3 Growth Companies With High Insider Ownership Expecting Up To 37% Earnings Growth

Reviewed by Simply Wall St

In a week marked by fluctuating earnings reports and mixed economic signals, global markets have shown volatility, with major indices like the Nasdaq Composite and S&P MidCap 400 experiencing highs before sharp declines. Amidst this backdrop, identifying growth companies with high insider ownership can be appealing as these stocks often exhibit strong alignment between management and shareholders, potentially offering resilience in uncertain market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 14.8% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Underneath we present a selection of stocks filtered out by our screen.

BYD (SEHK:1211)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited, along with its subsidiaries, operates in the automobiles and batteries sectors across the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally with a market cap of approximately HK$900.93 billion.

Operations: Revenue Segments (in millions of CN¥):

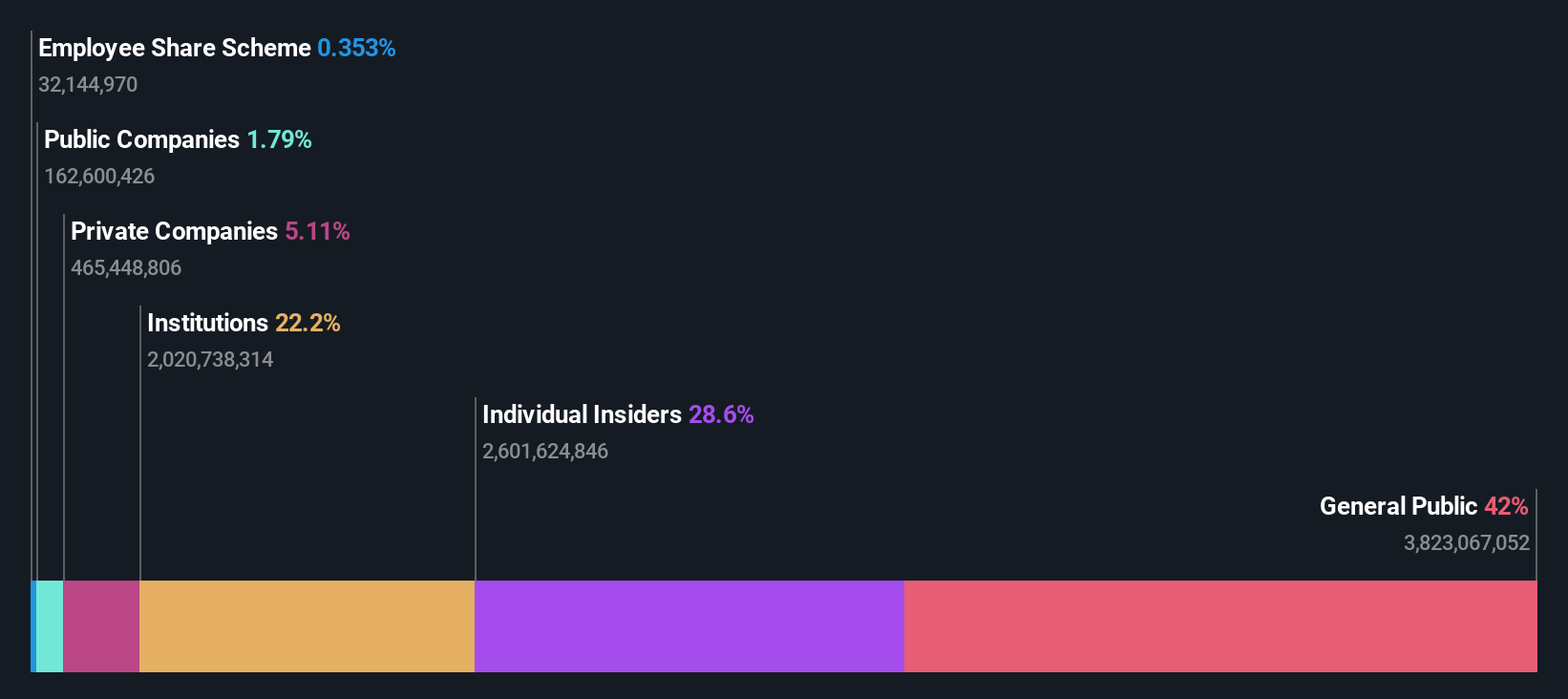

Insider Ownership: 30.1%

Earnings Growth Forecast: 17.3% p.a.

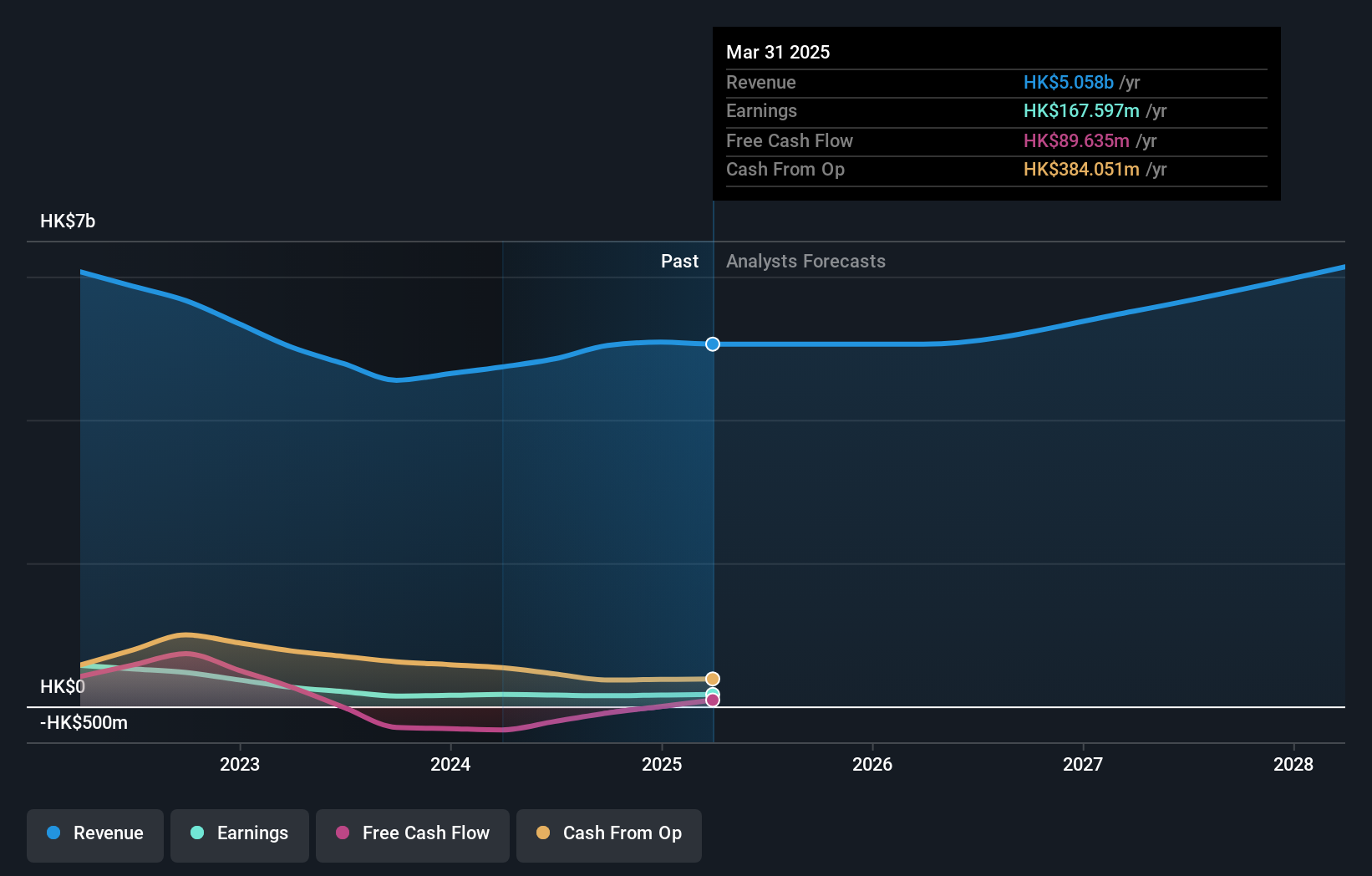

BYD Company Limited demonstrates characteristics of a growth company with substantial insider ownership. Its earnings grew by 18.1% over the past year, and future earnings are projected to increase at an annual rate of 17.3%, outpacing the Hong Kong market average. Recent production and sales figures show significant year-over-year increases, highlighting robust operational performance. The company's revenue is expected to grow faster than the local market, though not exceeding 20% annually, indicating strong but measured expansion potential.

- Get an in-depth perspective on BYD's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report BYD implies its share price may be too high.

Pacific Textiles Holdings (SEHK:1382)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pacific Textiles Holdings Limited manufactures and trades textile products across various international markets, with a market cap of HK$2.21 billion.

Operations: The company generates revenue of HK$4.67 billion from its manufacturing and trading of textile products across multiple regions worldwide.

Insider Ownership: 11.2%

Earnings Growth Forecast: 37.7% p.a.

Pacific Textiles Holdings shows potential as a growth-oriented entity with significant insider ownership. Although its profit margin has decreased from last year, earnings are projected to grow at 37.7% annually, surpassing the Hong Kong market's average. Revenue is expected to increase by 12% per year, outpacing local market growth rates. Recent operational disruptions due to Typhoon Yagi have been mitigated through strategic production reallocation, though profit margins remain impacted by large one-off items and unsustainable dividends.

- Click to explore a detailed breakdown of our findings in Pacific Textiles Holdings' earnings growth report.

- Our comprehensive valuation report raises the possibility that Pacific Textiles Holdings is priced higher than what may be justified by its financials.

Tri Chemical Laboratories (TSE:4369)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tri Chemical Laboratories Inc. specializes in chemical products for semiconductors, coating, optical fibers, solar cells, and compound semiconductors with a market cap of ¥98.14 billion.

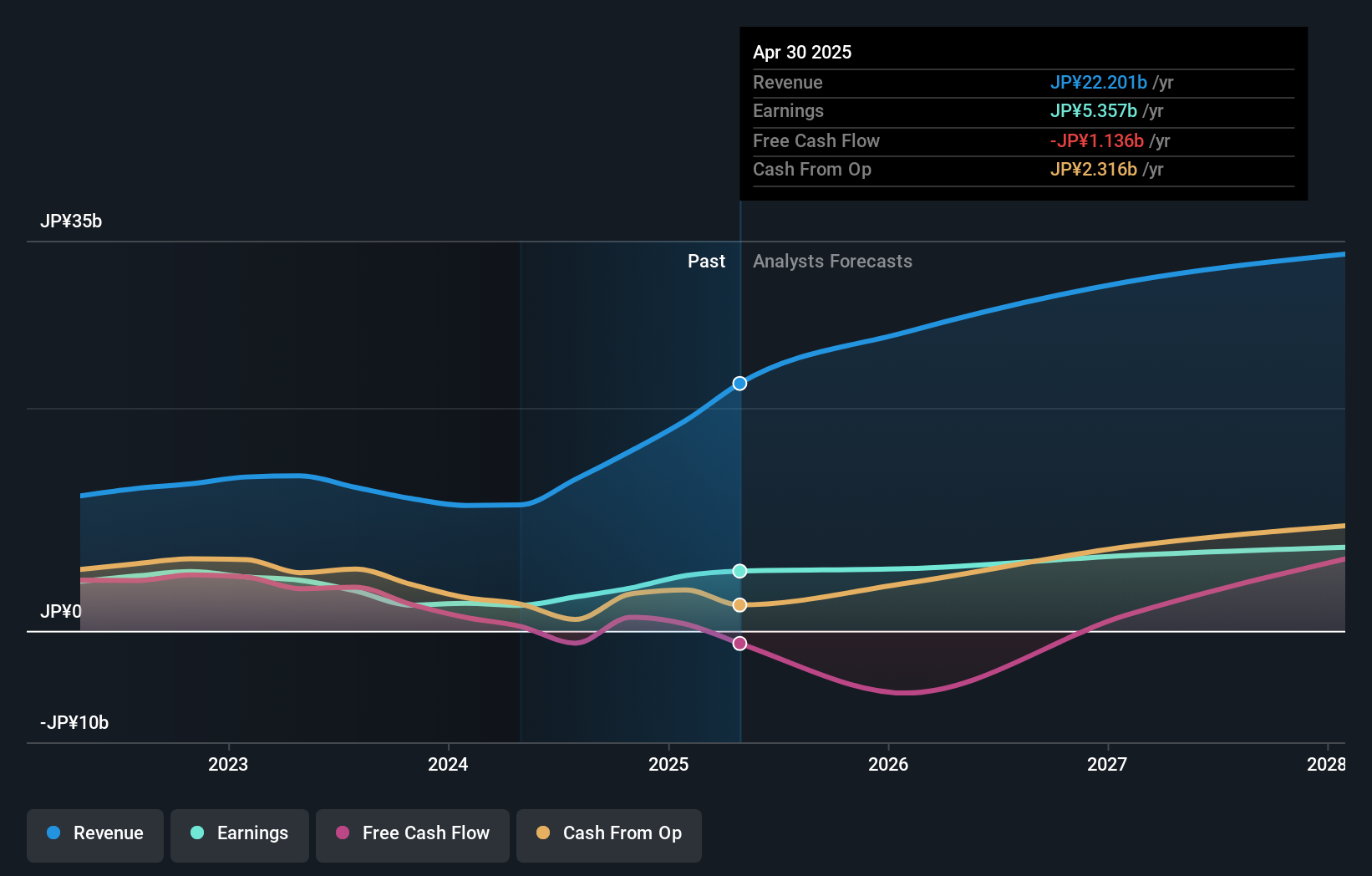

Operations: The company generates revenue from its High-Purity Chemical Compound Business for Manufacturing Semiconductors, amounting to ¥13.60 billion.

Insider Ownership: 17.4%

Earnings Growth Forecast: 35.6% p.a.

Tri Chemical Laboratories demonstrates growth potential with substantial insider ownership. The company forecasts significant earnings growth of 35.6% annually, outpacing the Japanese market average. Revenue is expected to rise by 26.1% per year, exceeding local market projections. Despite a volatile share price recently, Tri Chemical's projected net sales and operating profit for fiscal year 2025 are JPY 17 billion and JPY 3.9 billion respectively, indicating robust financial health amidst high-quality earnings expectations.

- Take a closer look at Tri Chemical Laboratories' potential here in our earnings growth report.

- Our valuation report here indicates Tri Chemical Laboratories may be overvalued.

Seize The Opportunity

- Unlock our comprehensive list of 1531 Fast Growing Companies With High Insider Ownership by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if BYD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1211

BYD

Engages in automobiles and batteries business in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Solid track record with excellent balance sheet.