Goodbaby International Holdings Limited (HKG:1086) Doing What It Can To Lift Shares

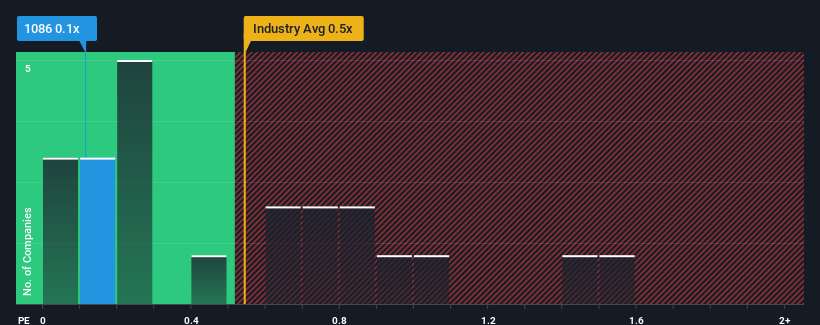

With a median price-to-sales (or "P/S") ratio of close to 0.5x in the Leisure industry in Hong Kong, you could be forgiven for feeling indifferent about Goodbaby International Holdings Limited's (HKG:1086) P/S ratio of 0.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Goodbaby International Holdings

How Has Goodbaby International Holdings Performed Recently?

Goodbaby International Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Goodbaby International Holdings.Is There Some Revenue Growth Forecasted For Goodbaby International Holdings?

In order to justify its P/S ratio, Goodbaby International Holdings would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 4.4% decrease to the company's top line. As a result, revenue from three years ago have also fallen 4.5% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 11% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 8.4%, which is noticeably less attractive.

With this information, we find it interesting that Goodbaby International Holdings is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Goodbaby International Holdings currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Goodbaby International Holdings is showing 1 warning sign in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1086

Goodbaby International Holdings

An investment holding company, researches and develops, designs, manufactures, markets, and sells durable juvenile products in Europe, North America, Mainland China, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives