- Hong Kong

- /

- Commercial Services

- /

- SEHK:257

China Everbright Environment Group (SEHK:257) Declares Interim Dividends

Reviewed by Simply Wall St

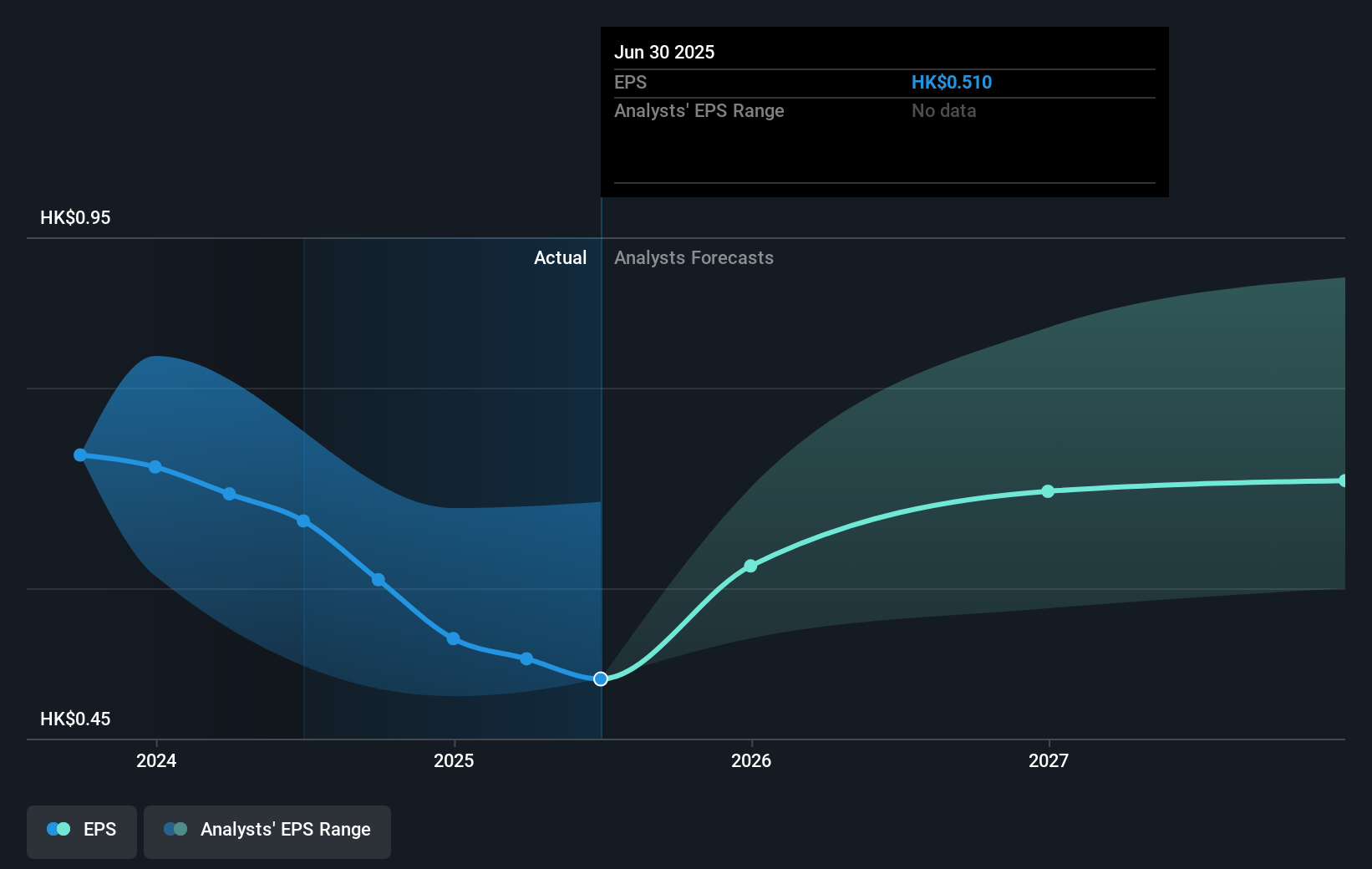

China Everbright Environment Group (SEHK:257) experienced a notable 25% share price increase over the last quarter. This price movement comes amidst a backdrop of mixed company-specific developments, including a decrease in net income and sales for the first half of 2025, as well as interim dividend declarations. The company's changes in executive leadership likely assured investors of continued governance stability. Additionally, broader market trends, including favorable rate-cut prospects, contributed to overall market buoyancy during this period. The 25% rise largely aligns with market optimism, potentially outweighing the company's earnings decline and complementing the positive market sentiments.

Over the past three years, China Everbright Environment Group's total return, including share price and dividends, was 65.34%. This performance contrasts with its one-year return, which fell short of the Hong Kong market's impressive 54.4% gain but exceeded the Hong Kong Commercial Services industry's 25.8% return. Such context highlights the company's varying trajectory, achieving strong long-term results while facing shorter-term market challenges.

While the company experienced significant share price fluctuations, its revenue and net income have seen declines. However, the declared interim dividends and executive changes might provide some stability. The share price's recent increase, despite these mixed signals, could align with broader market optimism and potential positive impacts from prospective interest rate cuts. The company's shares are currently trading close to analyst consensus price targets, suggesting limited upside potential in the near term.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:257

China Everbright Environment Group

An investment holding company, provides environmental solutions worldwide.

Good value average dividend payer.

Market Insights

Community Narratives