The three-year shareholder returns and company earnings persist lower as Li Ning (HKG:2331) stock falls a further 5.9% in past week

Every investor on earth makes bad calls sometimes. But really big losses can really drag down an overall portfolio. So consider, for a moment, the misfortune of Li Ning Company Limited (HKG:2331) investors who have held the stock for three years as it declined a whopping 76%. That would certainly shake our confidence in the decision to own the stock. The last week also saw the share price slip down another 5.9%.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

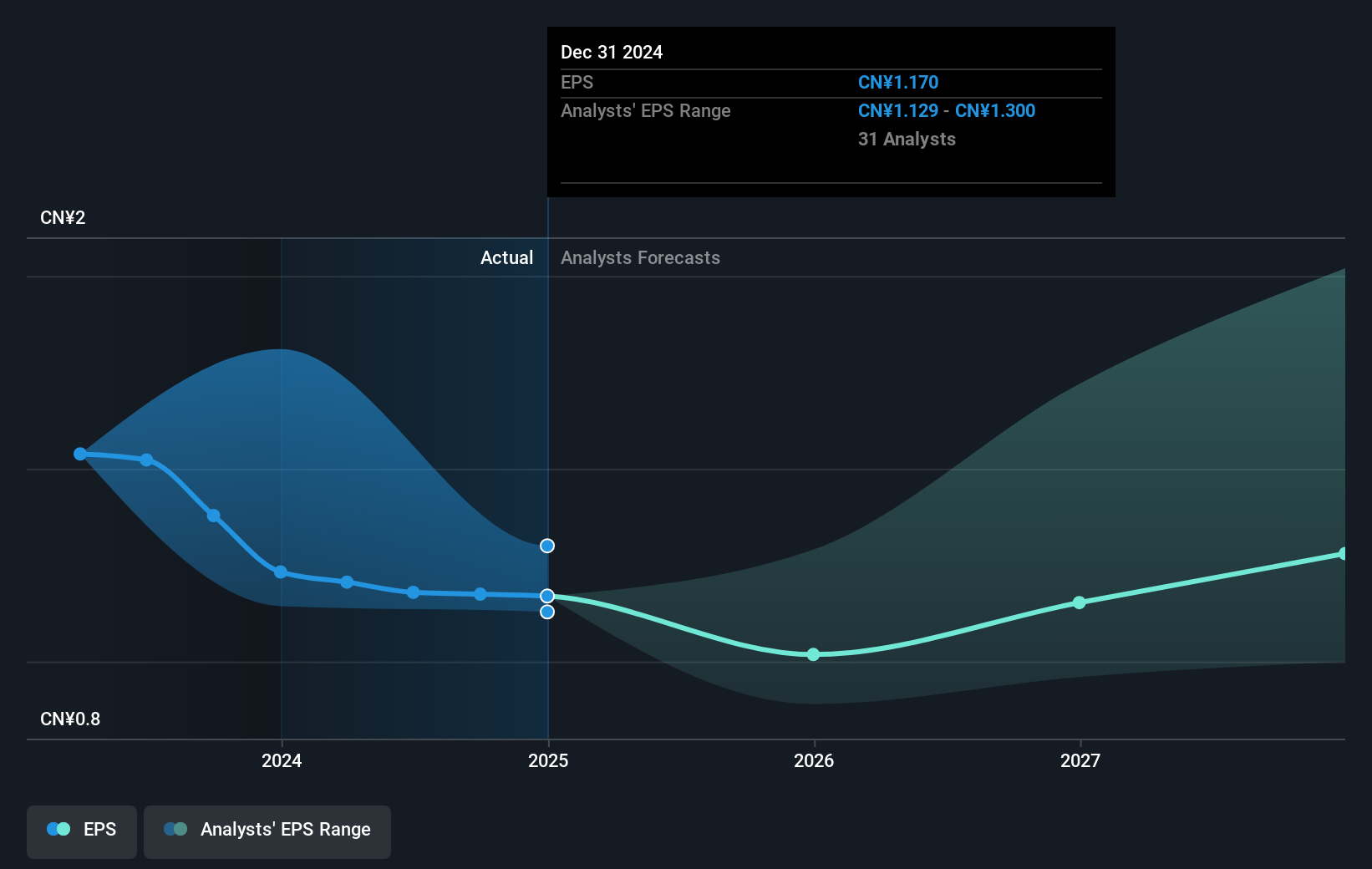

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the three years that the share price fell, Li Ning's earnings per share (EPS) dropped by 9.9% each year. This reduction in EPS is slower than the 38% annual reduction in the share price. So it seems the market was too confident about the business, in the past.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. It might be well worthwhile taking a look at our free report on Li Ning's earnings, revenue and cash flow.

A Different Perspective

Li Ning shareholders are up 11% for the year (even including dividends). But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 5% endured over half a decade. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Li Ning better, we need to consider many other factors. For instance, we've identified 1 warning sign for Li Ning that you should be aware of.

Li Ning is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2331

Li Ning

A sports brand company, engages in the research and development, design, manufacture, marketing, distribution, and retail of sporting goods in the People’s Republic of China.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives