- Hong Kong

- /

- Commercial Services

- /

- SEHK:1884

Health Check: How Prudently Does eprint Group (HKG:1884) Use Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, eprint Group Limited (HKG:1884) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for eprint Group

What Is eprint Group's Debt?

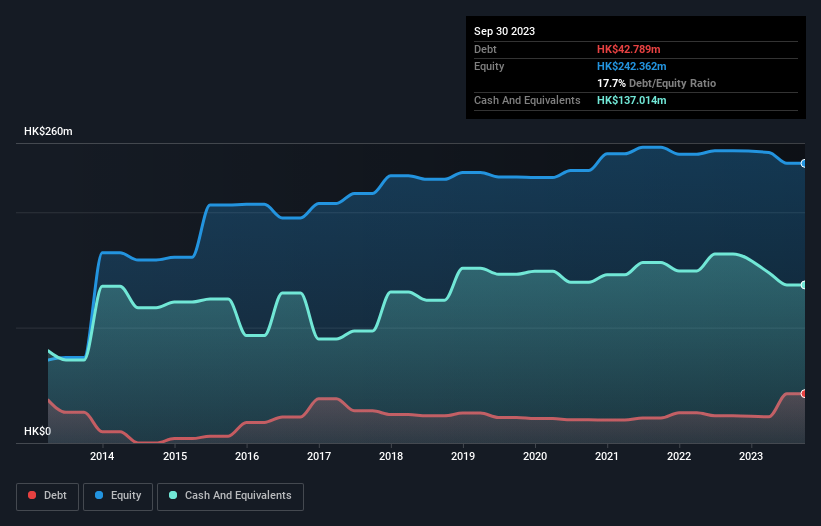

The image below, which you can click on for greater detail, shows that at September 2023 eprint Group had debt of HK$42.8m, up from HK$23.7m in one year. However, it does have HK$137.0m in cash offsetting this, leading to net cash of HK$94.2m.

A Look At eprint Group's Liabilities

According to the last reported balance sheet, eprint Group had liabilities of HK$115.8m due within 12 months, and liabilities of HK$33.8m due beyond 12 months. Offsetting this, it had HK$137.0m in cash and HK$8.24m in receivables that were due within 12 months. So it has liabilities totalling HK$4.36m more than its cash and near-term receivables, combined.

This state of affairs indicates that eprint Group's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the HK$231.0m company is struggling for cash, we still think it's worth monitoring its balance sheet. Despite its noteworthy liabilities, eprint Group boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is eprint Group's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, eprint Group reported revenue of HK$317m, which is a gain of 4.6%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is eprint Group?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year eprint Group had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of HK$20m and booked a HK$21m accounting loss. But the saving grace is the HK$94.2m on the balance sheet. That kitty means the company can keep spending for growth for at least two years, at current rates. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for eprint Group (1 is significant!) that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1884

eprint Group

An investment holding company, provides printing services and solutions on advertisements, bound books, stationeries, and yacht financing in Hong Kong.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026