- Philippines

- /

- Real Estate

- /

- PSE:RLC

Undervalued Small Caps With Insider Action Across Regions In January 2025

Reviewed by Simply Wall St

As global markets navigate mixed performances at the start of 2025, small-cap stocks have shown resilience, with indices like the Russell 2000 posting gains despite broader economic challenges such as a declining Chicago PMI and revised GDP forecasts. In this environment, identifying promising small-cap opportunities often involves looking for companies with strong fundamentals and strategic insider actions that suggest confidence in their future potential.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| 4imprint Group | 14.6x | 1.2x | 43.51% | ★★★★★☆ |

| Paradeep Phosphates | 25.8x | 0.8x | 24.77% | ★★★★★☆ |

| Maharashtra Seamless | 10.6x | 1.8x | 32.66% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 36.16% | ★★★★★☆ |

| ABG Sundal Collier Holding | 12.4x | 2.1x | 41.19% | ★★★★☆☆ |

| Avia Avian | 15.8x | 3.6x | 14.48% | ★★★★☆☆ |

| Logistri Fastighets | 12.7x | 9.0x | 41.99% | ★★★★☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| THG | NA | 0.3x | -587.27% | ★★★☆☆☆ |

| Digital Mediatama Maxima | NA | 1.3x | 12.00% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

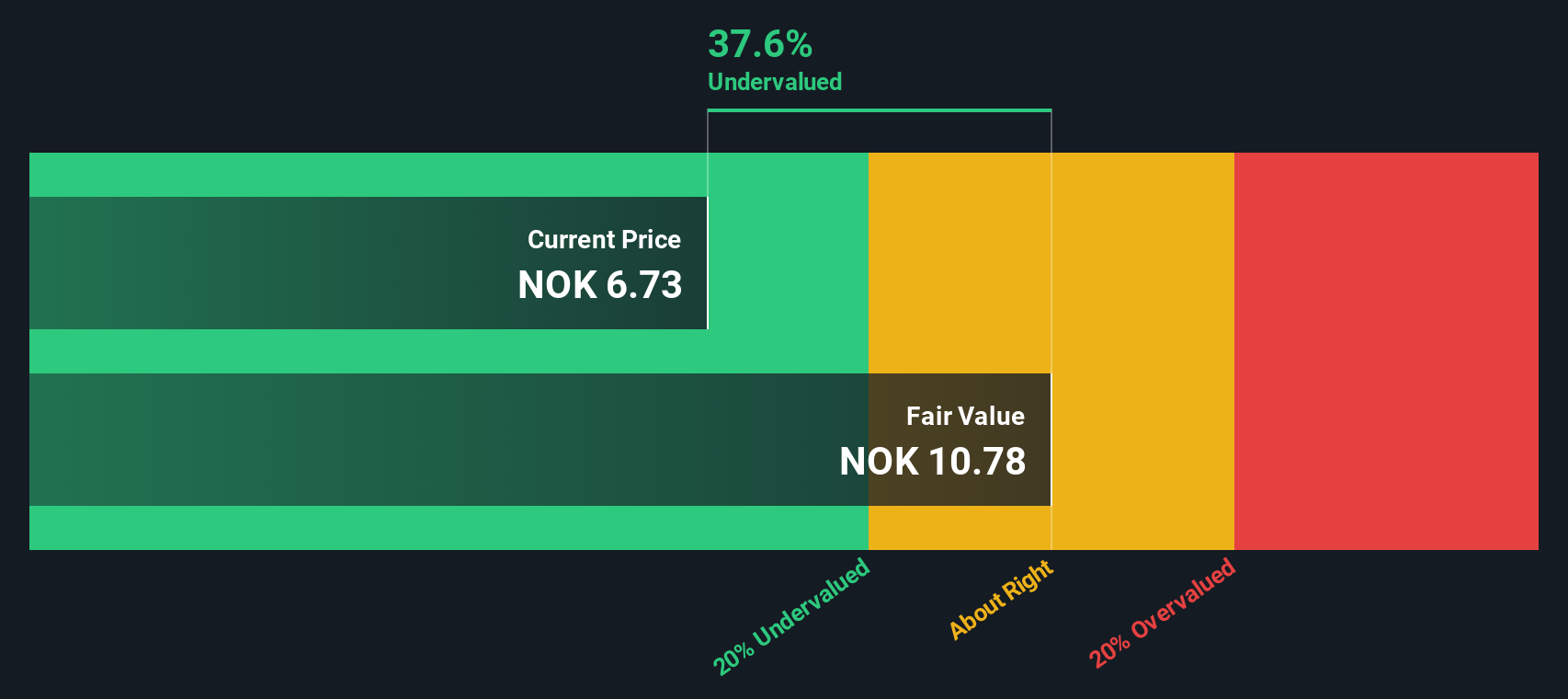

ABG Sundal Collier Holding (OB:ABG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ABG Sundal Collier Holding is a Nordic investment banking firm specializing in M&A and advisory, corporate financing, and brokerage and research services, with a market capitalization of NOK 2.97 billion.

Operations: The company's revenue streams primarily include M&A and Advisory, Corporate Financing, and Brokerage and Research services. Over the observed periods, it has consistently achieved a gross profit margin of 100%. Operating expenses are significant, with general and administrative expenses being a notable component. Net income margins have shown variability, reaching as high as 27.10% in some quarters before declining to lower levels in recent periods.

PE: 12.4x

ABG Sundal Collier Holding, a smaller company in the financial sector, has seen insider confidence with Jan Collier acquiring 715,000 shares for NOK 4.6 million, reflecting a 1.8% increase in their holdings. Despite earnings declining by an average of 4.8% annually over five years and reliance on higher-risk external borrowing, recent results show improvement; third-quarter revenue rose to NOK 392 million from NOK 356 million last year. The company’s participation in industry events like the Quality-Microcap seminar highlights its active market engagement and potential for future growth amidst challenges such as shareholder dilution over the past year.

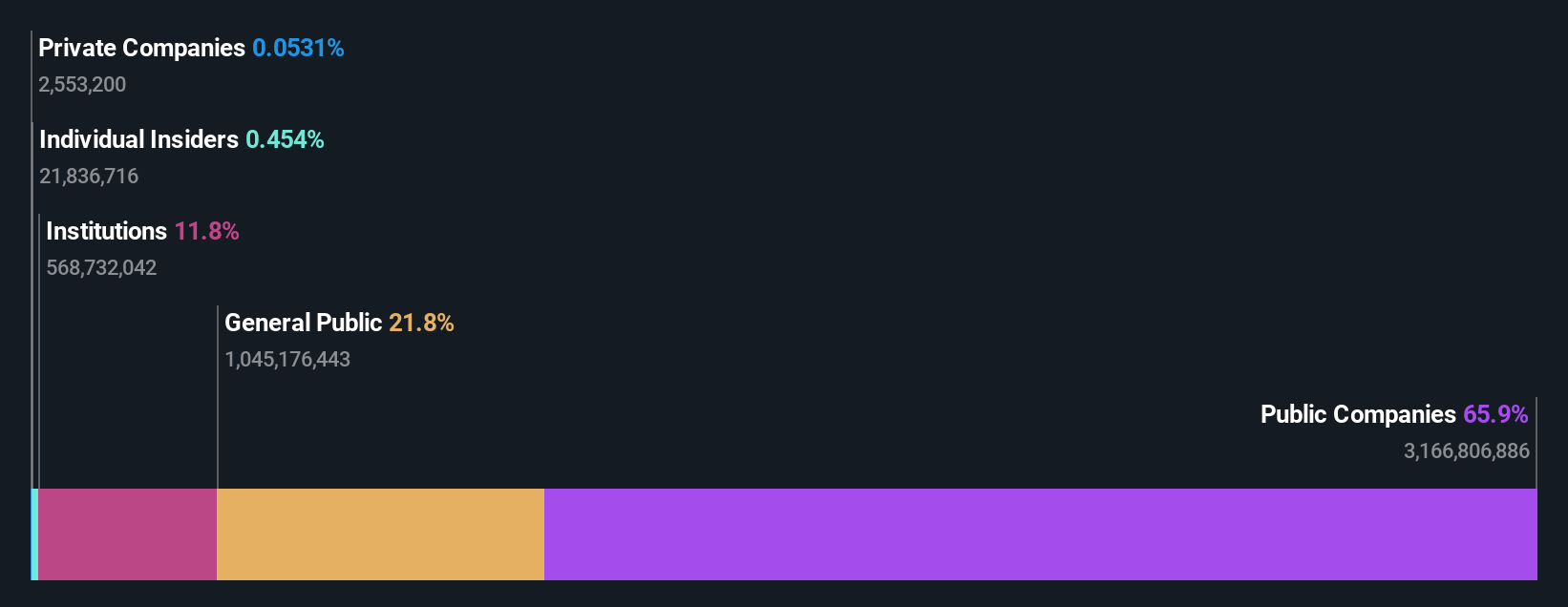

Robinsons Land (PSE:RLC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Robinsons Land is a diversified real estate company engaged in the development and operation of shopping malls, offices, hotels and resorts, destination estates, logistics and industrial facilities, and residential properties with a market capitalization of approximately ₱1.06 billion.

Operations: Robinsons Land generates revenue primarily through its malls, offices, hotels and resorts, destination estates, logistics and industrial facilities, and residential divisions. The company has shown a notable trend in its gross profit margin reaching 55.30% as of September 2024. Operating expenses are a significant cost component alongside non-operating expenses.

PE: 4.7x

Robinsons Land, a smaller player in the real estate sector, has been navigating changes with insider confidence as they anticipate earnings growth of 9.76% annually. Recent executive shifts see Maria Socorro Isabelle V. Aragon-GoBio stepping in as CEO from February 1, 2025, bringing extensive industry experience. Despite a dip in recent quarterly net income to PHP 2,759 million from PHP 3,057 million last year, nine-month figures show improved sales and revenue performance.

- Dive into the specifics of Robinsons Land here with our thorough valuation report.

Gain insights into Robinsons Land's past trends and performance with our Past report.

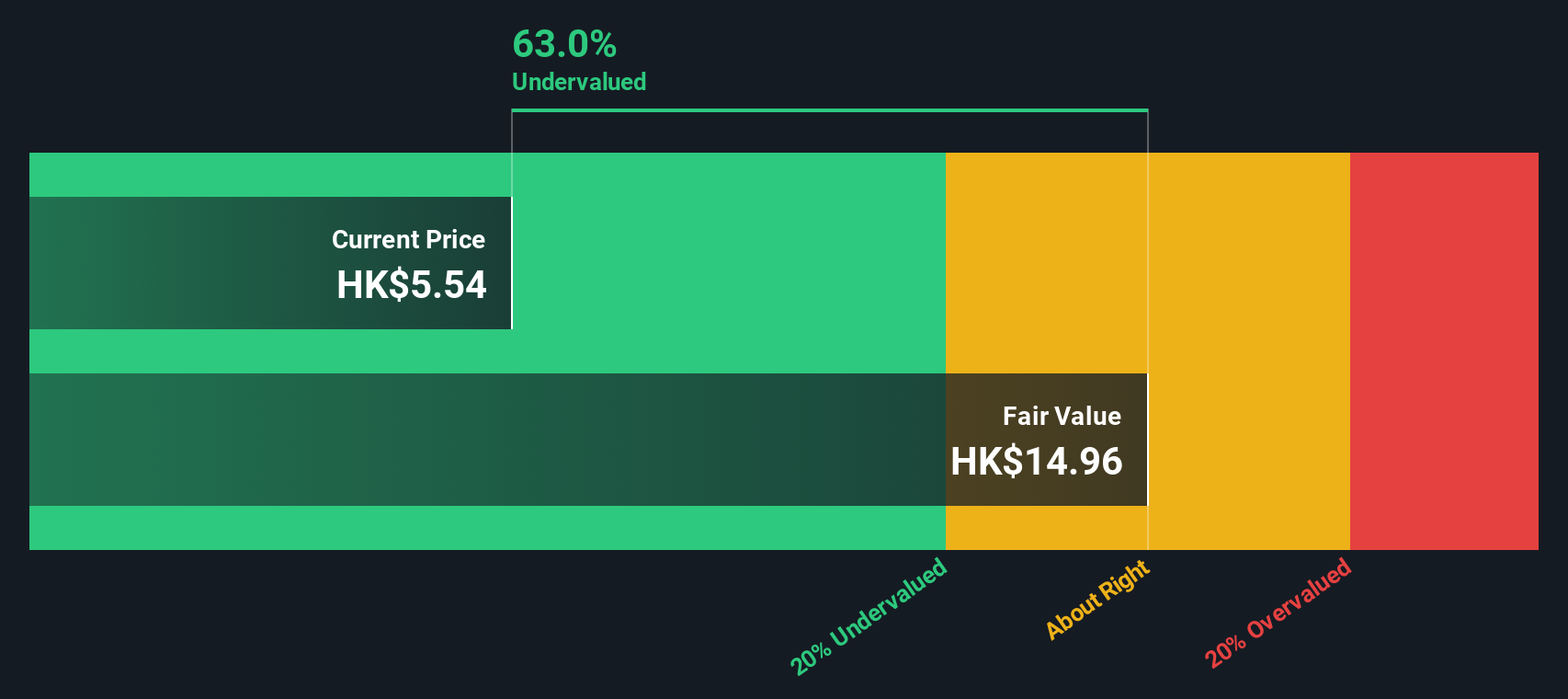

Xtep International Holdings (SEHK:1368)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Xtep International Holdings is a China-based company specializing in the design, development, and marketing of sportswear products, with a market capitalization of CN¥22.46 billion.

Operations: The company's revenue is primarily derived from the Mass Market segment, followed by Athleisure and Professional Sports. Over recent periods, the net profit margin has shown some fluctuations, reaching 7.43% in June 2024. Operating expenses are significant, with sales and marketing being a major component.

PE: 11.8x

Xtep International Holdings, a company with a small market capitalization, recently announced a special dividend of HK$0.447 per share and expanded its business by opening its first mono store in Malaysia. This move positions Xtep to capture the growing athletic market in Southeast Asia. Despite relying entirely on external borrowing for funding, indicating higher risk, insider confidence is evident as they have been purchasing shares over the past year. Earnings are projected to grow at 13% annually, suggesting potential value for investors seeking growth opportunities in emerging markets.

Summing It All Up

- Take a closer look at our Undervalued Small Caps With Insider Buying list of 175 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:RLC

Robinsons Land

Acquires, develops, operates, leases, disposes, and sells real estate properties in the Philippines.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives