- Hong Kong

- /

- Commercial Services

- /

- SEHK:8383

Here's Why Shareholders May Want To Be Cautious With Increasing Linocraft Holdings Limited's (HKG:8383) CEO Pay Packet

Despite strong share price growth of 34% for Linocraft Holdings Limited (HKG:8383) over the last few years, earnings growth has been disappointing, which suggests something is amiss. The upcoming AGM on 07 February 2023 may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

Check out our latest analysis for Linocraft Holdings

Comparing Linocraft Holdings Limited's CEO Compensation With The Industry

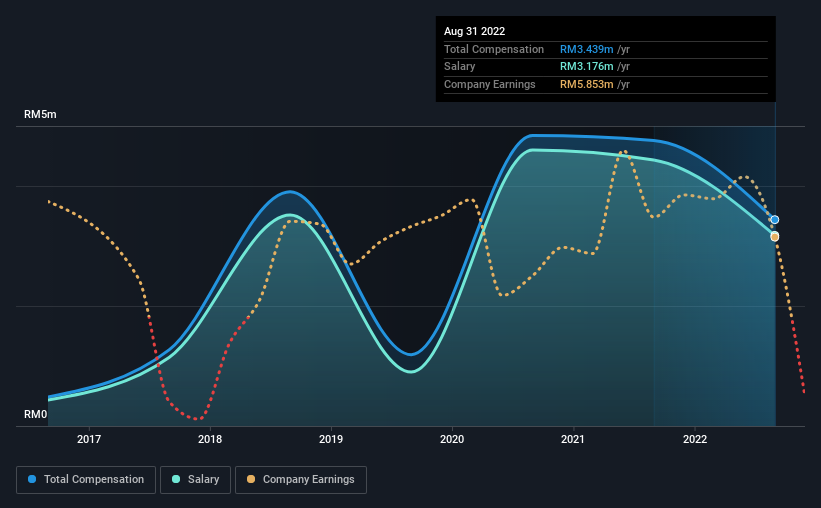

Our data indicates that Linocraft Holdings Limited has a market capitalization of HK$76m, and total annual CEO compensation was reported as RM3.4m for the year to August 2022. We note that's a decrease of 28% compared to last year. Notably, the salary which is RM3.18m, represents most of the total compensation being paid.

On comparing similar-sized companies in the Hong Kong Commercial Services industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was RM1.0m. Accordingly, our analysis reveals that Linocraft Holdings Limited pays Andrew Tan north of the industry median.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | RM3.2m | RM4.4m | 92% |

| Other | RM263k | RM324k | 8% |

| Total Compensation | RM3.4m | RM4.8m | 100% |

On an industry level, around 70% of total compensation represents salary and 30% is other remuneration. According to our research, Linocraft Holdings has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Linocraft Holdings Limited's Growth

Over the last three years, Linocraft Holdings Limited has shrunk its earnings per share by 10% per year. It achieved revenue growth of 2.1% over the last year.

Overall this is not a very positive result for shareholders. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Linocraft Holdings Limited Been A Good Investment?

Boasting a total shareholder return of 34% over three years, Linocraft Holdings Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 3 warning signs for Linocraft Holdings (2 make us uncomfortable!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8383

Linocraft Holdings

Linocraft Holdings Limited, an investment holding company, provides integrated offset printing and packaging solutions to direct customers and contract manufacturers in Malaysia, Singapore, and the Philippines.

Good value with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success