Does Miko International Holdings (HKG:1247) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Miko International Holdings Limited (HKG:1247) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Miko International Holdings

How Much Debt Does Miko International Holdings Carry?

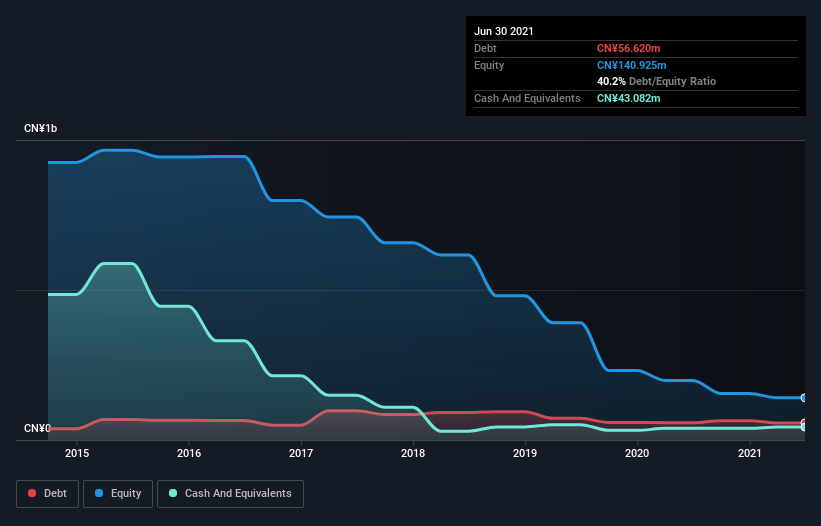

The chart below, which you can click on for greater detail, shows that Miko International Holdings had CN¥56.6m in debt in June 2021; about the same as the year before. However, it also had CN¥43.1m in cash, and so its net debt is CN¥13.5m.

A Look At Miko International Holdings' Liabilities

Zooming in on the latest balance sheet data, we can see that Miko International Holdings had liabilities of CN¥65.1m due within 12 months and liabilities of CN¥14.2m due beyond that. Offsetting these obligations, it had cash of CN¥43.1m as well as receivables valued at CN¥58.3m due within 12 months. So it actually has CN¥22.1m more liquid assets than total liabilities.

This surplus strongly suggests that Miko International Holdings has a rock-solid balance sheet (and the debt is of no concern whatsoever). On this view, lenders should feel as safe as the beloved of a black-belt karate master. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Miko International Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Miko International Holdings made a loss at the EBIT level, and saw its revenue drop to CN¥133m, which is a fall of 13%. We would much prefer see growth.

Caveat Emptor

While Miko International Holdings's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost a very considerable CN¥66m at the EBIT level. Looking on the brighter side, the business has adequate liquid assets, which give it time to grow and develop before its debt becomes a near-term issue. Still, we'd be more encouraged to study the business in depth if it already had some free cash flow. So it seems too risky for our taste. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 4 warning signs for Miko International Holdings you should be aware of, and 2 of them make us uncomfortable.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1247

Miko International Holdings

Designs, manufactures, wholesales, retails, and sells infant and children’s apparel, footwear, and other accessories in the People’s Republic of China.

Flawless balance sheet and slightly overvalued.