- Hong Kong

- /

- Consumer Durables

- /

- SEHK:1575

Regal Partners Holdings Limited (HKG:1575) May Have Run Too Fast Too Soon With Recent 42% Price Plummet

Regal Partners Holdings Limited (HKG:1575) shareholders won't be pleased to see that the share price has had a very rough month, dropping 42% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 70% share price decline.

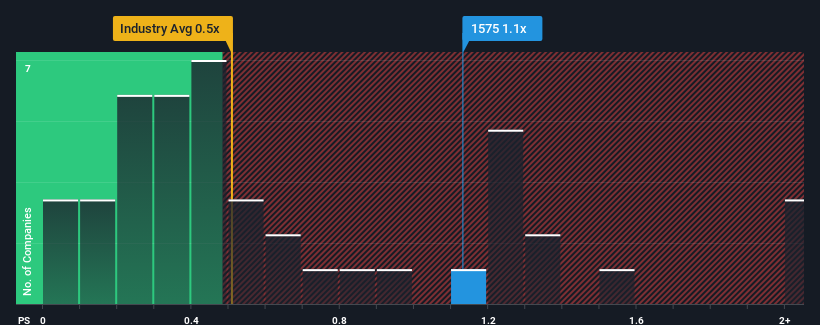

Although its price has dipped substantially, given close to half the companies operating in Hong Kong's Consumer Durables industry have price-to-sales ratios (or "P/S") below 0.5x, you may still consider Regal Partners Holdings as a stock to potentially avoid with its 1.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Our free stock report includes 4 warning signs investors should be aware of before investing in Regal Partners Holdings. Read for free now.View our latest analysis for Regal Partners Holdings

What Does Regal Partners Holdings' Recent Performance Look Like?

For instance, Regal Partners Holdings' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Regal Partners Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Regal Partners Holdings?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Regal Partners Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 36% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 76% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 9.4% shows it's an unpleasant look.

With this information, we find it concerning that Regal Partners Holdings is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Regal Partners Holdings' P/S remain high even after its stock plunged. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Regal Partners Holdings currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Regal Partners Holdings (2 can't be ignored) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Regal Partners Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1575

Regal Partners Holdings

An investment holding company, designs, manufactures, and sells sofas, sofa covers, and other furniture products in the People’s Republic of China, the United States, France, Norway, Spain, Ireland, the United Kingdom, and internationally.

Slight and overvalued.

Market Insights

Community Narratives