO brand in the People’s Republic of China, Saudi Arabia, and other Middle Eastern countries.

Very low and overvalued.

Market Insights

Community Narratives