- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7762

Asian Dividend Stocks: 3 Top Picks For Your Portfolio

Reviewed by Simply Wall St

Amid a backdrop of easing U.S.-China trade tensions and positive movements in major Asian indices, investors are increasingly turning their attention to dividend stocks as a source of steady income. In such uncertain times, stocks that offer reliable dividends can be particularly appealing, providing both potential stability and returns in an evolving market landscape.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.23% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.72% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.91% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.97% | ★★★★★★ |

| NCD (TSE:4783) | 4.61% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.83% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.90% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.55% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.38% | ★★★★★★ |

Click here to see the full list of 1019 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

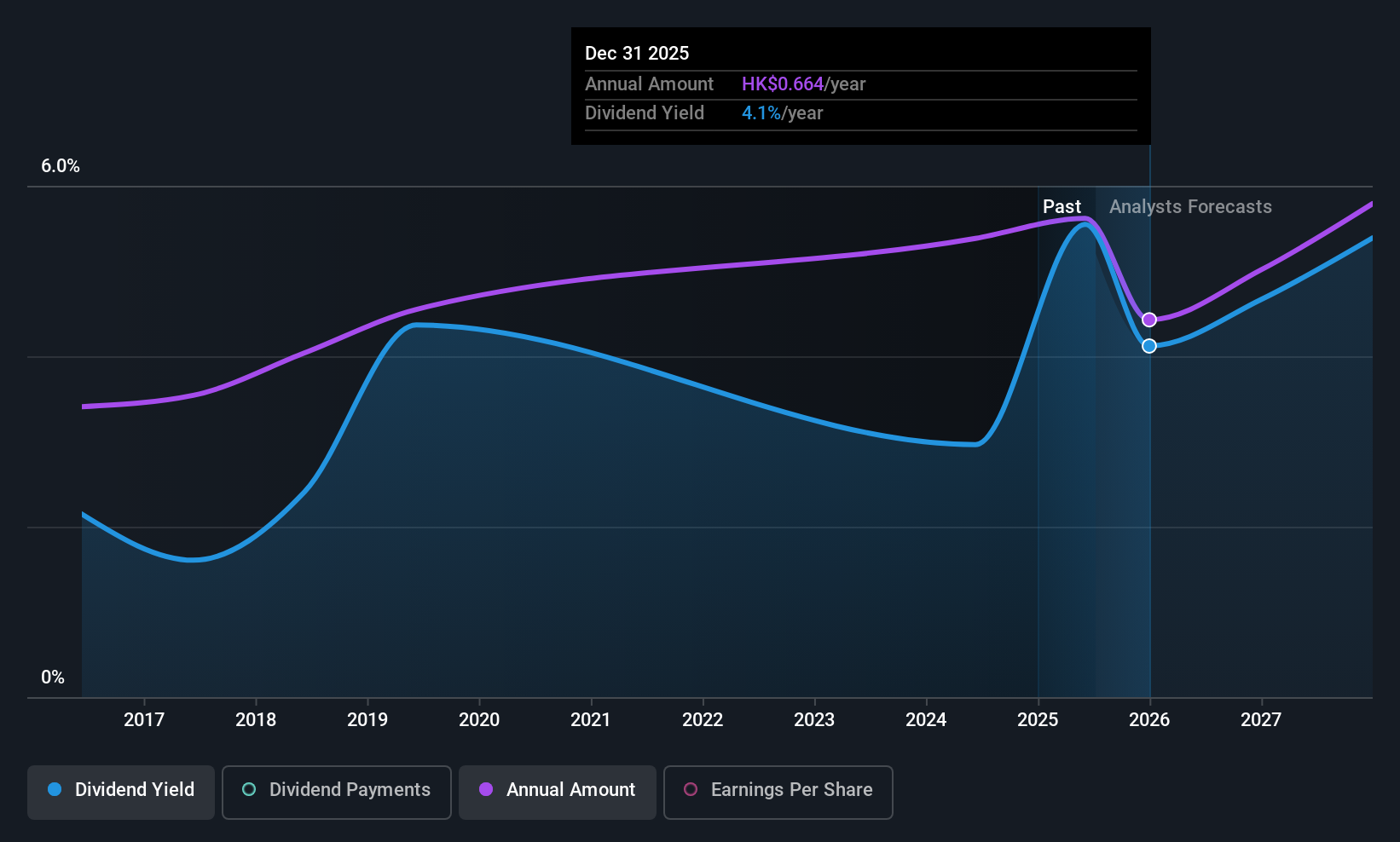

Samsonite Group (SEHK:1910)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samsonite Group S.A. designs, manufactures, sources, and distributes luggage and travel accessories across Asia, North America, Europe, and Latin America with a market cap of HK$26.42 billion.

Operations: Samsonite Group's revenue segments include the design, manufacture, sourcing, and distribution of luggage, business and computer bags, outdoor and casual bags, as well as travel accessories across its key markets.

Dividend Yield: 4.4%

Samsonite Group's dividend payments have been volatile over the past decade, with a current yield of 4.37%, which is below the top quartile in Hong Kong. Despite this, dividends are well-covered by earnings (49.7% payout ratio) and cash flows (40.1% cash payout ratio). The company recently reported stable earnings growth but faces high debt levels. Recent refinancing efforts aim to optimize its debt structure without significantly altering cash interest expenses, potentially stabilizing future financial performance.

- Navigate through the intricacies of Samsonite Group with our comprehensive dividend report here.

- According our valuation report, there's an indication that Samsonite Group's share price might be on the cheaper side.

Aida Engineering (TSE:6118)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Aida Engineering, Ltd. is a company that manufactures and sells press machines, auto-processing lines, industrial robots, auto-conveyers, and dies across Japan, China, the rest of Asia, the Americas, and Europe with a market cap of ¥54.90 billion.

Operations: Aida Engineering, Ltd.'s revenue is segmented as follows: ¥12.64 billion from China, ¥46.45 billion from Japan, ¥13.54 billion from Europe, ¥17.94 billion from the Americas, and ¥10.38 billion from Asia (excluding China and Japan).

Dividend Yield: 3.7%

Aida Engineering offers a stable dividend yield of 3.66%, ranking in the top 25% of Japanese dividend payers. Its dividends have been reliably growing over the past decade, supported by low payout ratios: 40.3% from earnings and 35.8% from cash flows, ensuring sustainability. The stock trades at a favorable price-to-earnings ratio of 10.4x compared to the market's 14.3x, indicating good value relative to peers amidst consistent earnings growth projections and recent profit increases.

- Delve into the full analysis dividend report here for a deeper understanding of Aida Engineering.

- The valuation report we've compiled suggests that Aida Engineering's current price could be quite moderate.

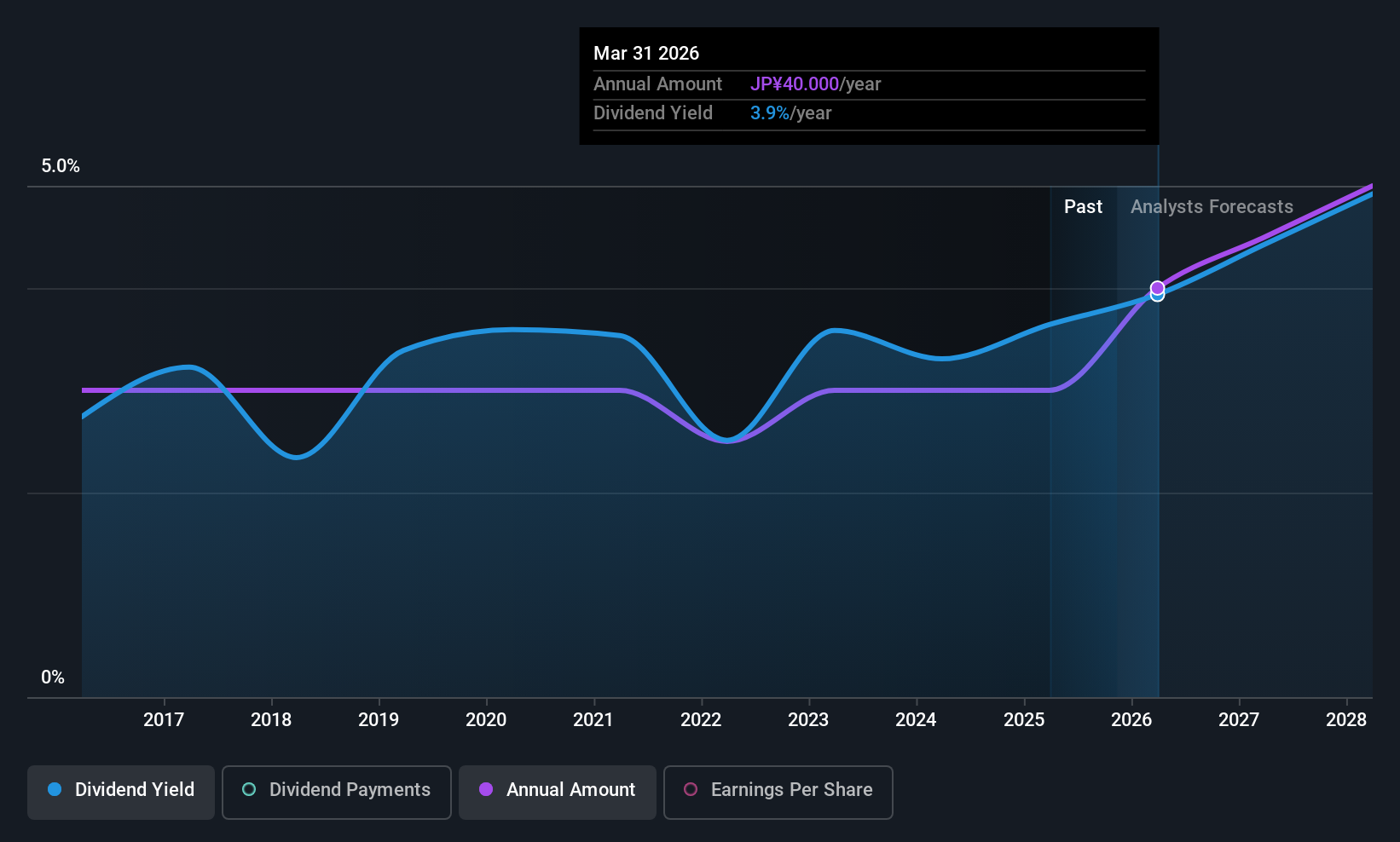

Citizen Watch (TSE:7762)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Citizen Watch Co., Ltd. is a global manufacturer and seller of watches and related components, with a market capitalization of ¥288.50 billion.

Operations: Citizen Watch Co., Ltd.'s revenue is primarily derived from its Watch Business, generating ¥177.09 billion, and its Machine Tools Business, contributing ¥75.95 billion.

Dividend Yield: 4%

Citizen Watch's dividend yield of 3.97% positions it among the top 25% of Japanese dividend payers, with a payout ratio of 44.8%, indicating dividends are well-covered by earnings and cash flows. However, its dividend history is marked by volatility, including annual drops over 20%. Despite trading at a favorable P/E ratio of 11.8x compared to the market's 14.3x, recent removal from the Nikkei 225 Index may impact investor perception.

- Click here and access our complete dividend analysis report to understand the dynamics of Citizen Watch.

- Our valuation report unveils the possibility Citizen Watch's shares may be trading at a discount.

Taking Advantage

- Access the full spectrum of 1019 Top Asian Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7762

Citizen Watch

Manufactures and sells watches and related components worldwide.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives