Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Town Ray Holdings Limited (HKG:1692) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Town Ray Holdings

How Much Debt Does Town Ray Holdings Carry?

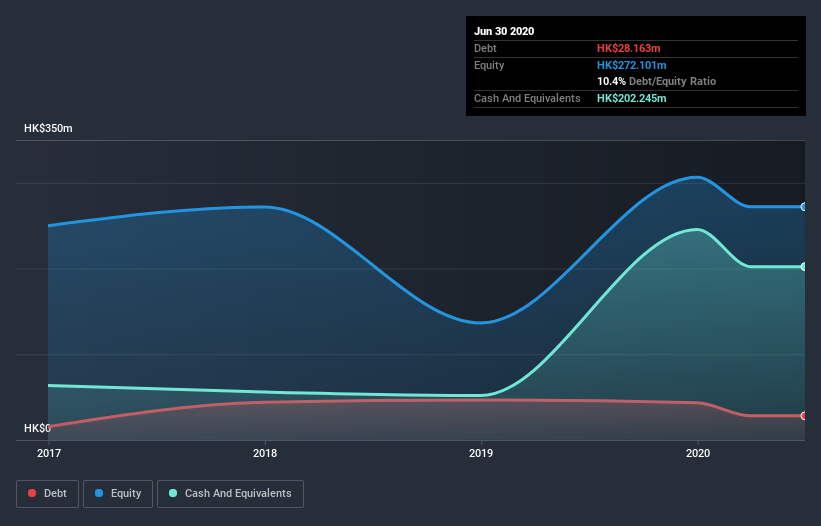

As you can see below, Town Ray Holdings had HK$28.2m of debt at June 2020, down from HK$46.7m a year prior. However, it does have HK$202.2m in cash offsetting this, leading to net cash of HK$174.1m.

How Healthy Is Town Ray Holdings's Balance Sheet?

We can see from the most recent balance sheet that Town Ray Holdings had liabilities of HK$127.5m falling due within a year, and liabilities of HK$8.09m due beyond that. On the other hand, it had cash of HK$202.2m and HK$60.5m worth of receivables due within a year. So it can boast HK$127.2m more liquid assets than total liabilities.

This luscious liquidity implies that Town Ray Holdings's balance sheet is sturdy like a giant sequoia tree. On this basis we think its balance sheet is strong like a sleek panther or even a proud lion. Succinctly put, Town Ray Holdings boasts net cash, so it's fair to say it does not have a heavy debt load!

In addition to that, we're happy to report that Town Ray Holdings has boosted its EBIT by 49%, thus reducing the spectre of future debt repayments. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Town Ray Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Town Ray Holdings has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, Town Ray Holdings actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing up

While it is always sensible to investigate a company's debt, in this case Town Ray Holdings has HK$174.1m in net cash and a decent-looking balance sheet. The cherry on top was that in converted 150% of that EBIT to free cash flow, bringing in HK$143m. At the end of the day we're not concerned about Town Ray Holdings's debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Town Ray Holdings , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Town Ray Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Town Ray Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1692

Town Ray Holdings

Manufactures and sells electrothermic household appliances in Europe, Asia, the United States, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives