- Hong Kong

- /

- Real Estate

- /

- SEHK:9928

Should Times Neighborhood Holdings (HKG:9928) Be Disappointed With Their 47% Profit?

Times Neighborhood Holdings Limited (HKG:9928) shareholders might understandably be very concerned that the share price has dropped 30% in the last quarter. But that doesn't change the reality that over twelve months the stock has done really well. To wit, it had solidly beat the market, up 47%.

See our latest analysis for Times Neighborhood Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

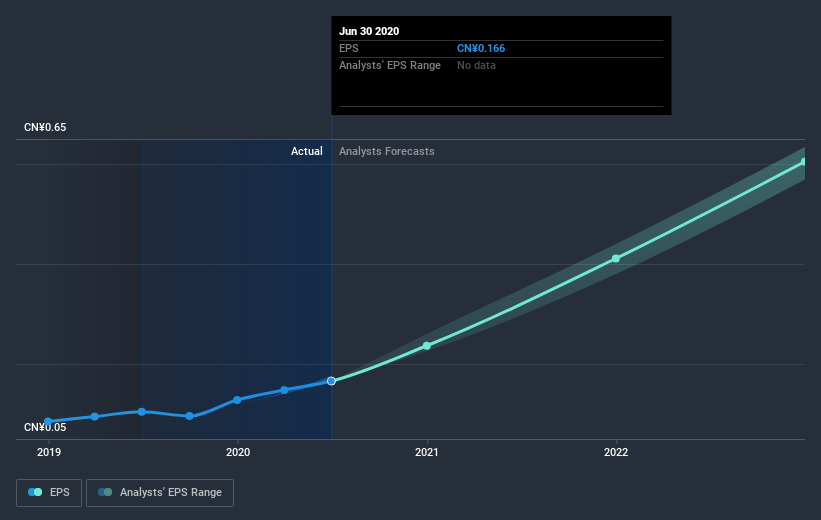

During the last year Times Neighborhood Holdings grew its earnings per share (EPS) by 59%. It's fair to say that the share price gain of 47% did not keep pace with the EPS growth. So it seems like the market has cooled on Times Neighborhood Holdings, despite the growth. Interesting.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Times Neighborhood Holdings' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Times Neighborhood Holdings boasts a total shareholder return of 48% for the last year (that includes the dividends) . Unfortunately the share price is down 30% over the last quarter. Shorter term share price moves often don't signify much about the business itself. It's always interesting to track share price performance over the longer term. But to understand Times Neighborhood Holdings better, we need to consider many other factors. Even so, be aware that Times Neighborhood Holdings is showing 1 warning sign in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading Times Neighborhood Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Times Neighborhood Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:9928

Times Neighborhood Holdings

Provides property management, community value-added, value-added, and other professional services in the People’s Republic of China.

Flawless balance sheet slight.

Market Insights

Community Narratives