- Hong Kong

- /

- Construction

- /

- SEHK:9900

Undiscovered Gems In Global Featuring 3 Promising Stocks With Strong Potential

Reviewed by Simply Wall St

In recent weeks, global markets have experienced notable shifts, with major U.S. stock indexes reaching record highs following the Federal Reserve's decision to cut interest rates for the first time this year. This move has spurred a rally in small-cap stocks, as evidenced by the Russell 2000 Index's gain of 2.16%, highlighting renewed investor interest in these often-overlooked segments of the market. In such an environment, identifying promising small-cap stocks can be particularly rewarding; these companies often possess unique growth potential that can thrive under favorable economic conditions and strategic positioning within their respective industries.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 5.00% | 14.21% | 13.26% | ★★★★★★ |

| Daphne International Holdings | NA | -5.92% | 82.03% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Taiyo KagakuLtd | 0.67% | 5.77% | 2.06% | ★★★★★☆ |

| Changjiu Holdings | 50.46% | 54.90% | 14.57% | ★★★★★☆ |

| Li Ming Development Construction | 170.96% | 14.13% | 22.83% | ★★★★☆☆ |

| ASL Marine Holdings | 155.37% | 13.24% | 51.91% | ★★★★☆☆ |

| TSTE | 38.15% | 4.63% | -6.91% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Hong Kong Zcloud Technology Construction (SEHK:9900)

Simply Wall St Value Rating: ★★★★★★

Overview: Hong Kong Zcloud Technology Construction Limited is an investment holding company that provides subcontracting works for both public and private sectors in Hong Kong, with a market capitalization of HK$8.18 billion.

Operations: Zcloud Technology Construction generates revenue primarily from its building construction and RMAA services, amounting to HK$1.28 billion. The company's financial performance is influenced by the costs associated with these subcontracting services.

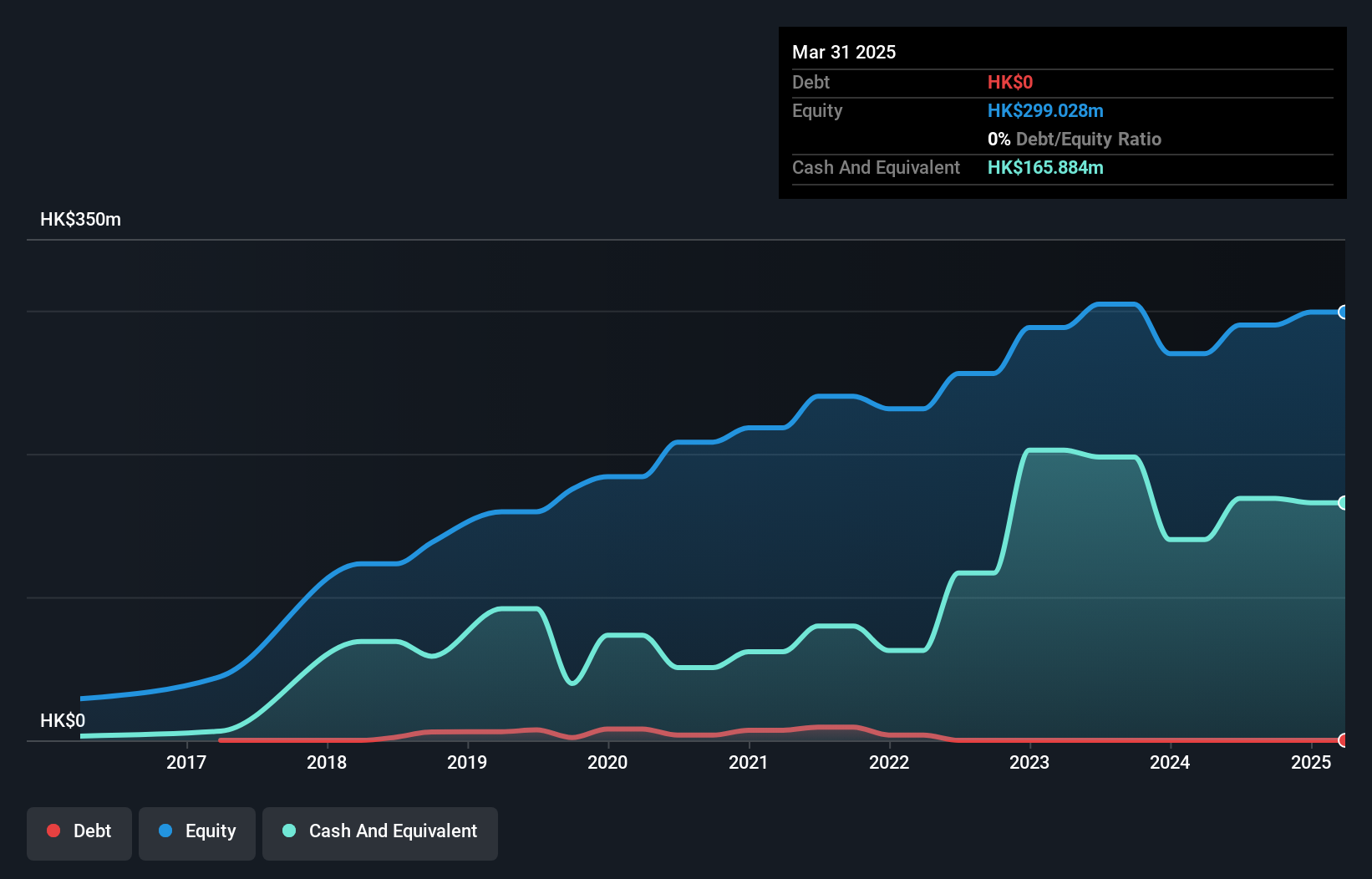

Zcloud Technology Construction, a smaller player in the industry, has shown notable financial resilience. Its earnings growth of 12.1% outpaced the construction sector's -0.8%, reflecting strong performance against industry trends. With no debt compared to a 4.3% debt-to-equity ratio five years ago, it stands on solid financial ground, eliminating concerns over interest coverage. Despite its volatile share price recently, Zcloud's free cash flow remains positive and high-quality earnings are evident from its net income increase to HK$31 million from HK$27.7 million last year. The recent inclusion in the S&P Global BMI Index highlights growing recognition of its potential value.

- Dive into the specifics of Hong Kong Zcloud Technology Construction here with our thorough health report.

Understand Hong Kong Zcloud Technology Construction's track record by examining our Past report.

Shandong University Electric Power Technology (SZSE:301609)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong University Electric Power Technology Co., Ltd. operates in the field of industrial automation and controls, with a market capitalization of CN¥8.41 billion.

Operations: The company's primary revenue stream is from its industrial automation and controls segment, generating CN¥692.39 million. With a market capitalization of CN¥8.41 billion, this segment plays a crucial role in the company's financial structure.

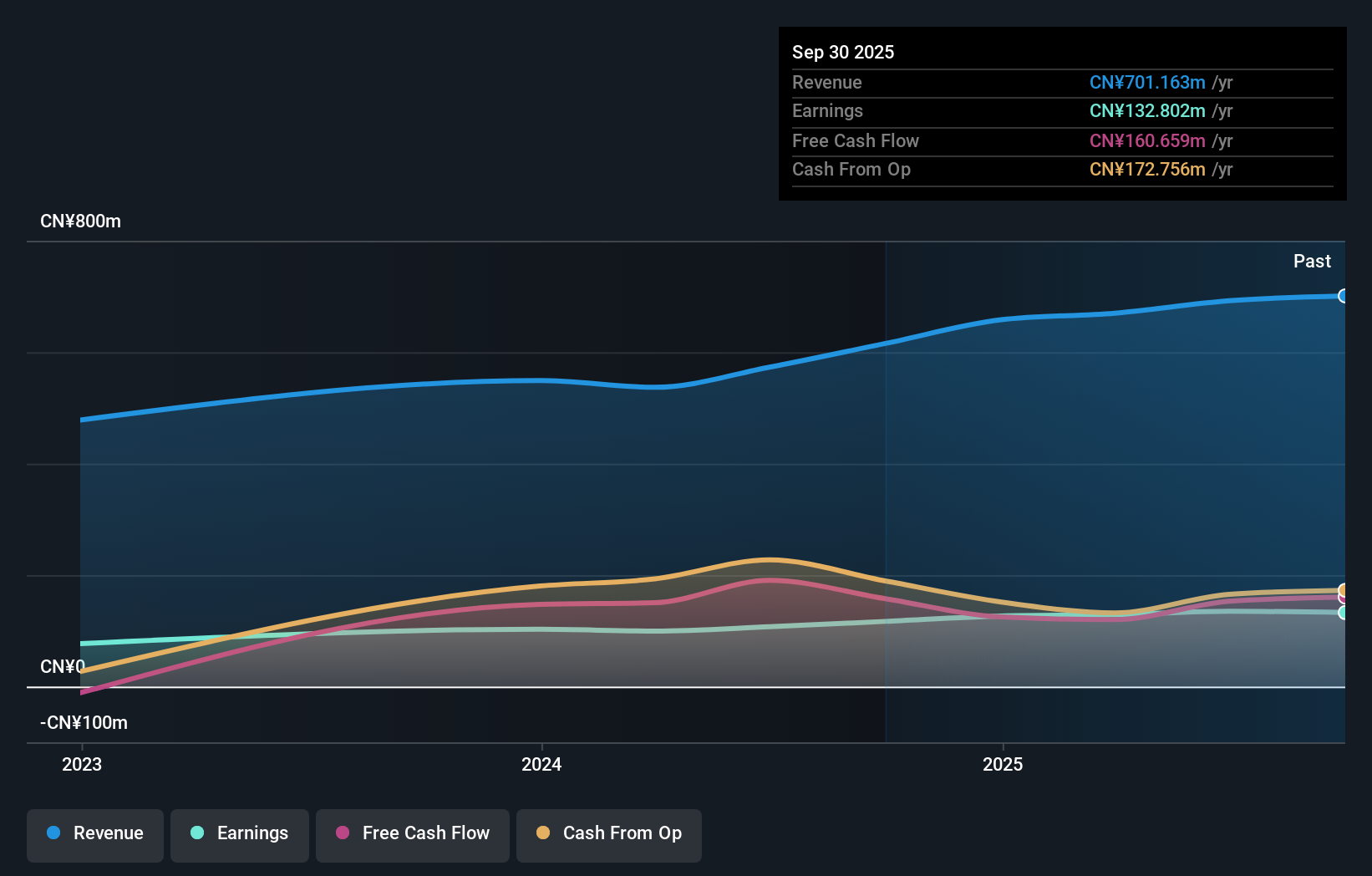

Shandong University Electric Power Technology, a promising player in the electrical sector, has shown robust earnings growth of 25.9% over the past year, outpacing the industry average of -0.3%. The company is debt-free and boasts high-quality earnings with no concerns about interest coverage or cash runway. Recent financials highlight a strong performance for the first half of 2025, with sales reaching CNY 279.42 million compared to CNY 245.18 million last year and net income climbing to CNY 49.33 million from CNY 40.91 million previously. Additionally, its IPO raised approximately CNY 537 million, marking significant capital inflow for future endeavors.

NSD (TSE:9759)

Simply Wall St Value Rating: ★★★★★☆

Overview: NSD Co., Ltd. is a Japanese company that offers a range of IT solutions, with a market capitalization of approximately ¥269.98 billion.

Operations: NSD generates revenue primarily through its System Development Business, with significant contributions from Financial IT (¥32.96 billion), Industrial IT (¥26.45 billion), and Social Infrastructure IT (¥23.06 billion). The Solution Business adds ¥15.33 billion to the revenue stream, while the IT Infrastructure Construction segment contributes ¥12.64 billion.

