- Hong Kong

- /

- Commercial Services

- /

- SEHK:257

There's No Escaping China Everbright Environment Group Limited's (HKG:257) Muted Earnings

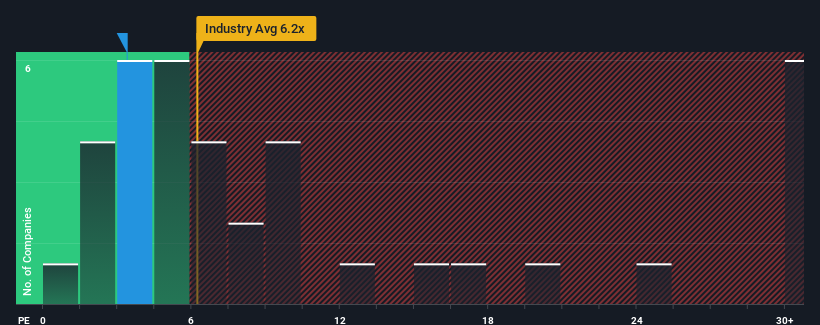

When close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 10x, you may consider China Everbright Environment Group Limited (HKG:257) as a highly attractive investment with its 3.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings that are retreating more than the market's of late, China Everbright Environment Group has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for China Everbright Environment Group

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as China Everbright Environment Group's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 18% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 5.4% per year as estimated by the seven analysts watching the company. With the market predicted to deliver 16% growth per annum, the company is positioned for a weaker earnings result.

With this information, we can see why China Everbright Environment Group is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On China Everbright Environment Group's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of China Everbright Environment Group's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with China Everbright Environment Group (at least 1 which is a bit unpleasant), and understanding these should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:257

China Everbright Environment Group

An investment holding company, provides environmental solutions worldwide.

Undervalued average dividend payer.

Market Insights

Community Narratives