- Hong Kong

- /

- Electrical

- /

- SEHK:842

It's A Story Of Risk Vs Reward With Leoch International Technology Limited (HKG:842)

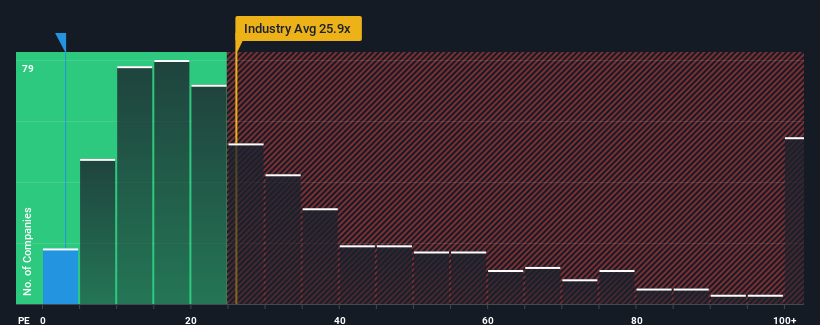

When close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 9x, you may consider Leoch International Technology Limited (HKG:842) as a highly attractive investment with its 3x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Leoch International Technology as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Leoch International Technology

How Is Leoch International Technology's Growth Trending?

Leoch International Technology's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 205%. Pleasingly, EPS has also lifted 694% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 23% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Leoch International Technology's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Leoch International Technology currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Leoch International Technology (at least 1 which is significant), and understanding them should be part of your investment process.

You might be able to find a better investment than Leoch International Technology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:842

Leoch International Technology

An investment holding company, engages in the power solutions and recycled lead business in Mainland China, Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Mediocre balance sheet second-rate dividend payer.

Market Insights

Community Narratives