- Hong Kong

- /

- Commercial Services

- /

- SEHK:8140

Shareholders May Not Be So Generous With BOSA Technology Holdings Limited's (HKG:8140) CEO Compensation And Here's Why

In the past three years, the share price of BOSA Technology Holdings Limited (HKG:8140) has struggled to grow and now shareholders are sitting on a loss. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 18 November 2022. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

Check out the opportunities and risks within the HK Commercial Services industry.

Comparing BOSA Technology Holdings Limited's CEO Compensation With The Industry

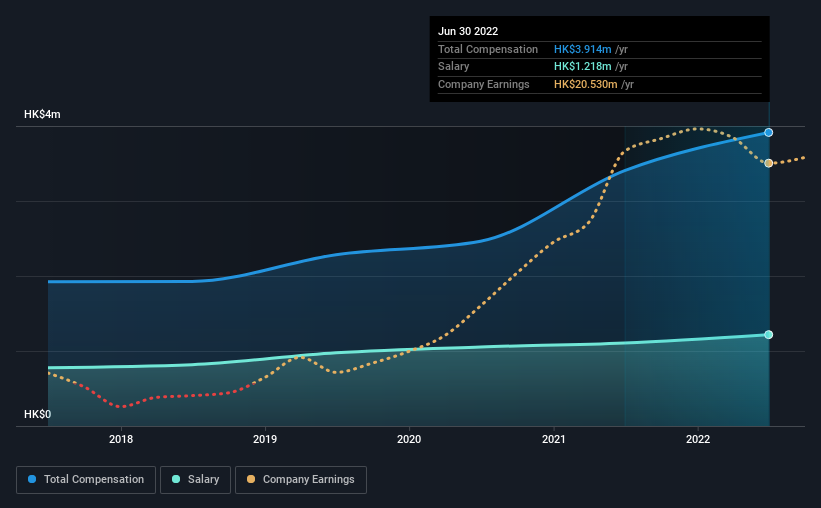

At the time of writing, our data shows that BOSA Technology Holdings Limited has a market capitalization of HK$79m, and reported total annual CEO compensation of HK$3.9m for the year to June 2022. We note that's an increase of 15% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at HK$1.2m.

For comparison, other companies in the industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$1.7m. Hence, we can conclude that K Lim is remunerated higher than the industry median. Furthermore, K Lim directly owns HK$11m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | HK$1.2m | HK$1.1m | 31% |

| Other | HK$2.7m | HK$2.3m | 69% |

| Total Compensation | HK$3.9m | HK$3.4m | 100% |

On an industry level, around 75% of total compensation represents salary and 25% is other remuneration. BOSA Technology Holdings sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at BOSA Technology Holdings Limited's Growth Numbers

Over the past three years, BOSA Technology Holdings Limited has seen its earnings per share (EPS) grow by 124% per year. In the last year, its revenue is up 1.9%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has BOSA Technology Holdings Limited Been A Good Investment?

Few BOSA Technology Holdings Limited shareholders would feel satisfied with the return of -90% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would be keen to know what's holding the stock back when earnings have grown. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 2 warning signs for BOSA Technology Holdings that investors should look into moving forward.

Switching gears from BOSA Technology Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if BOSA Technology Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8140

BOSA Technology Holdings

An investment holding company, provides mechanical splicing services to the reinforced concrete construction industry in Hong Kong.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives