- Hong Kong

- /

- Consumer Durables

- /

- SEHK:1692

Do Town Ray Holdings's (HKG:1692) Earnings Warrant Your Attention?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Town Ray Holdings (HKG:1692). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Town Ray Holdings

Town Ray Holdings's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. It's good to see that Town Ray Holdings's EPS have grown from HK$0.16 to HK$0.19 over twelve months. I doubt many would complain about that 21% gain.

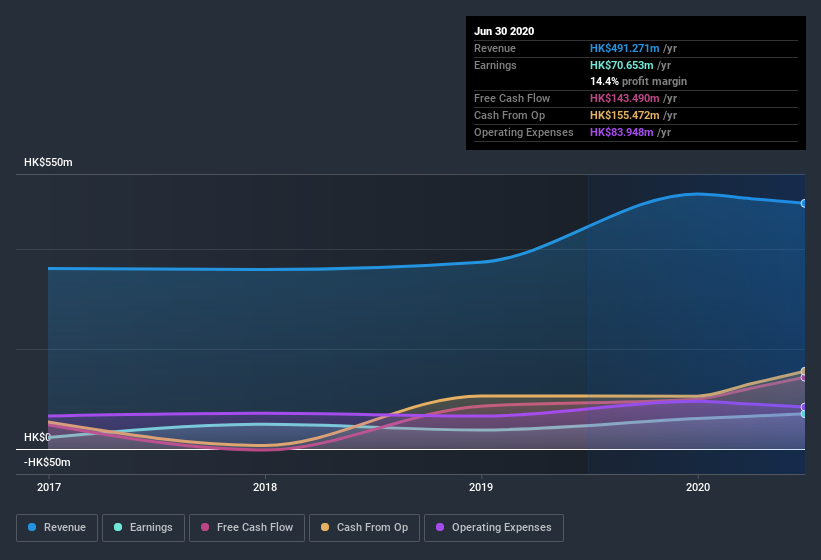

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Town Ray Holdings is growing revenues, and EBIT margins improved by 8.0 percentage points to 18%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Town Ray Holdings isn't a huge company, given its market capitalization of HK$309m. That makes it extra important to check on its balance sheet strength.

Are Town Ray Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Despite -HK$655k worth of sales, Town Ray Holdings insiders have overwhelmingly been buying the stock, spending HK$5.6m on purchases in the last twelve months. You could argue that level of buying implies genuine confidence in the business. We also note that it was the Co-founder & Non-Executive Director, Yuk Sim Cheng, who made the biggest single acquisition, paying HK$1.1m for shares at about HK$0.61 each.

Is Town Ray Holdings Worth Keeping An Eye On?

One positive for Town Ray Holdings is that it is growing EPS. That's nice to see. While some companies are struggling to grow EPS, Town Ray Holdings seems free from that morose affliction. The cherry on top is the insider share purchases, which provide an extra impetus to keep and eye on this stock, at the very least. You should always think about risks though. Case in point, we've spotted 2 warning signs for Town Ray Holdings you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Town Ray Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Town Ray Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Town Ray Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1692

Town Ray Holdings

Manufactures and sells electrothermic household appliances in Europe, Asia, the United States, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives