Does Goodbaby International Holdings (HKG:1086) Deserve A Spot On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Goodbaby International Holdings (HKG:1086). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Goodbaby International Holdings

How Fast Is Goodbaby International Holdings Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. Like a falcon taking flight, Goodbaby International Holdings's EPS soared from HK$0.12 to HK$0.15, over the last year. That's a commendable gain of 27%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While Goodbaby International Holdings may have maintained EBIT margins over the last year, revenue has fallen. Suffice it to say that is not a great sign of growth.

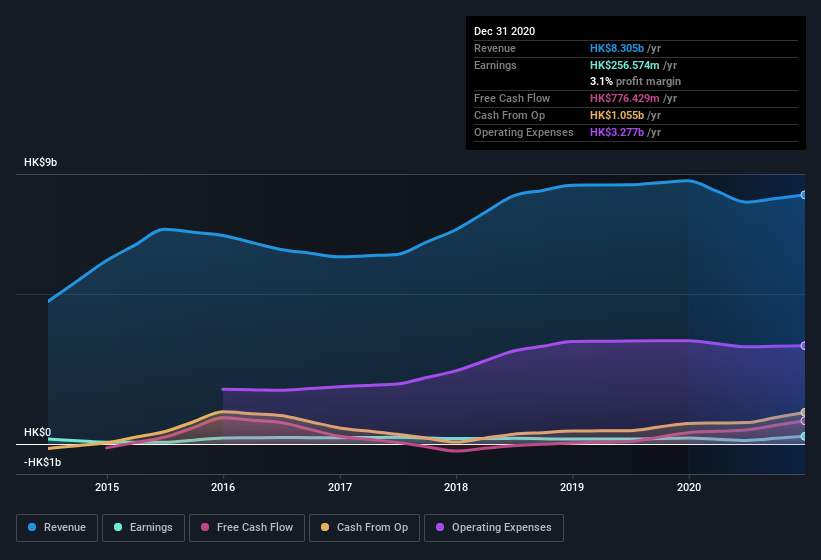

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Goodbaby International Holdings?

Are Goodbaby International Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The first bit of good news is that no Goodbaby International Holdings insiders reported share sales in the last twelve months. Even better, though, is that the CEO & Executive Director, Martin Pos, bought a whopping HK$2.3m worth of shares, paying about HK$0.96 per share, on average. To me that means at least one insider thinks that the company is doing well - and they are backing that view with cash.

On top of the insider buying, it's good to see that Goodbaby International Holdings insiders have a valuable investment in the business. To be specific, they have HK$147m worth of shares. That's a lot of money, and no small incentive to work hard. Even though that's only about 4.7% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add Goodbaby International Holdings To Your Watchlist?

For growth investors like me, Goodbaby International Holdings's raw rate of earnings growth is a beacon in the night. Better still, insiders own a large chunk of the company and one has even been buying more shares. So I do think this is one stock worth watching. We should say that we've discovered 2 warning signs for Goodbaby International Holdings that you should be aware of before investing here.

As a growth investor I do like to see insider buying. But Goodbaby International Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1086

Goodbaby International Holdings

An investment holding company, researches and develops, designs, manufactures, markets, and sells durable juvenile products in Europe, North America, Mainland China, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives