- Hong Kong

- /

- Trade Distributors

- /

- SEHK:8612

World Super Holdings (HKG:8612) Is Carrying A Fair Bit Of Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, World Super Holdings Limited (HKG:8612) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for World Super Holdings

What Is World Super Holdings's Debt?

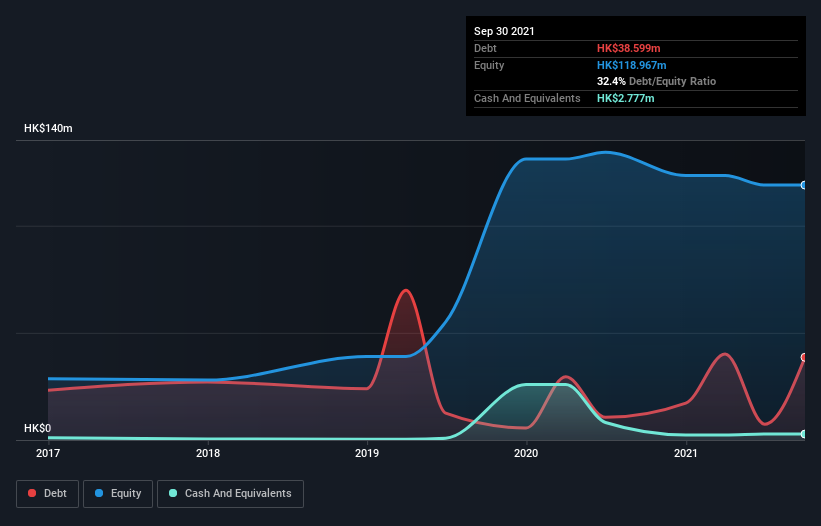

The image below, which you can click on for greater detail, shows that at June 2021 World Super Holdings had debt of HK$38.6m, up from HK$10.6m in one year. On the flip side, it has HK$2.78m in cash leading to net debt of about HK$35.8m.

How Healthy Is World Super Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that World Super Holdings had liabilities of HK$45.8m due within 12 months and liabilities of HK$9.46m due beyond that. Offsetting these obligations, it had cash of HK$2.78m as well as receivables valued at HK$43.1m due within 12 months. So it has liabilities totalling HK$9.38m more than its cash and near-term receivables, combined.

Since publicly traded World Super Holdings shares are worth a total of HK$151.2m, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since World Super Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year World Super Holdings wasn't profitable at an EBIT level, but managed to grow its revenue by 207%, to HK$171m. When it comes to revenue growth, that's like nailing the game winning 3-pointer!

Caveat Emptor

Despite the top line growth, World Super Holdings still had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost a very considerable HK$16m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled HK$37m in negative free cash flow over the last twelve months. So in short it's a really risky stock. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 5 warning signs with World Super Holdings (at least 2 which don't sit too well with us) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if World Super Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8612

World Super Holdings

An investment holding company, provides rental services of crawler cranes, oscillators, bored piling machines, and hydromill trench cutters in Hong Kong and Macau.

Medium-low with excellent balance sheet.