- Hong Kong

- /

- Professional Services

- /

- SEHK:8125

After Leaping 28% Royal Century Resources Holdings Limited (HKG:8125) Shares Are Not Flying Under The Radar

Royal Century Resources Holdings Limited (HKG:8125) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 59% share price decline over the last year.

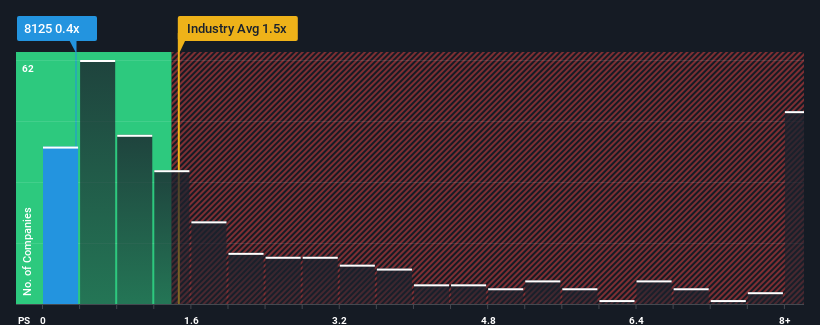

Even after such a large jump in price, there still wouldn't be many who think Royal Century Resources Holdings' price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Hong Kong's Professional Services industry is similar at about 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Royal Century Resources Holdings

What Does Royal Century Resources Holdings' P/S Mean For Shareholders?

Recent times have been quite advantageous for Royal Century Resources Holdings as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. Those who are bullish on Royal Century Resources Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Royal Century Resources Holdings will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Royal Century Resources Holdings' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 57% last year. Pleasingly, revenue has also lifted 31% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 9.9% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's understandable that Royal Century Resources Holdings' P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Final Word

Its shares have lifted substantially and now Royal Century Resources Holdings' P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we've seen, Royal Century Resources Holdings' three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Having said that, be aware Royal Century Resources Holdings is showing 3 warning signs in our investment analysis, and 2 of those shouldn't be ignored.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8125

China New Holdings

An investment holding company, engages in the design, fitting out and engineering, and procurement of furnishings and related products services.

Flawless balance sheet low.

Market Insights

Community Narratives