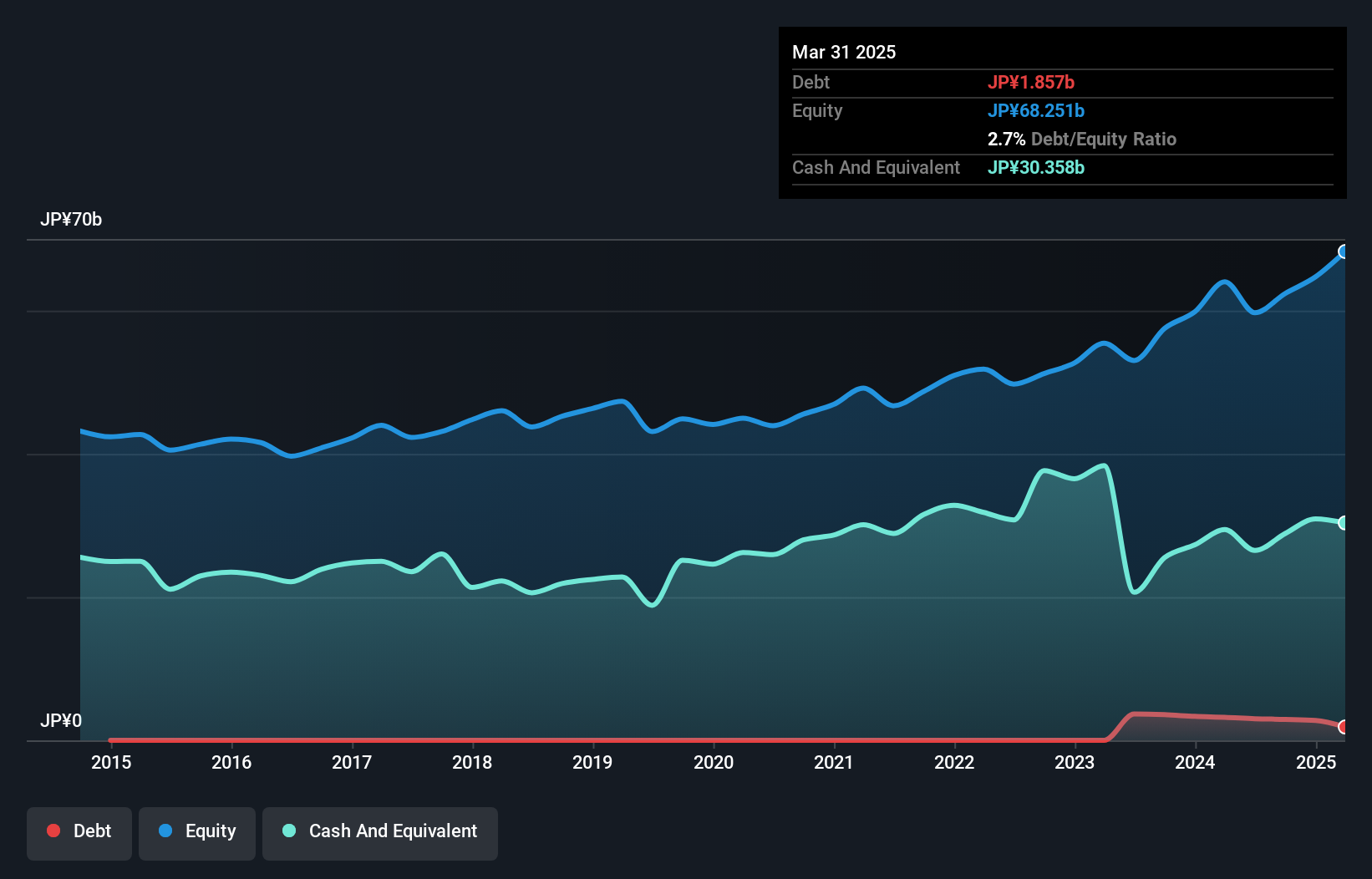

NSD's financial performance showcases a promising trajectory with earnings growing 13.3% annually over the past five years, although recent growth of 11.5% lagged behind the IT industry's 17%. The firm remains profitable with free cash flow positivity and has more cash than total debt, reflecting prudent financial management despite a slight increase in its debt-to-equity ratio to 2.4%. Recent sales figures highlight robust demand, with August net sales at ¥9.71 billion compared to ¥8.88 billion last year and year-to-date sales reaching ¥46.51 billion from ¥42.88 billion previously, indicating consistent revenue expansion potential moving forward.

- Delve into the full analysis health report here for a deeper understanding of NSD.

Assess NSD's past performance with our detailed historical performance reports.

Taking Advantage

- Reveal the 2939 hidden gems among our Global Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hong Kong Zcloud Technology Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9900

Hong Kong Zcloud Technology Construction

An investment holding company, engages in the provision of subcontracting works for public and private sectors in Hong Kong.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives