Is Sterling Group Holdings (HKG:1825) Using Debt In A Risky Way?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Sterling Group Holdings Limited (HKG:1825) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Sterling Group Holdings

What Is Sterling Group Holdings's Net Debt?

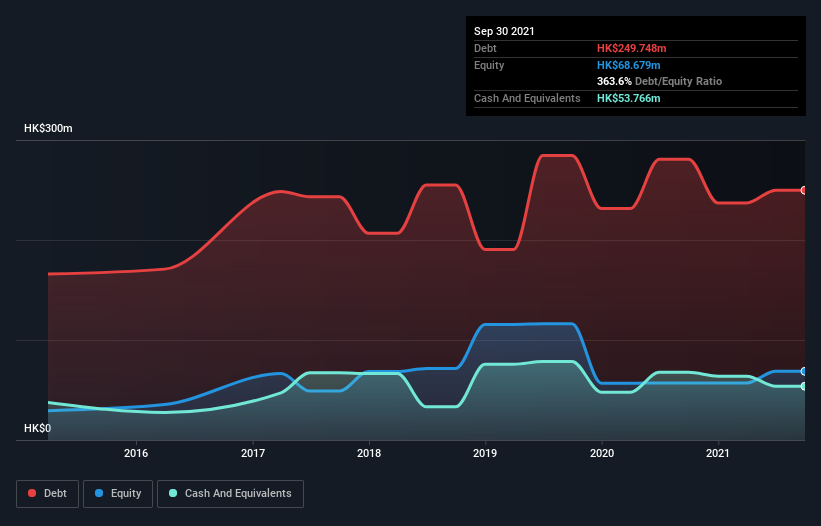

As you can see below, Sterling Group Holdings had HK$249.7m of debt at September 2021, down from HK$280.7m a year prior. However, it does have HK$53.8m in cash offsetting this, leading to net debt of about HK$196.0m.

How Strong Is Sterling Group Holdings' Balance Sheet?

We can see from the most recent balance sheet that Sterling Group Holdings had liabilities of HK$346.5m falling due within a year, and liabilities of HK$29.7m due beyond that. Offsetting this, it had HK$53.8m in cash and HK$238.5m in receivables that were due within 12 months. So its liabilities total HK$83.9m more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the HK$55.0m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Sterling Group Holdings would probably need a major re-capitalization if its creditors were to demand repayment. There's no doubt that we learn most about debt from the balance sheet. But it is Sterling Group Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Sterling Group Holdings made a loss at the EBIT level, and saw its revenue drop to HK$423m, which is a fall of 10.0%. We would much prefer see growth.

Caveat Emptor

Over the last twelve months Sterling Group Holdings produced an earnings before interest and tax (EBIT) loss. Indeed, it lost a very considerable HK$33m at the EBIT level. When we look at that alongside the significant liabilities, we're not particularly confident about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it had negative free cash flow of HK$17m over the last twelve months. That means it's on the risky side of things. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Sterling Group Holdings (of which 2 are concerning!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1825

Sterling Group Holdings

An investment holding company, manufactures and trades in apparel products in Hong Kong, the United States, and Europe.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026