- Hong Kong

- /

- Professional Services

- /

- SEHK:8619

King Of Catering (Global) Holdings Ltd.'s (HKG:8619) 29% Price Boost Is Out Of Tune With Revenues

King Of Catering (Global) Holdings Ltd. (HKG:8619) shares have continued their recent momentum with a 29% gain in the last month alone. The last 30 days were the cherry on top of the stock's 453% gain in the last year, which is nothing short of spectacular.

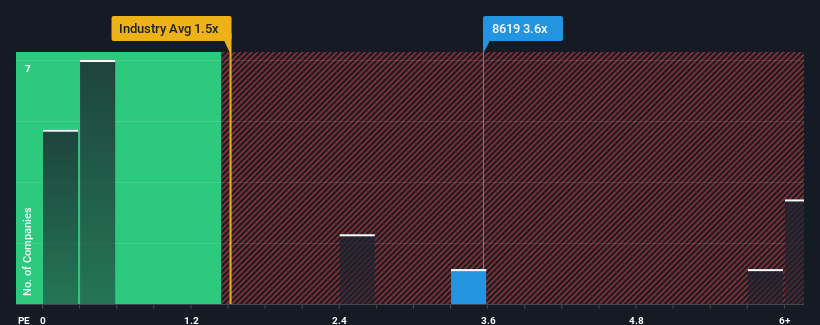

Following the firm bounce in price, you could be forgiven for thinking King Of Catering (Global) Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.6x, considering almost half the companies in Hong Kong's Professional Services industry have P/S ratios below 0.5x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for King Of Catering (Global) Holdings

How Has King Of Catering (Global) Holdings Performed Recently?

King Of Catering (Global) Holdings has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on King Of Catering (Global) Holdings' earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For King Of Catering (Global) Holdings?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like King Of Catering (Global) Holdings' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. The latest three year period has also seen an excellent 31% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

It's interesting to note that the rest of the industry is similarly expected to grow by 11% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's curious that King Of Catering (Global) Holdings' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does King Of Catering (Global) Holdings' P/S Mean For Investors?

The strong share price surge has lead to King Of Catering (Global) Holdings' P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into King Of Catering (Global) Holdings has shown that it currently trades on a higher than expected P/S since its recent three-year growth is only in line with the wider industry forecast. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term trends, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with King Of Catering (Global) Holdings (at least 1 which shouldn't be ignored), and understanding these should be part of your investment process.

If you're unsure about the strength of King Of Catering (Global) Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if NIU Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8619

NIU Holdings

Provides structural and geotechnical engineering design and consultancy services in Hong Kong, Macau, and the People’s Republic of China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives