- Singapore

- /

- Consumer Finance

- /

- SGX:S41

3 Promising Penny Stocks With Over US$100M Market Cap

Reviewed by Simply Wall St

As global markets navigate a mix of economic signals, including mixed performance in major U.S. indices and fluctuating economic data, investors are exploring diverse opportunities. Penny stocks, often seen as the domain of smaller or newer companies, continue to offer intriguing possibilities despite being considered a niche area. With their potential for growth at lower price points and when supported by strong financial health, these stocks can be attractive options for those seeking hidden gems in the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.71 | £425.03M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.01 | £757.4M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.64 | HK$40.08B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.87 | £469.45M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.966 | £152.38M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,821 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Lion Rock Group (SEHK:1127)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lion Rock Group Limited, with a market cap of HK$1.02 billion, is an investment holding company that offers printing services to international book publishers and print media companies.

Operations: The company generates revenue through two main segments: Printing, which contributes HK$1.84 billion, and Publishing, accounting for HK$931.82 million.

Market Cap: HK$1.02B

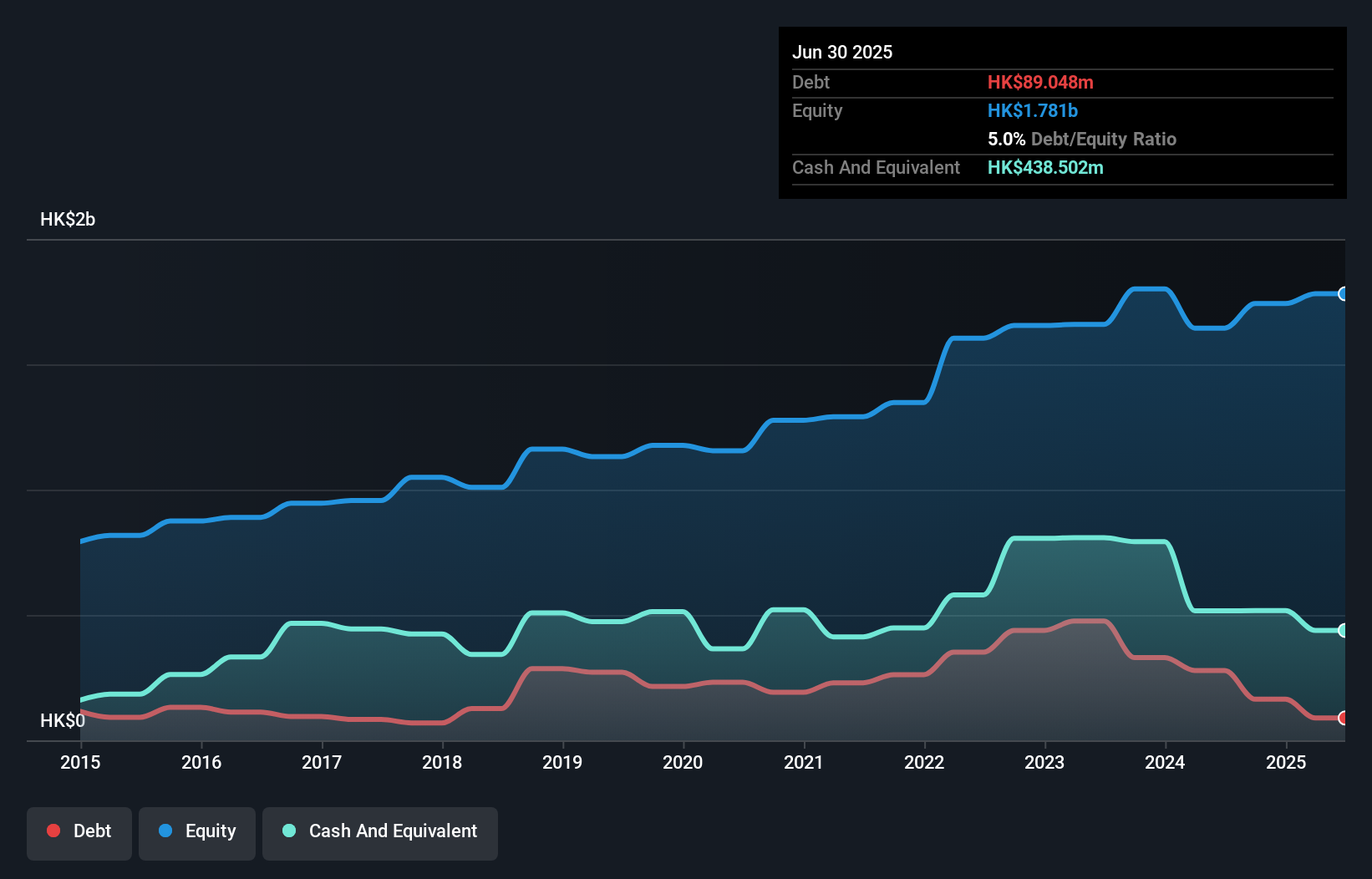

Lion Rock Group demonstrates financial stability with more cash than total debt and operating cash flow covering its debt well. The company has achieved significant earnings growth of 28.2% over the past year, surpassing both its five-year average and industry performance. Its interest payments are comfortably covered by EBIT, indicating strong financial health. While the company trades at a considerable discount to estimated fair value, potential investors should note the unstable dividend history and low return on equity of 14.9%. Additionally, Lion Rock's board is experienced with an average tenure of 10 years, supporting governance strength.

- Take a closer look at Lion Rock Group's potential here in our financial health report.

- Explore historical data to track Lion Rock Group's performance over time in our past results report.

C&D Property Management Group (SEHK:2156)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: C&D Property Management Group Co. Limited is an investment holding company that offers property management services for residential and non-residential properties in the People’s Republic of China, with a market cap of HK$3.39 billion.

Operations: The company generates revenue primarily from the provision of property management services and value-added services, amounting to CN¥3.80 billion.

Market Cap: HK$3.39B

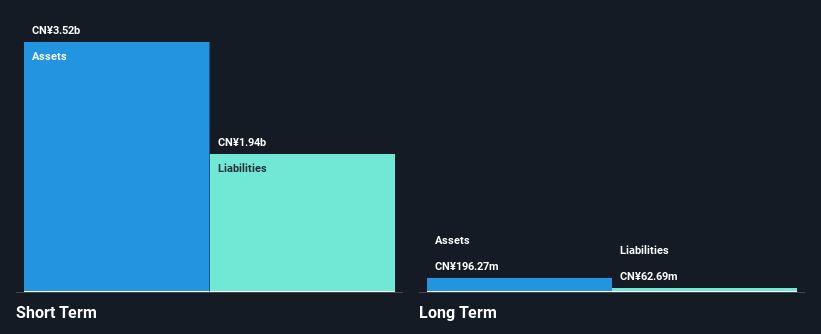

C&D Property Management Group shows promising financial metrics, with a strong Return on Equity of 33.1% and earnings growth of 68.4% over the past year, surpassing both its five-year average and industry performance. The company benefits from high-quality earnings and has significantly reduced its debt-to-equity ratio from very large levels to 1.3% over five years. Its short-term assets comfortably cover both short- and long-term liabilities, while operating cash flow effectively manages debt obligations. Despite these strengths, potential investors should consider that the dividend is not well covered by free cash flows, which could impact future payouts.

- Navigate through the intricacies of C&D Property Management Group with our comprehensive balance sheet health report here.

- Assess C&D Property Management Group's previous results with our detailed historical performance reports.

Hong Leong Finance (SGX:S41)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hong Leong Finance Limited is a financial service company serving consumer and SME markets in Singapore, with a market cap of SGD1.11 billion.

Operations: The company generates revenue primarily from its financing business, amounting to SGD227.13 million.

