- Hong Kong

- /

- Commercial Services

- /

- SEHK:1855

Investors Appear Satisfied With ZONQING Environmental Limited's (HKG:1855) Prospects As Shares Rocket 26%

ZONQING Environmental Limited (HKG:1855) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Unfortunately, despite the strong performance over the last month, the full year gain of 9.8% isn't as attractive.

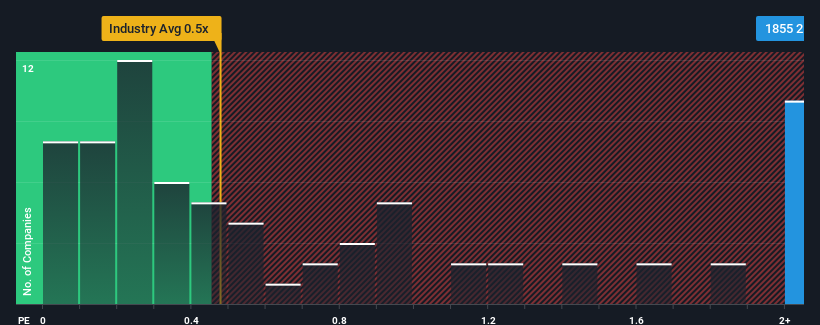

Following the firm bounce in price, you could be forgiven for thinking ZONQING Environmental is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 2.7x, considering almost half the companies in Hong Kong's Commercial Services industry have P/S ratios below 0.5x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for ZONQING Environmental

What Does ZONQING Environmental's P/S Mean For Shareholders?

Recent times have been quite advantageous for ZONQING Environmental as its revenue has been rising very briskly. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on ZONQING Environmental's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For ZONQING Environmental?

ZONQING Environmental's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 34%. Pleasingly, revenue has also lifted 121% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 4.5% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's understandable that ZONQING Environmental's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On ZONQING Environmental's P/S

The strong share price surge has lead to ZONQING Environmental's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that ZONQING Environmental maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with ZONQING Environmental, and understanding should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if ZONQING Environmental might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1855

ZONQING Environmental

Engages in landscaping, ecological restoration, and other related activities in the People’s Republic of China.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives