Deyun Holding (HKG:1440) delivers shareholders impressive 103% return over 1 year, surging 16% in the last week alone

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Deyun Holding Ltd. (HKG:1440) share price has soared 103% in the last 1 year. Most would be very happy with that, especially in just one year! It's also good to see the share price up 35% over the last quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report. Deyun Holding hasn't been listed for long, so it's still not clear if it is a long term winner.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

Check out our latest analysis for Deyun Holding

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

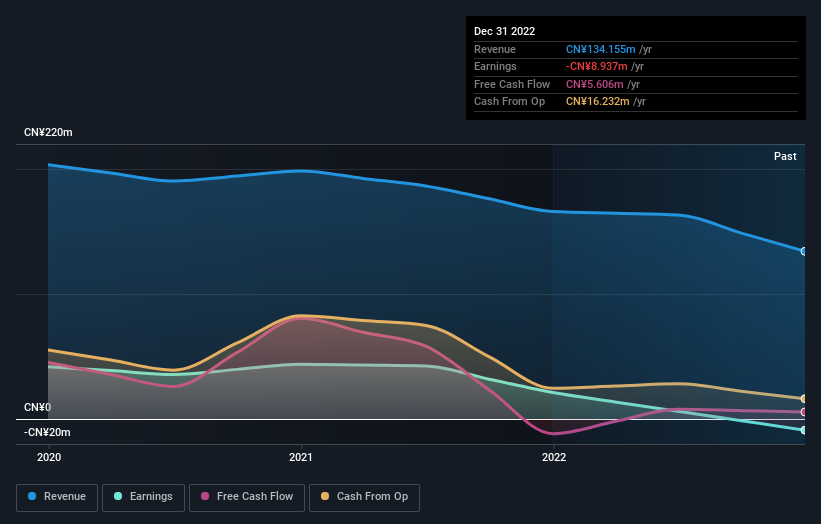

Over the last twelve months Deyun Holding went from profitable to unprofitable. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. It may be that the company has done well on other metrics.

Deyun Holding's revenue actually dropped 19% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on Deyun Holding's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Deyun Holding shareholders should be happy with the total gain of 103% over the last twelve months. And the share price momentum remains respectable, with a gain of 35% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Deyun Holding (1 can't be ignored) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1440

Star Shine Holdings Group

An investment holding company, engages in the manufacturing of lace and provision of dyeing services and footwear business in Mainland China and Hong Kong.

Mediocre balance sheet minimal.

Market Insights

Community Narratives