- Hong Kong

- /

- Commercial Services

- /

- SEHK:1253

Is China Greenland Broad Greenstate Group Company Limited's (HKG:1253) Stock Price Struggling As A Result Of Its Mixed Financials?

It is hard to get excited after looking at China Greenland Broad Greenstate Group's (HKG:1253) recent performance, when its stock has declined 12% over the past three months. It is possible that the markets have ignored the company's differing financials and decided to lean-in to the negative sentiment. Stock prices are usually driven by a company’s financial performance over the long term, and therefore we decided to pay more attention to the company's financial performance. In this article, we decided to focus on China Greenland Broad Greenstate Group's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Put another way, it reveals the company's success at turning shareholder investments into profits.

Check out our latest analysis for China Greenland Broad Greenstate Group

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for China Greenland Broad Greenstate Group is:

7.6% = CN¥72m ÷ CN¥954m (Based on the trailing twelve months to June 2020).

The 'return' is the income the business earned over the last year. So, this means that for every HK$1 of its shareholder's investments, the company generates a profit of HK$0.08.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

China Greenland Broad Greenstate Group's Earnings Growth And 7.6% ROE

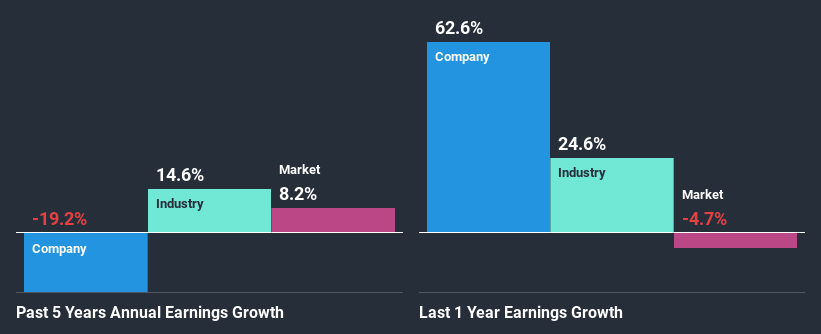

When you first look at it, China Greenland Broad Greenstate Group's ROE doesn't look that attractive. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 10% either. For this reason, China Greenland Broad Greenstate Group's five year net income decline of 19% is not surprising given its lower ROE. We believe that there also might be other aspects that are negatively influencing the company's earnings prospects. Such as - low earnings retention or poor allocation of capital.

However, when we compared China Greenland Broad Greenstate Group's growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 15% in the same period. This is quite worrisome.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if China Greenland Broad Greenstate Group is trading on a high P/E or a low P/E, relative to its industry.

Is China Greenland Broad Greenstate Group Making Efficient Use Of Its Profits?

While the company did payout a portion of its dividend in the past, it currently doesn't pay a dividend. This implies that potentially all of its profits are being reinvested in the business.

Conclusion

Overall, we have mixed feelings about China Greenland Broad Greenstate Group. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. To know the 3 risks we have identified for China Greenland Broad Greenstate Group visit our risks dashboard for free.

If you’re looking to trade China Greenland Broad Greenstate Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade China Greenland Broad Greenstate Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1253

China Greenland Broad Greenstate Group

An investment holding company, provides landscape design, gardening, project management, and related services in the People’s Republic of China.

Slight with mediocre balance sheet.

Market Insights

Community Narratives