- Hong Kong

- /

- Consumer Durables

- /

- SEHK:146

Tai Ping Carpets International (HKG:146) Could Be A Buy For Its Upcoming Dividend

Tai Ping Carpets International Limited (HKG:146) is about to trade ex-dividend in the next 4 days. The ex-dividend date generally occurs two days before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade can take two business days or more to settle. Meaning, you will need to purchase Tai Ping Carpets International's shares before the 9th of December to receive the dividend, which will be paid on the 30th of December.

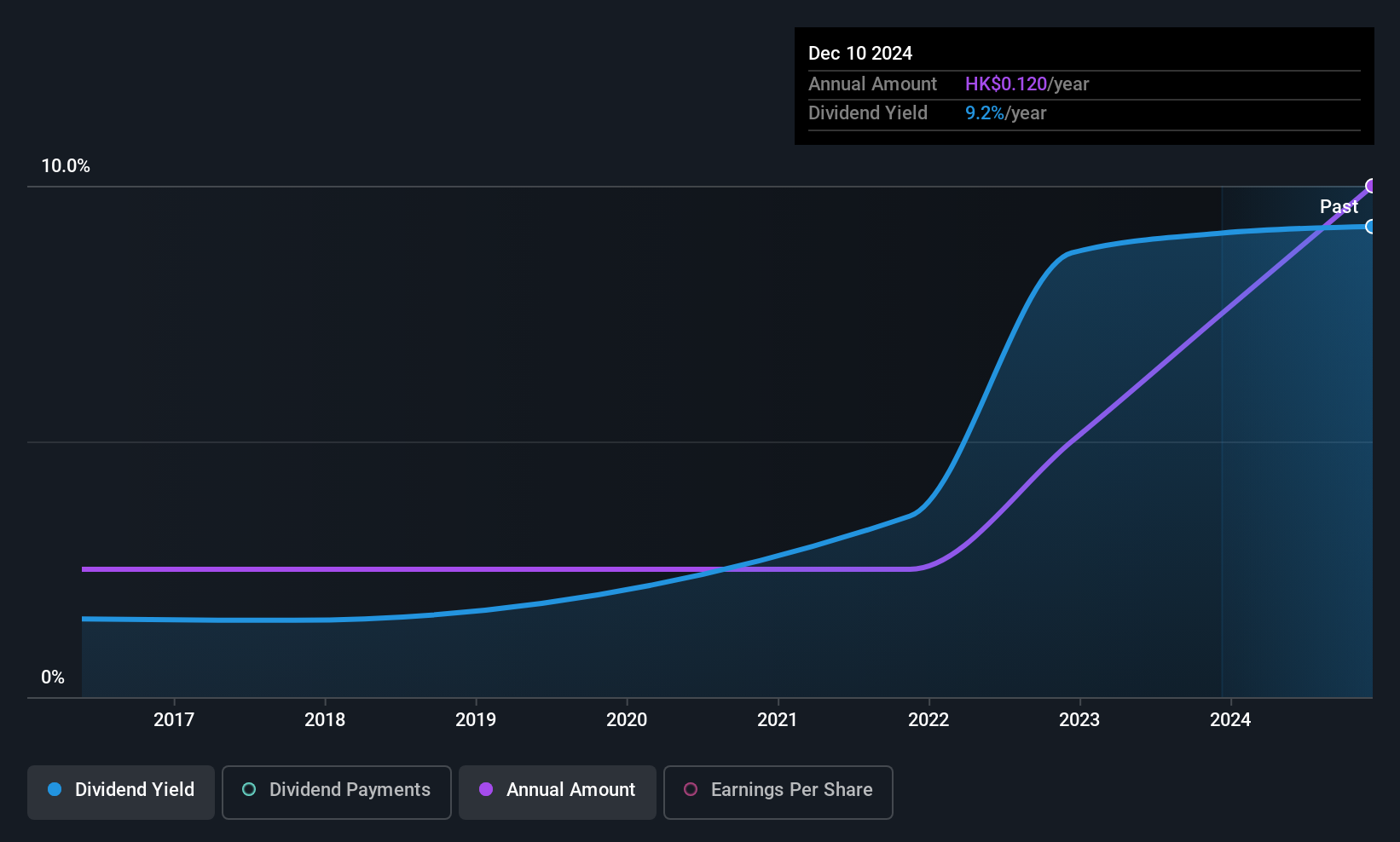

The company's next dividend payment will be HK$0.12 per share, on the back of last year when the company paid a total of HK$0.12 to shareholders. Based on the last year's worth of payments, Tai Ping Carpets International has a trailing yield of 6.4% on the current stock price of HK$1.88. If you buy this business for its dividend, you should have an idea of whether Tai Ping Carpets International's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Tai Ping Carpets International paid out 58% of its earnings to investors last year, a normal payout level for most businesses. A useful secondary check can be to evaluate whether Tai Ping Carpets International generated enough free cash flow to afford its dividend. Thankfully its dividend payments took up just 32% of the free cash flow it generated, which is a comfortable payout ratio.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Check out our latest analysis for Tai Ping Carpets International

Click here to see how much of its profit Tai Ping Carpets International paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. It's encouraging to see Tai Ping Carpets International has grown its earnings rapidly, up 44% a year for the past five years. Management appears to be striking a nice balance between reinvesting for growth and paying dividends to shareholders. With a reasonable payout ratio, profits being reinvested, and some earnings growth, Tai Ping Carpets International could have strong prospects for future increases to the dividend.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Tai Ping Carpets International's dividend payments are effectively flat on where they were 10 years ago.

To Sum It Up

From a dividend perspective, should investors buy or avoid Tai Ping Carpets International? We like Tai Ping Carpets International's growing earnings per share and the fact that - while its payout ratio is around average - it paid out a lower percentage of its cash flow. There's a lot to like about Tai Ping Carpets International, and we would prioritise taking a closer look at it.

On that note, you'll want to research what risks Tai Ping Carpets International is facing. Case in point: We've spotted 2 warning signs for Tai Ping Carpets International you should be aware of.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Tai Ping Carpets International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:146

Tai Ping Carpets International

Engages in the design, manufacture, import, export, and sale of carpets in Asia, Europe, the Middle East, the United States, and Africa.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026