- Poland

- /

- Entertainment

- /

- WSE:FOR

Kingmaker Footwear Holdings Leads The Pack Of 3 Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate mixed signals, with the S&P 500 Index closing another strong year despite recent slumps, investors are exploring diverse opportunities. Penny stocks, often representing smaller or newer companies, remain an intriguing area for those willing to look beyond the major indices. Despite their vintage moniker, these stocks can offer substantial value when backed by solid financials and potential for growth.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.54 | MYR2.69B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.79 | £453.67M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.66 | HK$40.3B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £491.62M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.40 | £185.93M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.54 | £68.28M | ★★★★☆☆ |

Click here to see the full list of 5,804 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Kingmaker Footwear Holdings (SEHK:1170)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kingmaker Footwear Holdings Limited is an investment holding company that manufactures and sells footwear products across the United States, Europe, Asia, and internationally with a market cap of HK$402.21 million.

Operations: The company's revenue segment is focused on the manufacturing and sale of footwear products, generating HK$632.30 million.

Market Cap: HK$402.21M

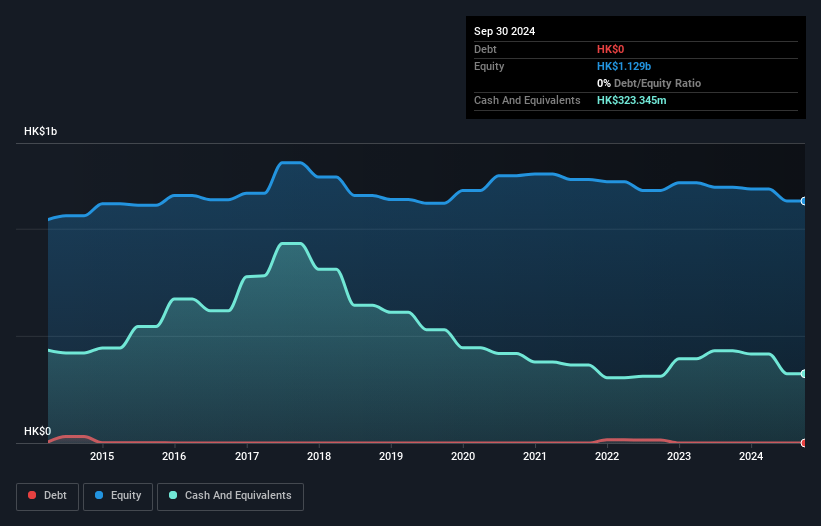

Kingmaker Footwear Holdings, with a market cap of HK$402.21 million, reported a net loss of HK$12.97 million for the half year ending September 2024, down from a profit in the previous year. Despite being debt-free and having short-term assets exceeding liabilities, the company is currently unprofitable with negative return on equity. The board is experienced with an average tenure of 9.5 years, but management's experience remains unclear. Recent announcements include a special dividend of HKD 0.02 per share while no interim dividend was recommended for this period due to financial performance challenges.

- Unlock comprehensive insights into our analysis of Kingmaker Footwear Holdings stock in this financial health report.

- Examine Kingmaker Footwear Holdings' past performance report to understand how it has performed in prior years.

Maiyue Technology (SEHK:2501)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Maiyue Technology Limited is an investment holding company that offers integrated IT solutions and services primarily to the education and government sectors in the People's Republic of China, with a market capitalization of HK$460 million.

Operations: The company generates revenue from three primary segments: Sales of Hardware and Software (CN¥75.31 million), Provision of Standalone IT Services (CN¥42.57 million), and Provision of Integrated IT Solution Services (CN¥143.61 million).

Market Cap: HK$460M

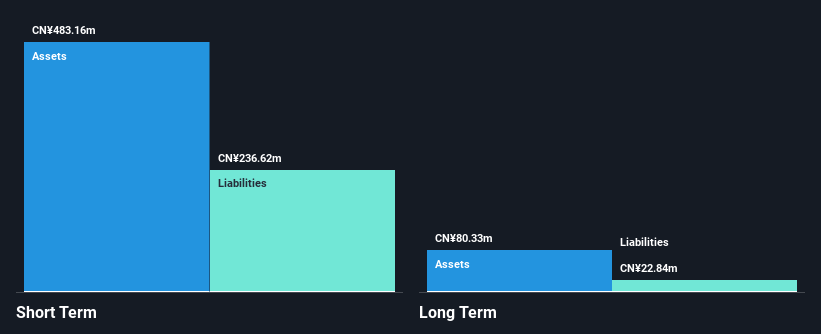

Maiyue Technology Limited, with a market cap of HK$460 million, generates revenue from three segments: Sales of Hardware and Software (CN¥75.31 million), Standalone IT Services (CN¥42.57 million), and Integrated IT Solution Services (CN¥143.61 million). The company has strong short-term assets (CN¥483.2M) exceeding both short-term liabilities (CN¥236.6M) and long-term liabilities (CN¥22.8M). However, declining earnings growth (-48.9% last year) and lower profit margins compared to the previous year indicate challenges in profitability improvement efforts, compounded by negative operating cash flow impacting debt coverage despite satisfactory net debt to equity ratio at 7.4%.

- Click here to discover the nuances of Maiyue Technology with our detailed analytical financial health report.

- Evaluate Maiyue Technology's historical performance by accessing our past performance report.

Forever Entertainment (WSE:FOR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Forever Entertainment S.A. is a video game producer and publisher operating in Poland and internationally, with a market cap of PLN100.64 million.

Operations: The company generates revenue of PLN30.04 million from its Software & Programming segment.

Market Cap: PLN100.64M

Forever Entertainment S.A., with a market cap of PLN100.64 million, reported third-quarter earnings showing a revenue decrease to PLN7.06 million from PLN9.08 million the previous year, yet net income increased to PLN1.03 million from PLN0.92 million. The company is debt-free, with improved profit margins at 23.9%, and short-term assets of PLN17.5M covering both short-term and long-term liabilities effectively. Although earnings have declined by 10.8% annually over five years, recent growth of 31.6% suggests potential recovery in profitability despite challenges such as low return on equity at 15.5%.

- Click to explore a detailed breakdown of our findings in Forever Entertainment's financial health report.

- Gain insights into Forever Entertainment's past trends and performance with our report on the company's historical track record.

Key Takeaways

- Gain an insight into the universe of 5,804 Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:FOR

Forever Entertainment

Produces and publishes video games in Poland and internationally.

Flawless balance sheet with proven track record.