Market Cap: SGD1.11B

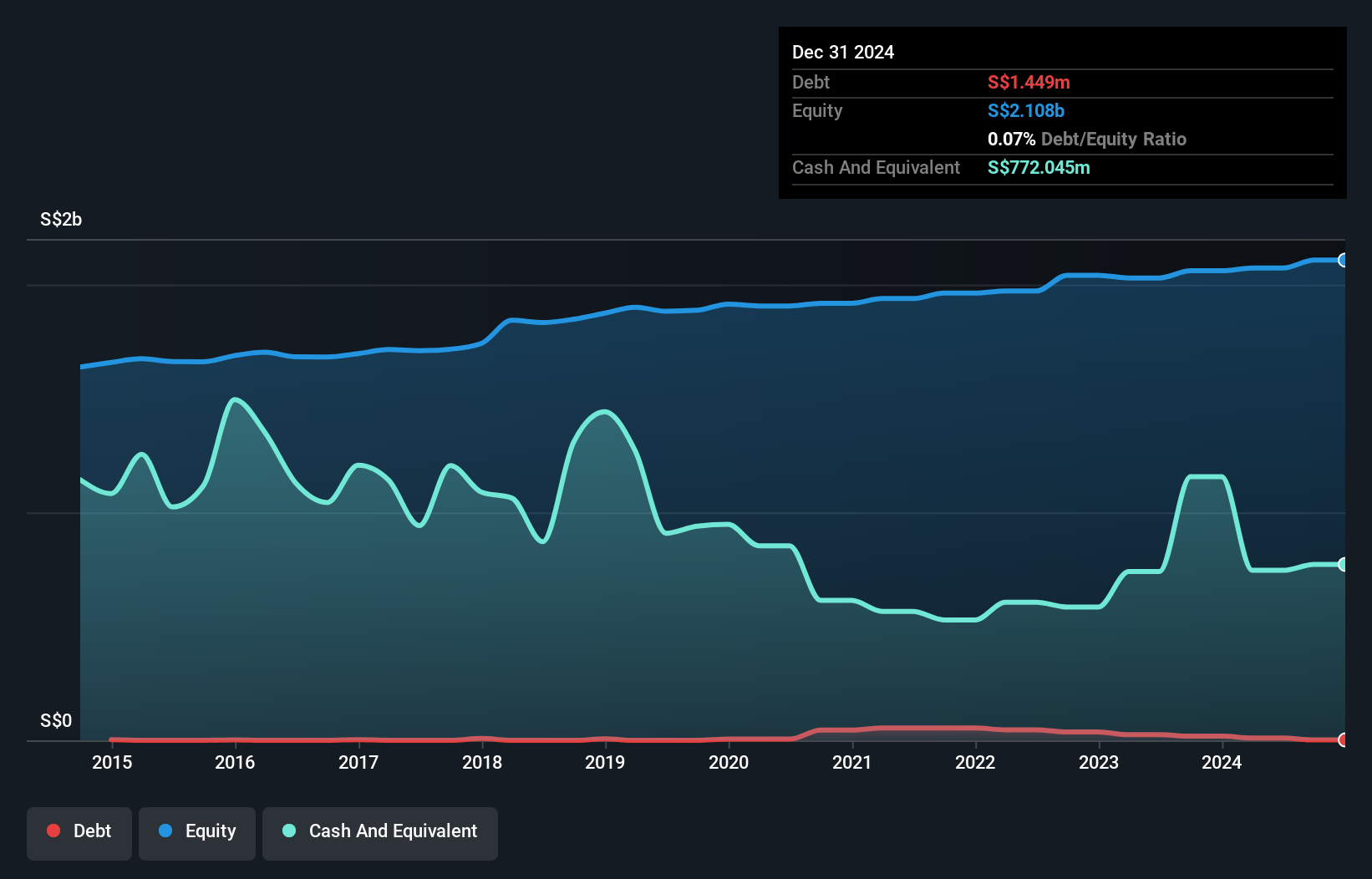

Hong Leong Finance Limited demonstrates several strengths relevant to penny stock investors, including a seasoned management team with an average tenure of 8.3 years and stable weekly volatility at 1%. The company maintains high-quality earnings and an appropriate Loans to Deposits ratio of 95%, funded primarily by low-risk customer deposits. However, recent challenges include negative earnings growth of -24.9% over the past year and a low Return on Equity at 4.8%. While its Price-To-Earnings ratio is slightly below the Singapore market average, potential investors should note its unstable dividend track record and lower profit margins compared to last year.

- Dive into the specifics of Hong Leong Finance here with our thorough balance sheet health report.

- Examine Hong Leong Finance's past performance report to understand how it has performed in prior years.

Taking Advantage

- Embark on your investment journey to our 5,821 Penny Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hong Leong Finance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:S41

Hong Leong Finance

Operates as a financial services company for consumer, and small and medium-sized enterprises (SMEs) markets in Singapore.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives