As global markets navigate a period of economic adjustments, with notable interest rate cuts by the European Central Bank and the Bank of England, Hong Kong's Hang Seng Index has faced challenges, recently experiencing a decline. In this climate, dividend stocks in Hong Kong present an intriguing opportunity for investors seeking stable income streams amidst market fluctuations.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| China Hongqiao Group (SEHK:1378) | 8.70% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 6.92% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 6.88% | ★★★★★☆ |

| Playmates Toys (SEHK:869) | 8.57% | ★★★★★☆ |

| Lion Rock Group (SEHK:1127) | 8.09% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.01% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 8.62% | ★★★★★☆ |

| Tianjin Development Holdings (SEHK:882) | 6.85% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.69% | ★★★★★☆ |

| Tian An China Investments (SEHK:28) | 5.01% | ★★★★★☆ |

Click here to see the full list of 92 stocks from our Top SEHK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Chow Sang Sang Holdings International (SEHK:116)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chow Sang Sang Holdings International Limited is an investment holding company that manufactures and retails jewellery, with a market cap of HK$4.60 billion.

Operations: Chow Sang Sang Holdings International Limited generates revenue primarily from the retail of jewellery and watches at HK$22.65 billion, followed by the wholesale of precious metals at HK$1.14 billion, and trading of LGD at HK$9.33 million.

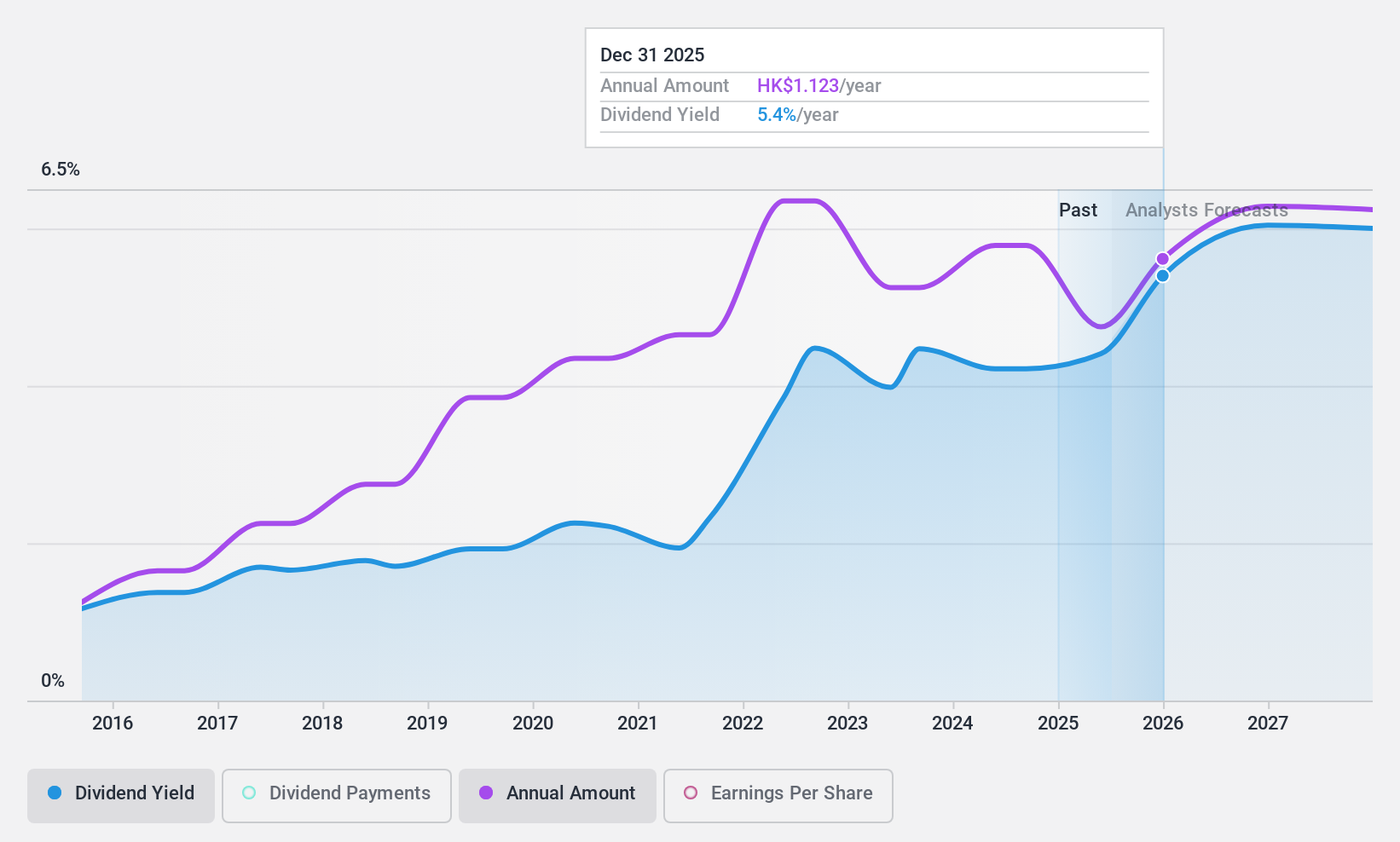

Dividend Yield: 8.1%

Chow Sang Sang Holdings International's dividend payments have been volatile over the past decade, with recent decreases indicating instability. Despite this, dividends are well-covered by earnings and cash flows, with a payout ratio of 50.8% and a cash payout ratio of 19.9%. The company recently announced a share buyback program worth HK$100 million, which could enhance shareholder value by increasing net asset value and earnings per share amidst declining revenues and profits.

- Click here to discover the nuances of Chow Sang Sang Holdings International with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Chow Sang Sang Holdings International's current price could be quite moderate.

China Resources Gas Group (SEHK:1193)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Resources Gas Group Limited is an investment holding company involved in the sale of natural and liquefied gas and the connection of gas pipelines, with a market capitalization of approximately HK$75.44 billion.

Operations: China Resources Gas Group Limited generates revenue primarily from the sale and distribution of gas fuel and related products (excluding gas stations) at HK$87.31 billion, followed by gas connection services at HK$9.65 billion, comprehensive services at HK$4.34 billion, gas stations at HK$3.23 billion, and design and construction services at HK$444.11 million.

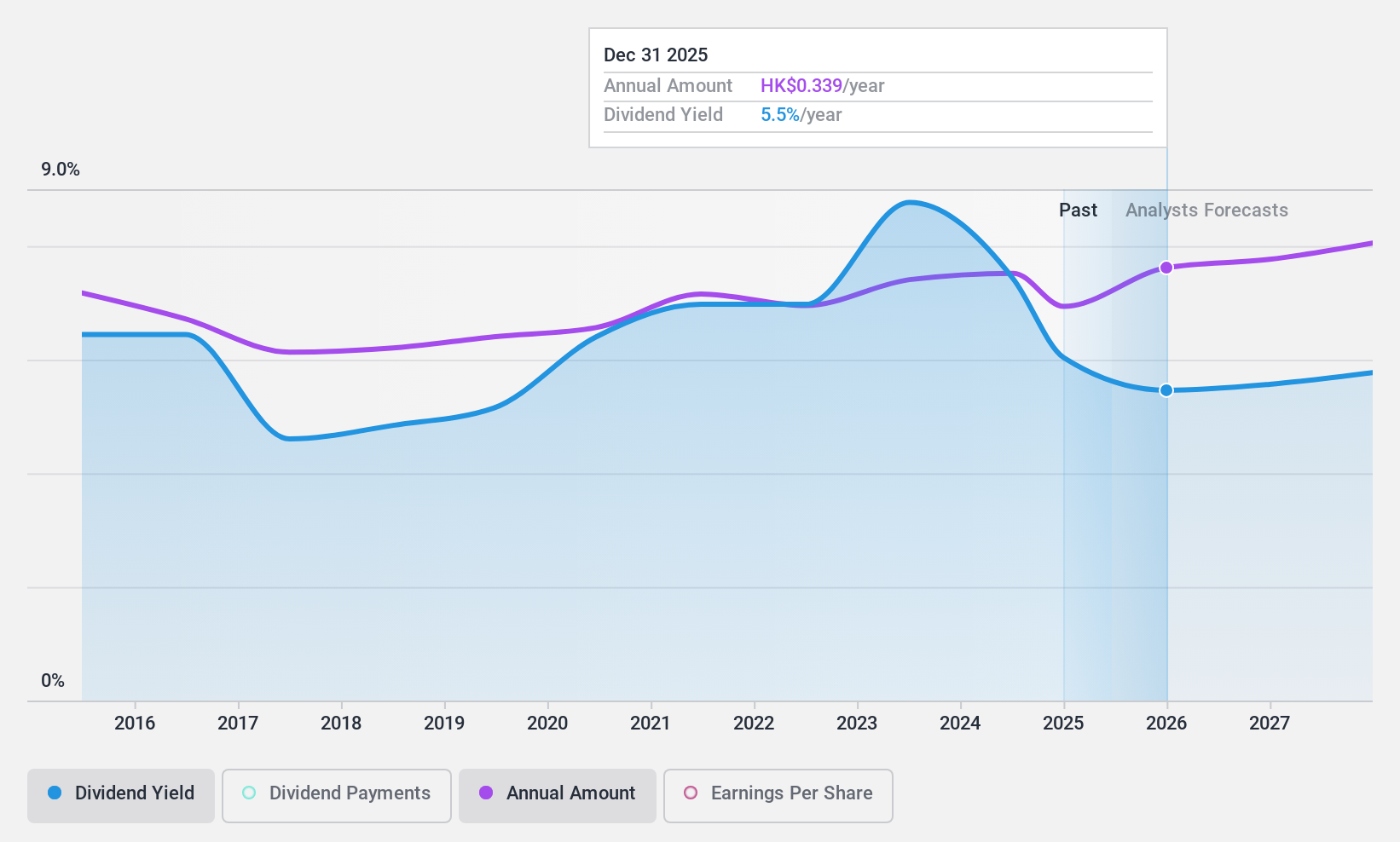

Dividend Yield: 3.5%

China Resources Gas Group's dividend payments have been volatile over the past decade, despite a recent interim dividend of HK$0.25 per share. Dividends are covered by earnings and cash flows, with payout ratios of 55.5% and 61.6%, respectively. The company's net income slightly decreased to HK$3.46 billion for the first half of 2024, while sales rose to HK$52.08 billion, reflecting mixed financial stability amidst executive changes in leadership roles.

- Dive into the specifics of China Resources Gas Group here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that China Resources Gas Group is trading beyond its estimated value.

Industrial and Commercial Bank of China (SEHK:1398)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Industrial and Commercial Bank of China Limited, along with its subsidiaries, offers a range of banking products and services both in the People's Republic of China and internationally, with a market cap of HK$2.28 trillion.

Operations: Industrial and Commercial Bank of China's revenue is primarily derived from three segments: Personal Banking (CN¥230.60 billion), Corporate Banking (CN¥316.69 billion), and Treasury Operations (CN¥95.79 billion).

Dividend Yield: 6.6%

Industrial and Commercial Bank of China offers a stable dividend yield of 6.55%, supported by a low payout ratio of 46.4%, ensuring dividends are well covered by earnings. The bank's dividend payments have been reliable and growing over the past decade, although they trail the top tier in Hong Kong's market. Recent developments include a change in auditors to Ernst & Young, with no reported disagreements from previous auditors, maintaining transparency for shareholders.

- Click to explore a detailed breakdown of our findings in Industrial and Commercial Bank of China's dividend report.

- In light of our recent valuation report, it seems possible that Industrial and Commercial Bank of China is trading behind its estimated value.

Where To Now?

- Click here to access our complete index of 92 Top SEHK Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:116

Chow Sang Sang Holdings International

An investment holding company, manufactures and retails jewellery.

Undervalued with excellent balance sheet and pays a dividend.