- Hong Kong

- /

- Consumer Durables

- /

- SEHK:1070

Investors Appear Satisfied With TCL Electronics Holdings Limited's (HKG:1070) Prospects As Shares Rocket 72%

Despite an already strong run, TCL Electronics Holdings Limited (HKG:1070) shares have been powering on, with a gain of 72% in the last thirty days. The last 30 days bring the annual gain to a very sharp 40%.

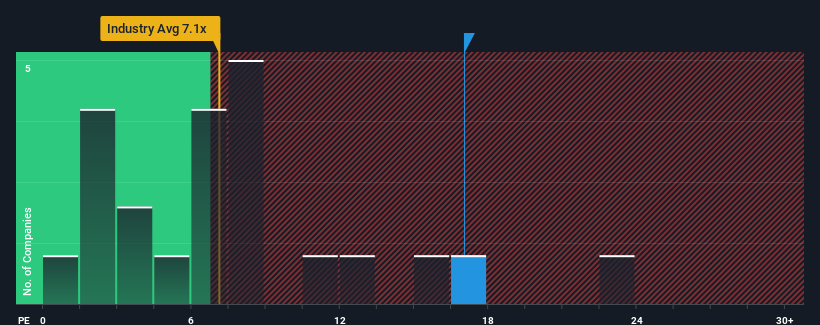

After such a large jump in price, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may consider TCL Electronics Holdings as a stock to avoid entirely with its 17x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's superior to most other companies of late, TCL Electronics Holdings has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for TCL Electronics Holdings

How Is TCL Electronics Holdings' Growth Trending?

In order to justify its P/E ratio, TCL Electronics Holdings would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 65% gain to the company's bottom line. Still, incredibly EPS has fallen 63% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 17% each year as estimated by the dual analysts watching the company. With the market only predicted to deliver 15% per annum, the company is positioned for a stronger earnings result.

With this information, we can see why TCL Electronics Holdings is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On TCL Electronics Holdings' P/E

TCL Electronics Holdings' P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that TCL Electronics Holdings maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for TCL Electronics Holdings with six simple checks.

You might be able to find a better investment than TCL Electronics Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if TCL Electronics Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1070

TCL Electronics Holdings

An investment holding company, operates as a consumer electronics company in Mainland China, Europe, North America, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026