- Hong Kong

- /

- Commercial Services

- /

- SEHK:587

China Conch Environment Protection Holdings (HKG:587) stock falls 10% in past week as one-year earnings and shareholder returns continue downward trend

Even the best stock pickers will make plenty of bad investments. And unfortunately for China Conch Environment Protection Holdings Limited (HKG:587) shareholders, the stock is a lot lower today than it was a year ago. The share price has slid 56% in that time. China Conch Environment Protection Holdings may have better days ahead, of course; we've only looked at a one year period. Furthermore, it's down 22% in about a quarter. That's not much fun for holders.

After losing 10% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for China Conch Environment Protection Holdings

SWOT Analysis for China Conch Environment Protection Holdings

- Debt is well covered by earnings.

- Earnings declined over the past year.

- Expensive based on P/E ratio and estimated fair value.

- Annual earnings are forecast to grow faster than the Hong Kong market.

- Debt is not well covered by operating cash flow.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

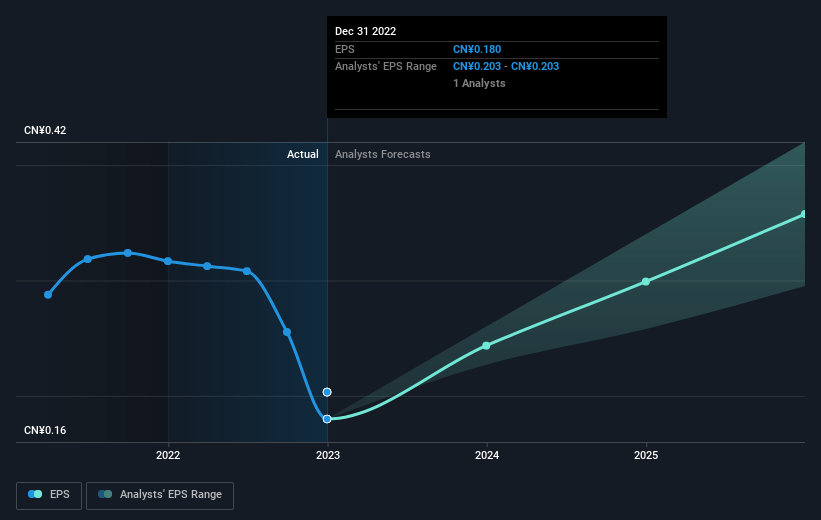

Unhappily, China Conch Environment Protection Holdings had to report a 43% decline in EPS over the last year. The share price decline of 56% is actually more than the EPS drop. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock. The P/E ratio of 11.64 also points to the negative market sentiment.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on China Conch Environment Protection Holdings' earnings, revenue and cash flow.

A Different Perspective

We doubt China Conch Environment Protection Holdings shareholders are happy with the loss of 56% over twelve months. That falls short of the market, which lost 6.5%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 22% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand China Conch Environment Protection Holdings better, we need to consider many other factors. Even so, be aware that China Conch Environment Protection Holdings is showing 2 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:587

China Conch Environment Protection Holdings

An investment holding company, provides treatment solutions for industrial solid and hazardous waste utilizing cement kiln waste treatment technologies in the People’s Republic of China.

Slight with limited growth.

Market Insights

Community Narratives