- Singapore

- /

- Commercial Services

- /

- SGX:LS9

ICO Group Leads The Charge With 2 Other Noteworthy Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic indicators, investors continue to explore diverse opportunities. Penny stocks, despite their nostalgic name, remain a relevant investment area for those interested in smaller or newer companies. By focusing on financial strength and potential growth, these stocks can offer surprising value and stability amidst broader market uncertainties.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.05 | £772.37M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.88 | HK$44.38B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

Click here to see the full list of 5,814 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

ICO Group (SEHK:1460)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ICO Group Limited is an investment holding company that offers IT application services to institutions and enterprises in Hong Kong and internationally, with a market cap of HK$134.27 million.

Operations: The company's revenue is primarily derived from IT Infrastructure Solutions Services (HK$804.44 million), followed by IT Maintenance and Support Services (HK$162.72 million), IT Application and Solution Development Services (HK$66.13 million), and IT Secondment Services (HK$29.56 million).

Market Cap: HK$134.27M

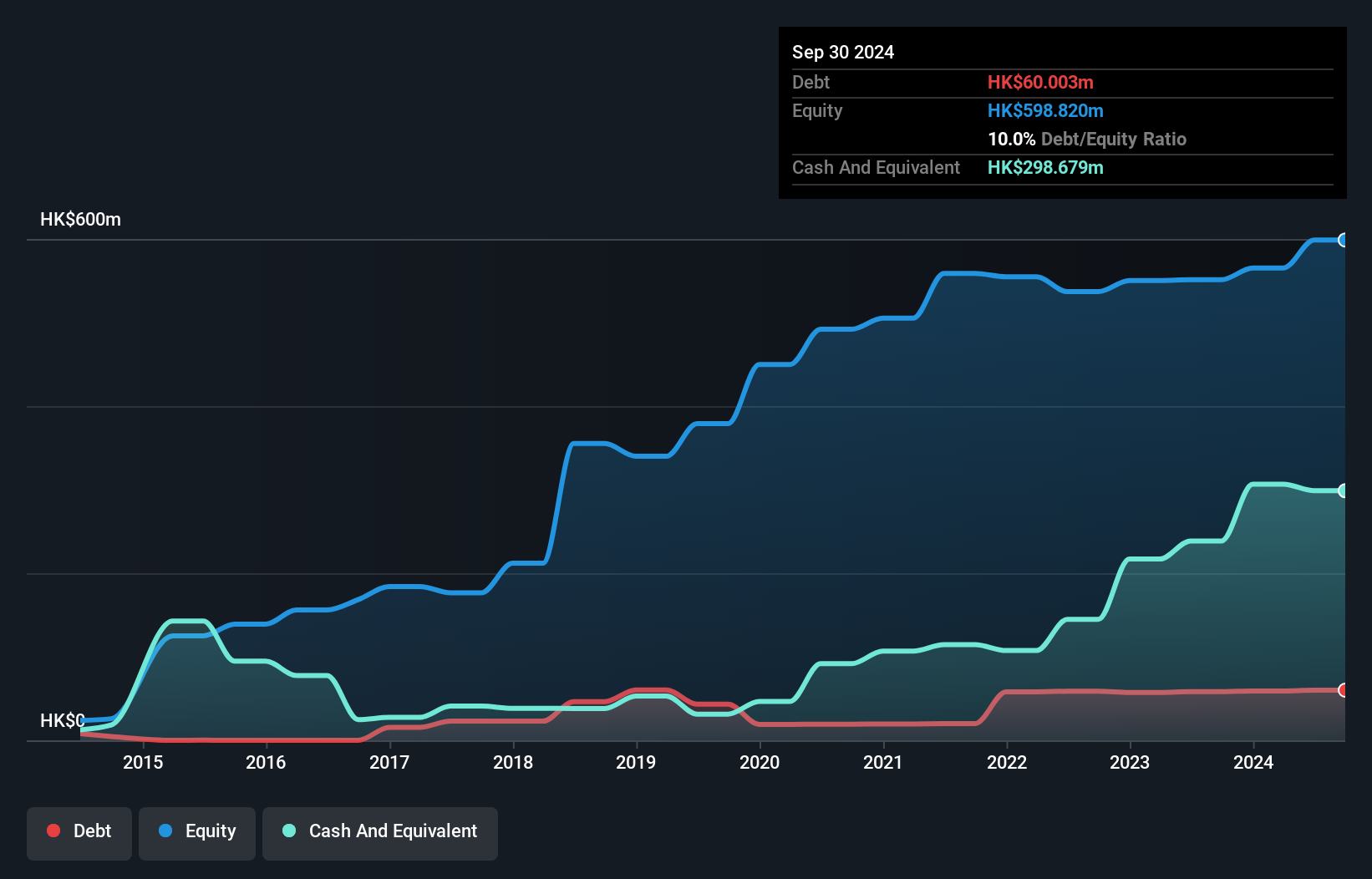

ICO Group Limited has demonstrated a significant earnings growth of 142.4% over the past year, surpassing the IT industry's decline, although its five-year performance shows a decrease in earnings by 32.1% annually. The company is trading at a substantial discount to its estimated fair value and maintains strong financial health with short-term assets exceeding liabilities and cash surpassing total debt. Recent half-year results showed an increase in net income to HK$22.02 million despite slightly lower sales compared to the previous year, reflecting improved profitability margins from 1% to 2.3%. However, share price volatility remains high.

- Click here and access our complete financial health analysis report to understand the dynamics of ICO Group.

- Review our historical performance report to gain insights into ICO Group's track record.

IPE Group (SEHK:929)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IPE Group Limited is an investment holding company that manufactures and sells precision metal components and assembled parts for automotive, hydraulic, electronic equipment, and other devices with a market cap of HK$462.99 million.

Operations: The company generates revenue from three main segments: Automotive Components (HK$464.83 million), Hydraulic Equipment Components (HK$436.08 million), and Electronic Equipment Components (HK$28.39 million).

Market Cap: HK$462.99M

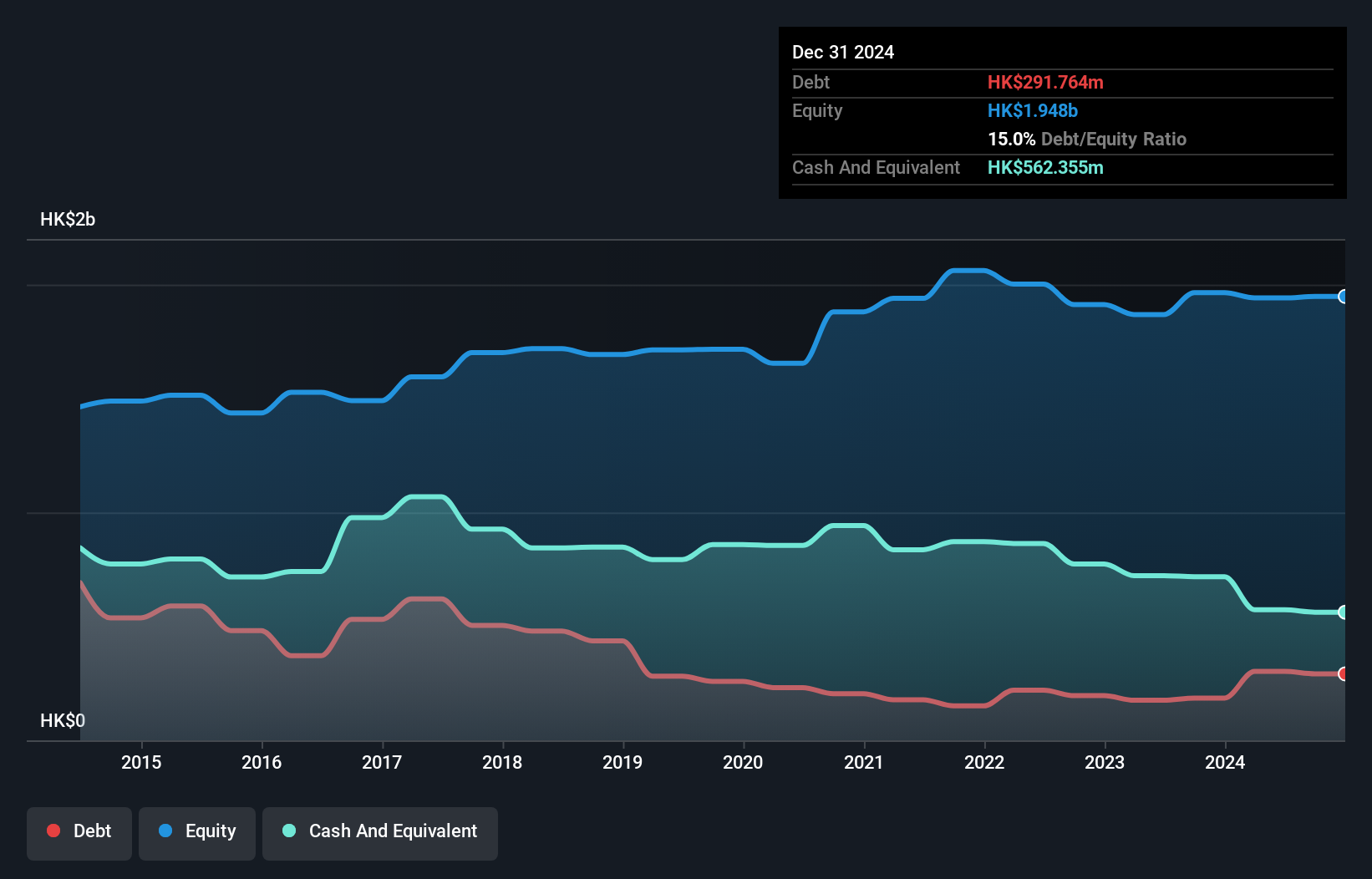

IPE Group Limited has recently become profitable, though its earnings have declined by 26.3% annually over the past five years. Despite this, the company's financial health appears solid with short-term assets of HK$1.4 billion comfortably covering both short and long-term liabilities. The management team is experienced, and interest payments are well covered by EBIT at 24.9 times coverage. However, Return on Equity remains low at 1%, and recent financial results were impacted by a significant one-off gain of HK$7.8 million. The company holds more cash than total debt, indicating prudent financial management amidst stable weekly volatility of 9%.

- Dive into the specifics of IPE Group here with our thorough balance sheet health report.

- Gain insights into IPE Group's past trends and performance with our report on the company's historical track record.

Leader Environmental Technologies (SGX:LS9)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Leader Environmental Technologies Limited is an investment holding company that operates as an environmental technology provider in the People’s Republic of China and Taiwan, with a market cap of SGD61.40 million.

Operations: The company's revenue is primarily derived from Engineering Solution Services (CN¥40.58 million) and AI Water and Sludge Treatment Services (CN¥8.78 million), with a smaller contribution from the Manufacturing of High-Performance Membrane Products (CN¥0.16 million).

Market Cap: SGD61.4M

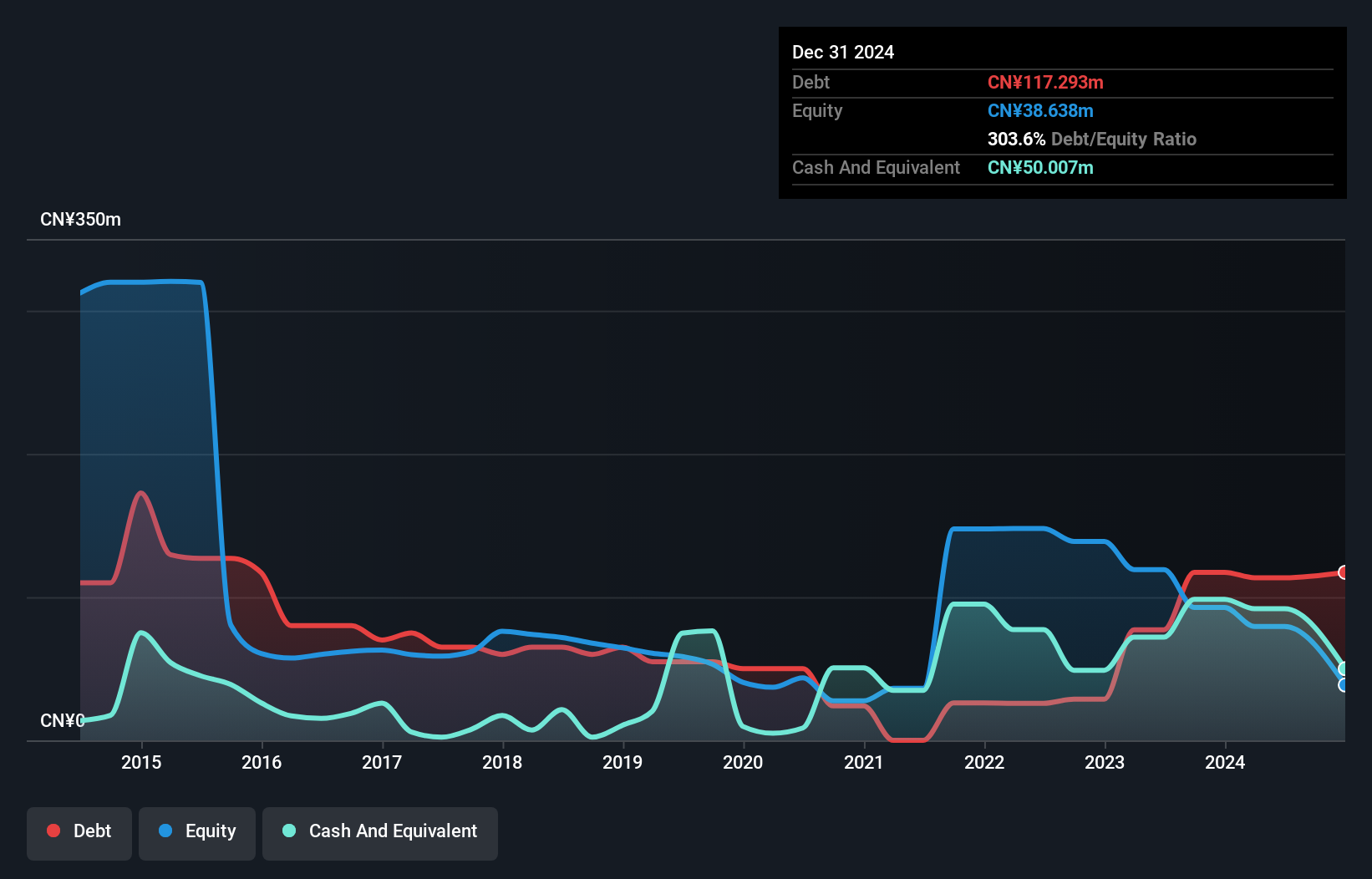

Leader Environmental Technologies Limited operates in the environmental technology sector, primarily generating revenue from Engineering Solution Services (CN¥40.58 million) and AI Water and Sludge Treatment Services (CN¥8.78 million). Despite its unprofitability and a negative Return on Equity of -52.78%, the company maintains a satisfactory net debt to equity ratio of 27.3% and has a cash runway exceeding one year based on current free cash flow levels. The management team is relatively new with an average tenure of 1.4 years, while the board is more seasoned with an average tenure of 3.8 years, providing some stability amidst financial challenges.

- Jump into the full analysis health report here for a deeper understanding of Leader Environmental Technologies.

- Assess Leader Environmental Technologies' previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Unlock more gems! Our Penny Stocks screener has unearthed 5,811 more companies for you to explore.Click here to unveil our expertly curated list of 5,814 Penny Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:LS9

Leader Environmental Technologies

An investment holding company, operates as an environmental technology provider in the People’s Republic of China and Taiwan.

Moderate risk unattractive dividend payer.

Market Insights

Community Narratives