Is Weakness In 361 Degrees International Limited (HKG:1361) Stock A Sign That The Market Could be Wrong Given Its Strong Financial Prospects?

It is hard to get excited after looking at 361 Degrees International's (HKG:1361) recent performance, when its stock has declined 3.3% over the past three months. However, a closer look at its sound financials might cause you to think again. Given that fundamentals usually drive long-term market outcomes, the company is worth looking at. Specifically, we decided to study 361 Degrees International's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for 361 Degrees International is:

12% = CN¥1.2b ÷ CN¥11b (Based on the trailing twelve months to June 2025).

The 'return' refers to a company's earnings over the last year. Another way to think of that is that for every HK$1 worth of equity, the company was able to earn HK$0.12 in profit.

Check out our latest analysis for 361 Degrees International

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

361 Degrees International's Earnings Growth And 12% ROE

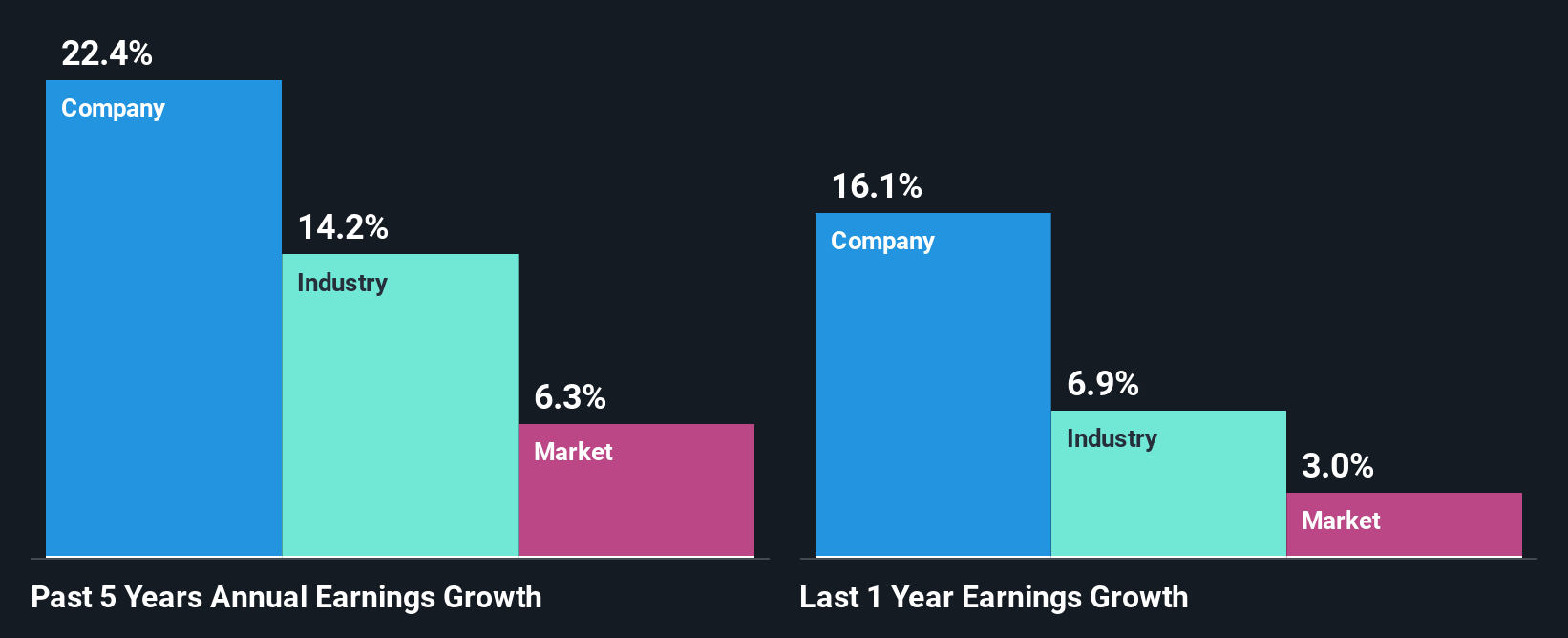

To start with, 361 Degrees International's ROE looks acceptable. Further, the company's ROE is similar to the industry average of 11%. Consequently, this likely laid the ground for the impressive net income growth of 22% seen over the past five years by 361 Degrees International. We believe that there might also be other aspects that are positively influencing the company's earnings growth. For instance, the company has a low payout ratio or is being managed efficiently.

We then compared 361 Degrees International's net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 14% in the same 5-year period.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Has the market priced in the future outlook for 1361? You can find out in our latest intrinsic value infographic research report.

Is 361 Degrees International Making Efficient Use Of Its Profits?

361 Degrees International's three-year median payout ratio is a pretty moderate 46%, meaning the company retains 54% of its income. So it seems that 361 Degrees International is reinvesting efficiently in a way that it sees impressive growth in its earnings (discussed above) and pays a dividend that's well covered.

Additionally, 361 Degrees International has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 45% of its profits over the next three years. Accordingly, forecasts suggest that 361 Degrees International's future ROE will be 13% which is again, similar to the current ROE.

Conclusion

On the whole, we feel that 361 Degrees International's performance has been quite good. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. Unsurprisingly, this has led to an impressive earnings growth. That being so, a study of the latest analyst forecasts show that the company is expected to see a slowdown in its future earnings growth. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

Valuation is complex, but we're here to simplify it.

Discover if 361 Degrees International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1361

361 Degrees International

An investment holding company, manufactures and trades in sporting goods in the People’s Republic of China.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026