- Hong Kong

- /

- Entertainment

- /

- SEHK:2400

Top SEHK Stocks Estimated To Be Undervalued In July 2024

Reviewed by Simply Wall St

The Hong Kong market has been experiencing a period of uncertainty, with the Hang Seng Index retreating 2.28% recently due to mixed economic signals and investor sentiment. Despite these challenges, there are opportunities for discerning investors who focus on undervalued stocks that have strong fundamentals and potential for growth. In this article, we will explore three stocks listed on the SEHK that are estimated to be undervalued in July 2024.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Giant Biogene Holding (SEHK:2367) | HK$40.50 | HK$76.51 | 47.1% |

| COSCO SHIPPING Energy Transportation (SEHK:1138) | HK$9.38 | HK$16.44 | 42.9% |

| Beauty Farm Medical and Health Industry (SEHK:2373) | HK$16.70 | HK$32.98 | 49.4% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$28.25 | HK$49.09 | 42.4% |

| Mobvista (SEHK:1860) | HK$1.92 | HK$3.70 | 48.2% |

| WuXi XDC Cayman (SEHK:2268) | HK$17.90 | HK$32.39 | 44.7% |

| AK Medical Holdings (SEHK:1789) | HK$4.32 | HK$8.09 | 46.6% |

| Q Technology (Group) (SEHK:1478) | HK$4.36 | HK$8.39 | 48% |

| MicroPort Scientific (SEHK:853) | HK$5.35 | HK$9.81 | 45.5% |

| Vobile Group (SEHK:3738) | HK$1.31 | HK$2.32 | 43.6% |

We're going to check out a few of the best picks from our screener tool.

Everest Medicines (SEHK:1952)

Overview: Everest Medicines Limited is a biopharmaceutical company focused on discovering, licensing, developing, and commercializing therapies and vaccines for critical unmet medical needs in Greater China and other Asia Pacific markets, with a market cap of HK$6.27 billion.

Operations: The company generates revenue primarily from its pharmaceutical segment, which amounted to CN¥125.93 million.

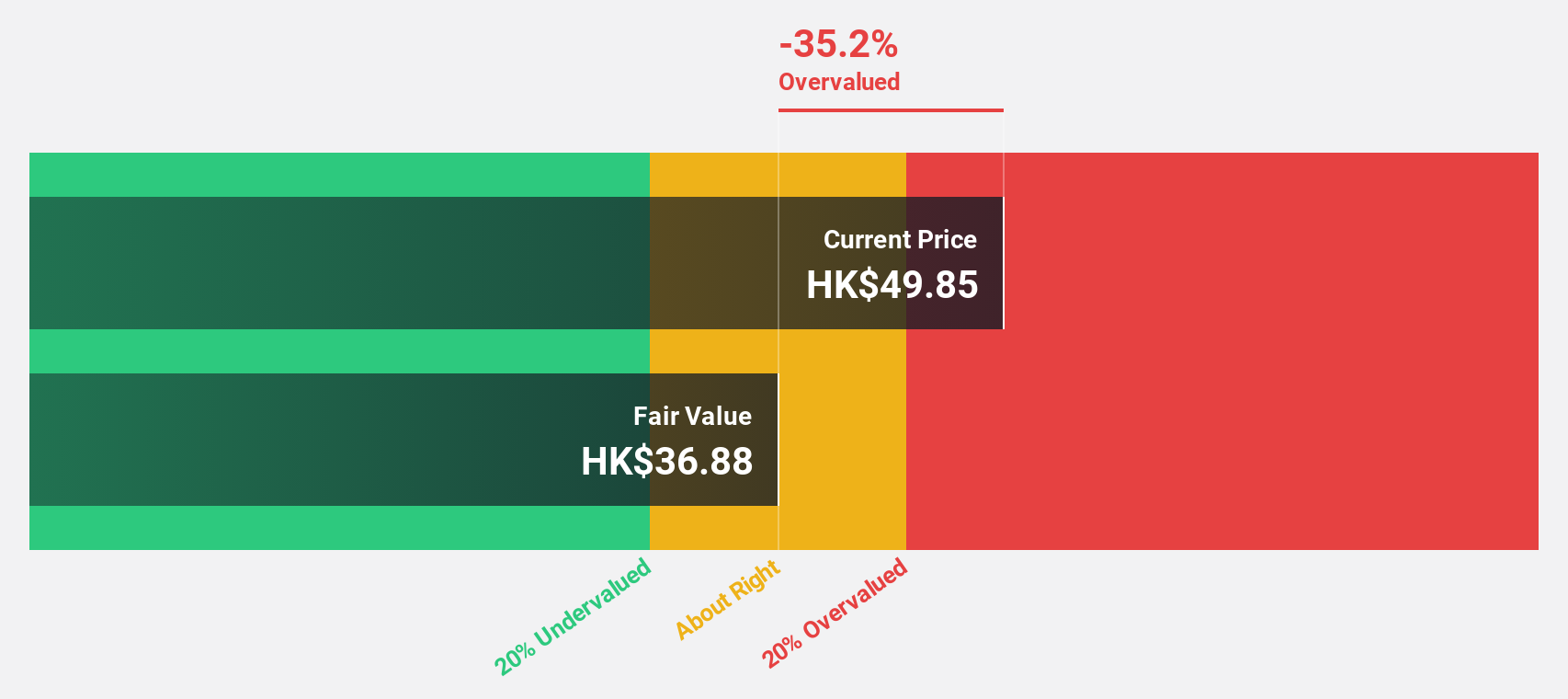

Estimated Discount To Fair Value: 20.1%

Everest Medicines is trading 20.1% below its estimated fair value of HK$24.46, suggesting it may be undervalued based on cash flows. The company expects revenue to grow at 37.8% annually, significantly outpacing the Hong Kong market's 7.4%. Despite shareholder dilution over the past year, Everest is forecast to become profitable within three years and has shown strong earnings growth potential with a projected annual increase of 76.28%. Recent product approvals and clinical trial advancements further bolster its growth prospects.

- Our comprehensive growth report raises the possibility that Everest Medicines is poised for substantial financial growth.

- Dive into the specifics of Everest Medicines here with our thorough financial health report.

ANTA Sports Products (SEHK:2020)

Overview: ANTA Sports Products Limited, with a market cap of HK$198.57 billion, engages in the research and development, design, manufacturing, and marketing of shoes, apparel, and accessories in Mainland China, Hong Kong, Macao, and internationally.

Operations: The company's revenue segments are as follows: ANTA Brand: CN¥30.31 billion, FILA Brand: CN¥25.10 billion, and All Other Brands: CN¥6.95 billion.

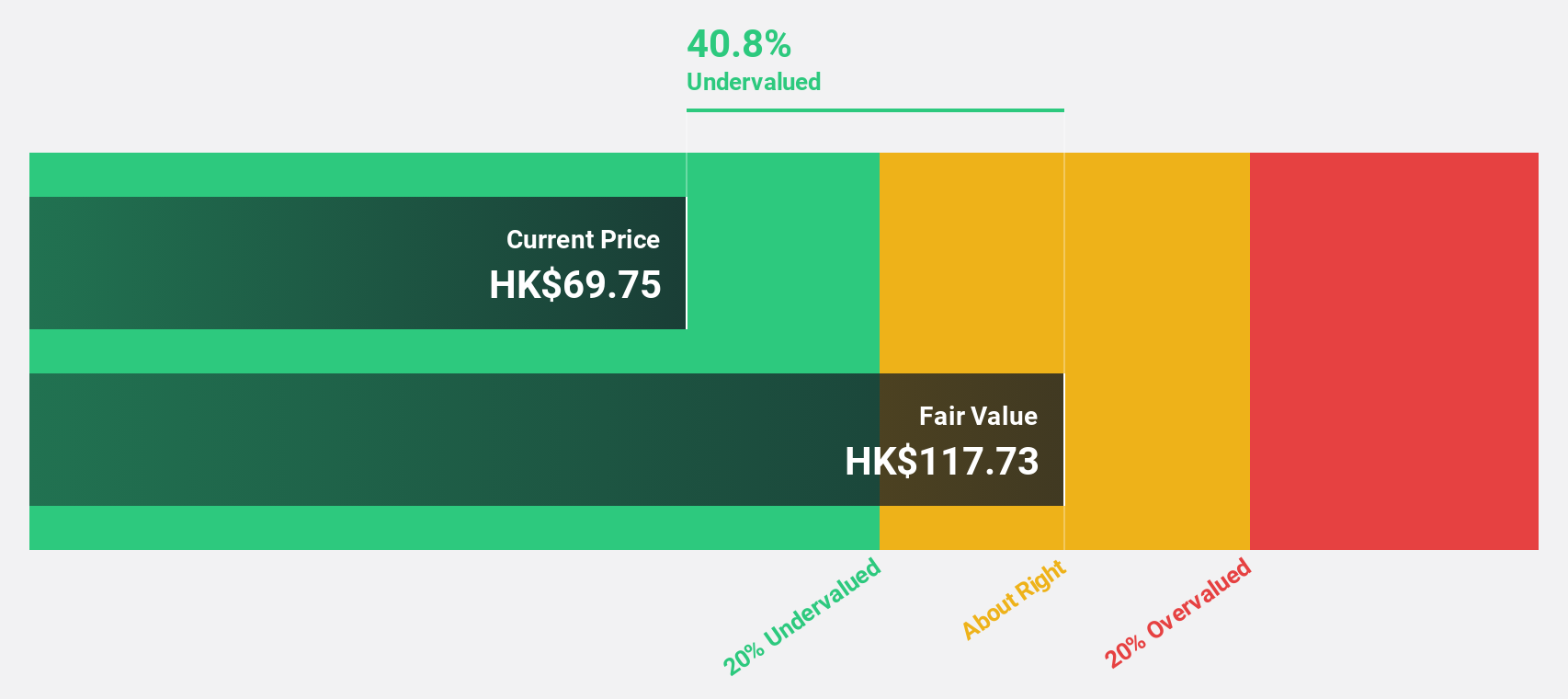

Estimated Discount To Fair Value: 41.5%

ANTA Sports Products is trading at HK$70.1, well below its estimated fair value of HK$119.74, indicating significant undervaluation based on cash flows. The company has shown robust earnings growth of 34.9% over the past year and is expected to grow profits by 12.7% annually, outpacing the Hong Kong market's 11.3%. Recent sales reports highlight positive growth across all branded products, reinforcing its strong revenue outlook despite slower projected revenue growth compared to earnings.

- Our expertly prepared growth report on ANTA Sports Products implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of ANTA Sports Products.

XD (SEHK:2400)

Overview: XD Inc. (SEHK:2400) is an investment holding company that develops, publishes, operates, and distributes mobile and web games in Mainland China and internationally, with a market cap of HK$10.84 billion.

Operations: The company's revenue segments include CN¥2.09 billion from games and CN¥1.30 billion from the TapTap platform.

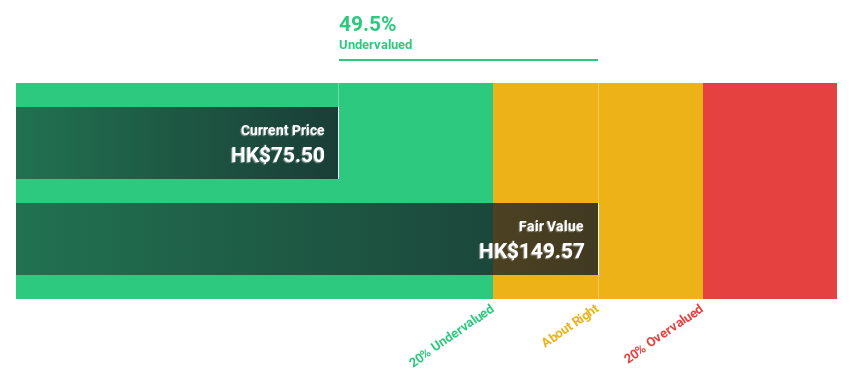

Estimated Discount To Fair Value: 22.9%

XD Inc. is trading at HK$22.95, significantly below its estimated fair value of HK$29.76, reflecting substantial undervaluation based on cash flows. The company is expected to achieve profitability within three years with a forecasted earnings growth rate of 56.8% per year and revenue growth of 16.1% annually, outpacing the Hong Kong market's average. Recent amendments to the company's bylaws were approved at the AGM, potentially enhancing corporate governance and shareholder value in the long term.

- Our growth report here indicates XD may be poised for an improving outlook.

- Click here to discover the nuances of XD with our detailed financial health report.

Summing It All Up

- Unlock more gems! Our Undervalued SEHK Stocks Based On Cash Flows screener has unearthed 34 more companies for you to explore.Click here to unveil our expertly curated list of 37 Undervalued SEHK Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2400

XD

An investment holding company, develops, publishes, operates, and distributes mobile and web games in Mainland China and internationally.

High growth potential with excellent balance sheet.