- Hong Kong

- /

- Construction

- /

- SEHK:9979

Is Now The Time To Put Greentown Management Holdings (HKG:9979) On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Greentown Management Holdings (HKG:9979). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Greentown Management Holdings

How Fast Is Greentown Management Holdings Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Greentown Management Holdings managed to grow EPS by 5.2% per year, over three years. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

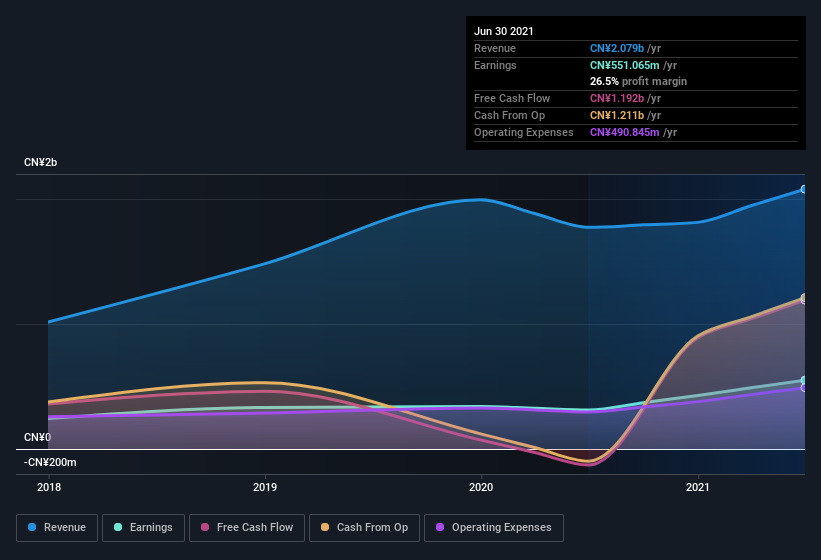

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Greentown Management Holdings maintained stable EBIT margins over the last year, all while growing revenue 17% to CN¥2.1b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Greentown Management Holdings's future profits.

Are Greentown Management Holdings Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One gleaming positive for Greentown Management Holdings, in the last year, is that a certain insider has buying shares with ample enthusiasm. In one fell swoop, CEO & Executive Director Jun Li, spent HK$2.9m, at a price of HK$4.67 per share. It doesn't get much better than that, in terms of large investments from insiders.

Does Greentown Management Holdings Deserve A Spot On Your Watchlist?

As I already mentioned, Greentown Management Holdings is a growing business, which is what I like to see. Not every business can grow its EPS, but Greentown Management Holdings certainly can. The icing on the cake is that an insider bought shares during the year, which inclines me to put this one on a watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Greentown Management Holdings , and understanding them should be part of your investment process.

The good news is that Greentown Management Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9979

Greentown Management Holdings

An investment holding company, provides project management services in the People’s Republic of China.

Excellent balance sheet and good value.

Market Insights

Community Narratives