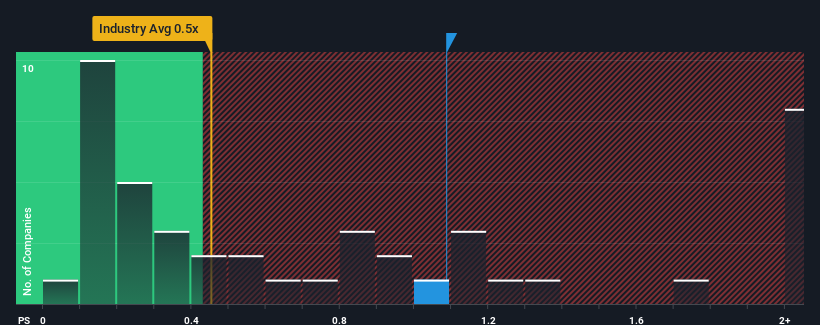

Vesync Co., Ltd's (HKG:2148) price-to-sales (or "P/S") ratio of 1.1x may not look like an appealing investment opportunity when you consider close to half the companies in the Consumer Durables industry in Hong Kong have P/S ratios below 0.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Vesync

What Does Vesync's P/S Mean For Shareholders?

Recent times have been pleasing for Vesync as its revenue has risen in spite of the industry's average revenue going into reverse. It seems that many are expecting the company to continue defying the broader industry adversity, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Vesync will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Vesync?

The only time you'd be truly comfortable seeing a P/S as high as Vesync's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 8.0% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 185% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 17% per annum as estimated by the five analysts watching the company. That's shaping up to be materially higher than the 14% each year growth forecast for the broader industry.

With this in mind, it's not hard to understand why Vesync's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Vesync maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Consumer Durables industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 2 warning signs for Vesync that you need to take into consideration.

If these risks are making you reconsider your opinion on Vesync, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2148

Vesync

Engages in the research and development, manufacture, and sale of smart household appliances and smart home devices in North America, Europe, and Asia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives