- Hong Kong

- /

- Professional Services

- /

- SEHK:8125

Royal Century Resources Holdings Limited (HKG:8125) Not Lagging Industry On Growth Or Pricing

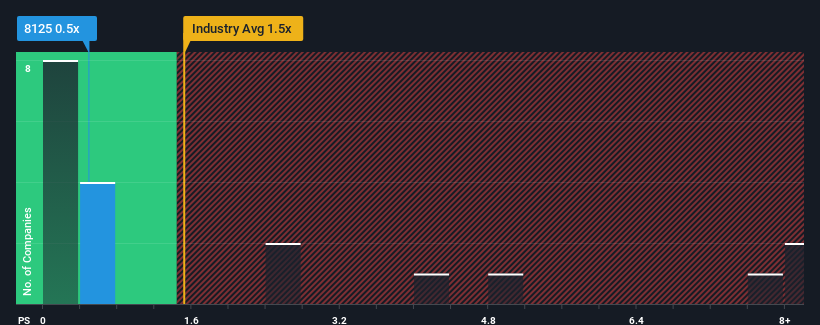

With a median price-to-sales (or "P/S") ratio of close to 0.5x in the Professional Services industry in Hong Kong, you could be forgiven for feeling indifferent about Royal Century Resources Holdings Limited's (HKG:8125) P/S ratio, which comes in at about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Royal Century Resources Holdings

How Royal Century Resources Holdings Has Been Performing

With revenue growth that's exceedingly strong of late, Royal Century Resources Holdings has been doing very well. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Royal Century Resources Holdings' earnings, revenue and cash flow.How Is Royal Century Resources Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Royal Century Resources Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 57% last year. The strong recent performance means it was also able to grow revenue by 31% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 11% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's understandable that Royal Century Resources Holdings' P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Bottom Line On Royal Century Resources Holdings' P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we've seen, Royal Century Resources Holdings' three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Royal Century Resources Holdings (2 are a bit unpleasant!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Royal Century Resources Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8125

China New Holdings

An investment holding company, engages in the design, fitting out and engineering, and procurement of furnishings and related products services in Hong Kong and Macau.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026