- Hong Kong

- /

- Consumer Durables

- /

- SEHK:1070

If You Like EPS Growth Then Check Out TCL Electronics Holdings (HKG:1070) Before It's Too Late

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like TCL Electronics Holdings (HKG:1070). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for TCL Electronics Holdings

How Quickly Is TCL Electronics Holdings Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. TCL Electronics Holdings managed to grow EPS by 16% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

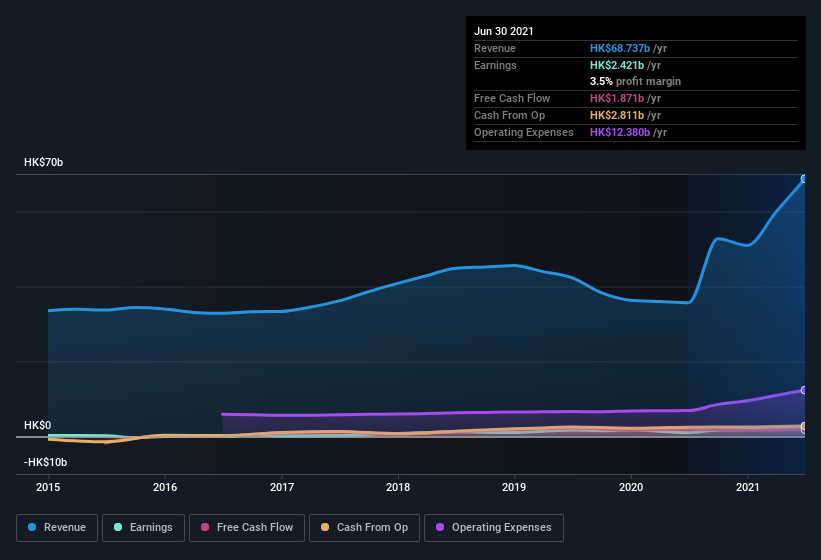

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While TCL Electronics Holdings did well to grow revenue over the last year, EBIT margins were dampened at the same time. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for TCL Electronics Holdings's future profits.

Are TCL Electronics Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We did see some selling in the last twelve months, but that's insignificant compared to the whopping HK$14m that the , Dong Sheng Li spent acquiring shares. We should note the average purchase price was around HK$5.55. Big purchases like that are well worth noting, especially for those who like to follow the insider money.

Along with the insider buying, another encouraging sign for TCL Electronics Holdings is that insiders, as a group, have a considerable shareholding. Indeed, they hold HK$330m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 3.0% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does TCL Electronics Holdings Deserve A Spot On Your Watchlist?

One important encouraging feature of TCL Electronics Holdings is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for TCL Electronics Holdings (1 is concerning) you should be aware of.

The good news is that TCL Electronics Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if TCL Electronics Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1070

TCL Electronics Holdings

An investment holding company, operates as a consumer electronics company in Mainland China, Europe, North America, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives