- Hong Kong

- /

- Consumer Durables

- /

- SEHK:229

Shareholders May Not Be So Generous With Raymond Industrial Limited's (HKG:229) CEO Compensation And Here's Why

Key Insights

- Raymond Industrial to hold its Annual General Meeting on 20th of May

- Total pay for CEO John Wong includes HK$3.99m salary

- The overall pay is 106% above the industry average

- Over the past three years, Raymond Industrial's EPS grew by 1.9% and over the past three years, the total shareholder return was 1.0%

Under the guidance of CEO John Wong, Raymond Industrial Limited (HKG:229) has performed reasonably well recently. As shareholders go into the upcoming AGM on 20th of May, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders will still be cautious of paying the CEO excessively.

See our latest analysis for Raymond Industrial

Comparing Raymond Industrial Limited's CEO Compensation With The Industry

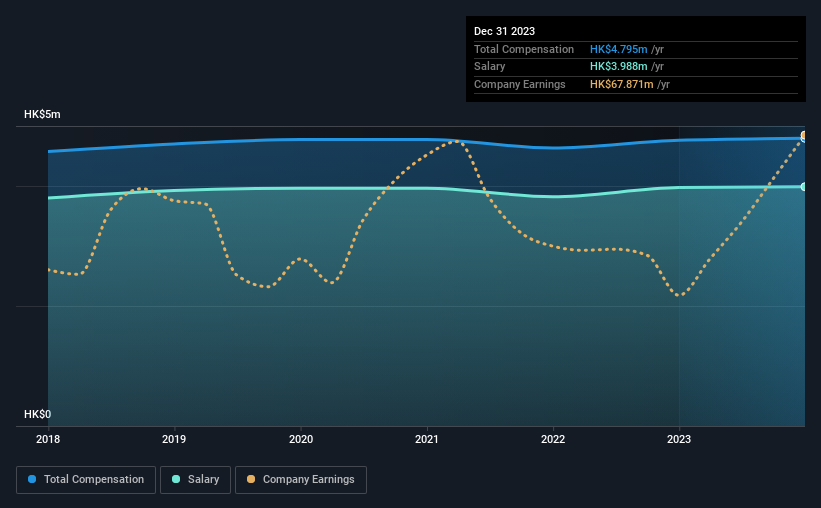

At the time of writing, our data shows that Raymond Industrial Limited has a market capitalization of HK$521m, and reported total annual CEO compensation of HK$4.8m for the year to December 2023. That's mostly flat as compared to the prior year's compensation. We note that the salary portion, which stands at HK$3.99m constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the Hong Kong Consumer Durables industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$2.3m. Hence, we can conclude that John Wong is remunerated higher than the industry median. What's more, John Wong holds HK$61m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$4.0m | HK$4.0m | 83% |

| Other | HK$807k | HK$790k | 17% |

| Total Compensation | HK$4.8m | HK$4.8m | 100% |

Speaking on an industry level, nearly 89% of total compensation represents salary, while the remainder of 11% is other remuneration. Our data reveals that Raymond Industrial allocates salary more or less in line with the wider market. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Raymond Industrial Limited's Growth Numbers

Over the past three years, Raymond Industrial Limited has seen its earnings per share (EPS) grow by 1.9% per year. It achieved revenue growth of 28% over the last year.

We like the look of the strong year-on-year improvement in revenue. And in that context, the modest EPS improvement certainly isn't shabby. So while we'd stop short of saying growth is absolutely outstanding, there are definitely some clear positives! We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Raymond Industrial Limited Been A Good Investment?

Raymond Industrial Limited has generated a total shareholder return of 1.0% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Raymond Industrial that investors should think about before committing capital to this stock.

Important note: Raymond Industrial is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you're looking to trade Raymond Industrial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:229

Raymond Industrial

Engages in the manufacture and sale of electrical home appliances in Asia, Europe, Latin America, North America, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives