- Hong Kong

- /

- Commercial Services

- /

- SEHK:1855

Investors Appear Satisfied With ZONBONG LANDSCAPE Environmental Limited's (HKG:1855) Prospects As Shares Rocket 41%

The ZONBONG LANDSCAPE Environmental Limited (HKG:1855) share price has done very well over the last month, posting an excellent gain of 41%. The last month tops off a massive increase of 251% in the last year.

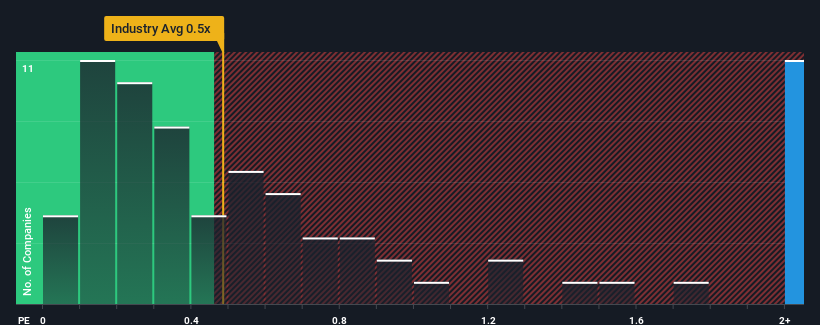

After such a large jump in price, given around half the companies in Hong Kong's Commercial Services industry have price-to-sales ratios (or "P/S") below 0.5x, you may consider ZONBONG LANDSCAPE Environmental as a stock to avoid entirely with its 3.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for ZONBONG LANDSCAPE Environmental

What Does ZONBONG LANDSCAPE Environmental's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, ZONBONG LANDSCAPE Environmental has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for ZONBONG LANDSCAPE Environmental, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is ZONBONG LANDSCAPE Environmental's Revenue Growth Trending?

ZONBONG LANDSCAPE Environmental's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The latest three year period has also seen an excellent 135% overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 8.7% shows it's noticeably more attractive.

With this information, we can see why ZONBONG LANDSCAPE Environmental is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From ZONBONG LANDSCAPE Environmental's P/S?

Shares in ZONBONG LANDSCAPE Environmental have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that ZONBONG LANDSCAPE Environmental maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

There are also other vital risk factors to consider and we've discovered 3 warning signs for ZONBONG LANDSCAPE Environmental (2 don't sit too well with us!) that you should be aware of before investing here.

If you're unsure about the strength of ZONBONG LANDSCAPE Environmental's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade ZONQING Environmental, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ZONQING Environmental might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1855

ZONQING Environmental

Engages in landscaping, ecological restoration, and other related activities in the People’s Republic of China.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives