- Singapore

- /

- Construction

- /

- SGX:E3B

Global's Top Penny Stocks For October 2025

Reviewed by Simply Wall St

Global markets have shown resilience in the face of uncertainty, with U.S. stocks posting gains despite a government shutdown and economic data delays. This backdrop has created a "bad news is good news" scenario, where weaker labor market reports bolster expectations for Federal Reserve rate cuts, benefiting small-cap stocks like those in the Russell 2000 Index. In such conditions, penny stocks—often representing smaller or newer companies—remain relevant as they can offer surprising value when backed by solid financials. These stocks may present opportunities for investors to uncover hidden value and potential long-term growth.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.51 | HK$933.97M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.71 | A$423.4M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.635 | MYR322.88M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.71 | HK$2.25B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.33 | SGD539.03M | ✅ 4 ⚠️ 1 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.37 | MYR550.13M | ✅ 5 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.38 | SGD13.3B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.495 | $287.76M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £184.68M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 3,569 stocks from our Global Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Lung Kee Group Holdings (SEHK:255)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lung Kee Group Holdings Limited is an investment holding company that manufactures and markets mould bases and related products in the People’s Republic of China and internationally, with a market cap of HK$1.17 billion.

Operations: The company generates revenue of HK$1.46 billion from its metal processors and fabrication segment.

Market Cap: HK$1.17B

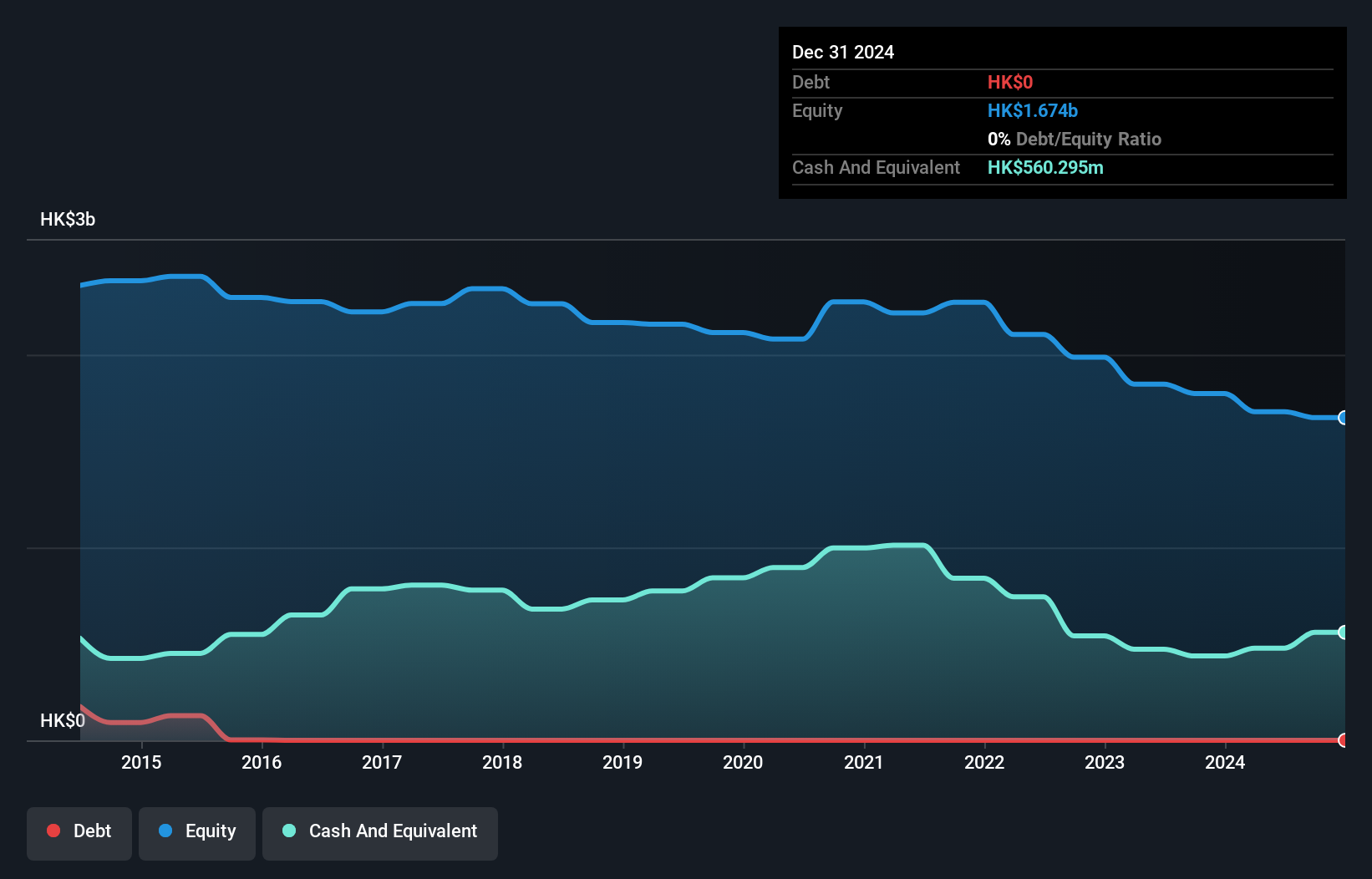

Lung Kee Group Holdings Limited, with a market cap of HK$1.17 billion, has demonstrated resilience despite challenges. The company reported sales of HK$688.65 million for the first half of 2025, a decline from the previous year but reduced its net loss to HK$3.55 million from HK$23.92 million. It remains debt-free and benefits from an experienced board and management team with an average tenure of 17.5 years each, ensuring stability in governance and operations. While earnings have declined over five years, recent profitability marks a positive shift amid stable weekly volatility and strong asset coverage for liabilities.

- Take a closer look at Lung Kee Group Holdings' potential here in our financial health report.

- Explore historical data to track Lung Kee Group Holdings' performance over time in our past results report.

Wealth Glory Holdings (SEHK:8269)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wealth Glory Holdings Limited is an investment holding company involved in the trading of natural resources and commodities in Hong Kong and the People's Republic of China, with a market cap of HK$516.62 million.

Operations: The company generates revenue from money lending (HK$1.23 million) and trading of consumer products (HK$34.18 million).

Market Cap: HK$516.62M

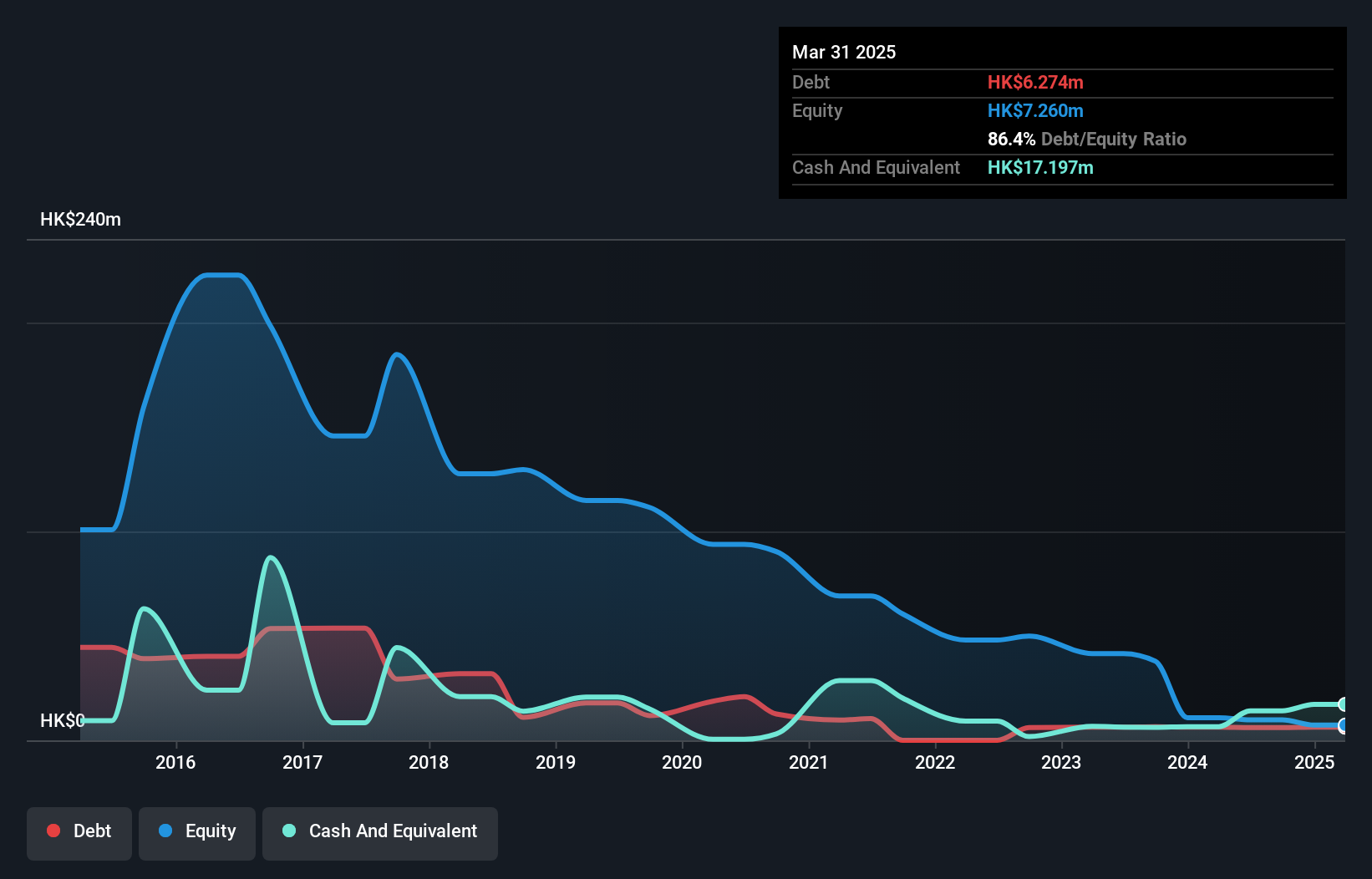

Wealth Glory Holdings Limited, with a market cap of HK$516.62 million, is currently pre-revenue, generating limited income from money lending and consumer product trading. The company has more cash than debt and sufficient cash runway for over three years despite being unprofitable. Recent executive changes include the appointment of Mr. Yuen Hiu Tung as chairman, known for his extensive experience in entrepreneurship and investment management. While the stock's share price remains highly volatile compared to most Hong Kong stocks, its short-term assets exceed liabilities, providing some financial stability amidst ongoing challenges in achieving profitability.

- Jump into the full analysis health report here for a deeper understanding of Wealth Glory Holdings.

- Gain insights into Wealth Glory Holdings' historical outcomes by reviewing our past performance report.

Wee Hur Holdings (SGX:E3B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wee Hur Holdings Ltd. is an investment holding company involved in general building and civil engineering construction in Singapore and Australia, with a market cap of SGD680.24 million.

Operations: The company's revenue segments include Building Construction at SGD137.48 million, Workers Dormitory generating SGD84.26 million, Property Development in Singapore with SGD76.46 million, Fund Management contributing SGD43.72 million, PBSA Operations at SGD2.12 million, Corporate Segment with SGD3.55 million, and Property Development in Australia bringing in SGD0.93 million.

Market Cap: SGD680.24M

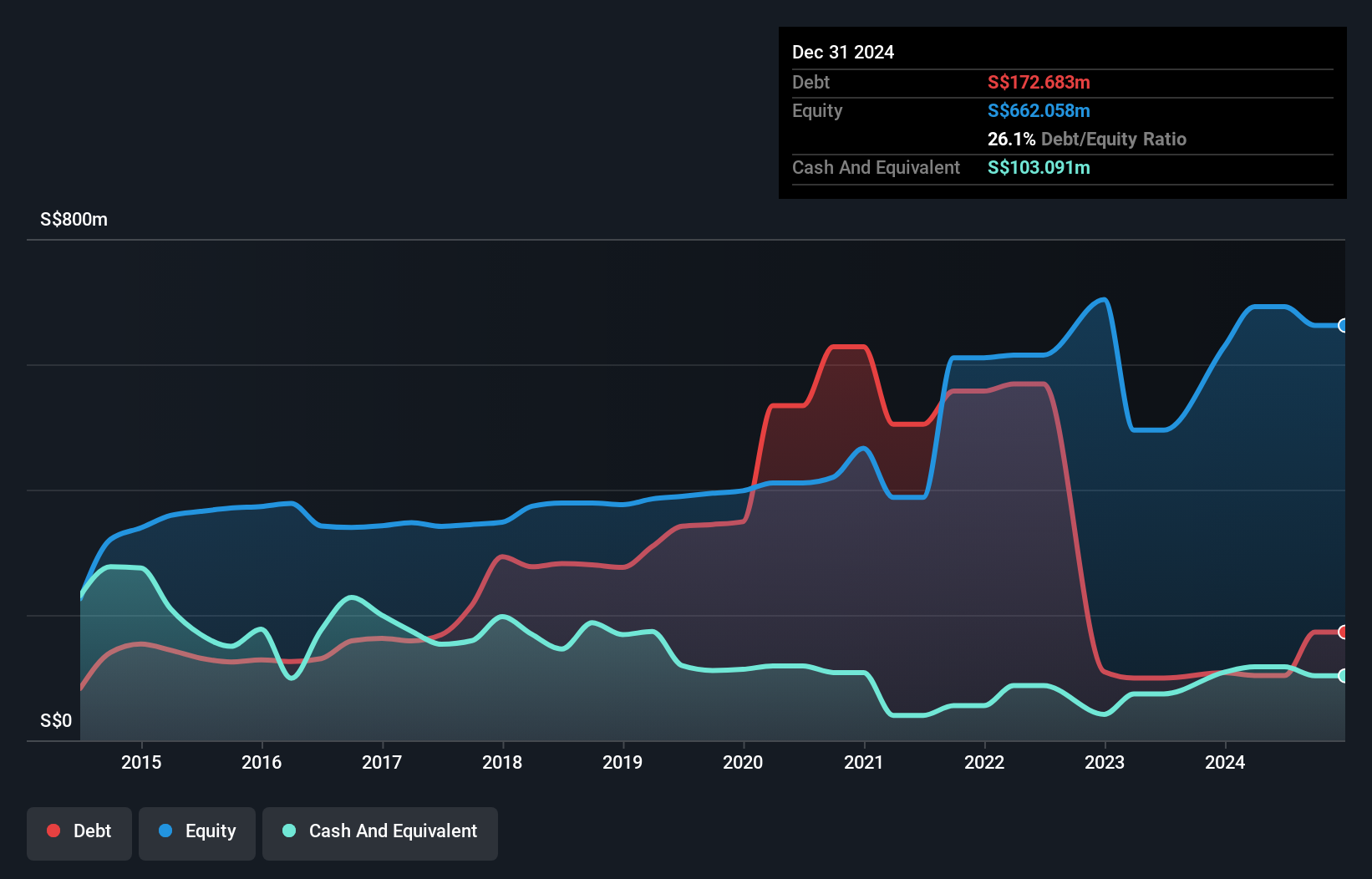

Wee Hur Holdings, with a market cap of SGD680.24 million, has demonstrated financial resilience by reducing its debt to equity ratio from 130% to 34.6% over five years and maintaining more cash than total debt. Its short-term assets significantly exceed both short and long-term liabilities, indicating strong liquidity. Despite a large one-off loss impacting recent earnings, the company continues to generate substantial revenue across various segments like Building Construction (SGD137.48 million) and Workers Dormitory (SGD84.26 million). Recent inclusion in the S&P Global BMI Index reflects its growing recognition in the investment community despite challenges such as declining profit margins.

- Dive into the specifics of Wee Hur Holdings here with our thorough balance sheet health report.

- Learn about Wee Hur Holdings' future growth trajectory here.

Taking Advantage

- Unlock more gems! Our Global Penny Stocks screener has unearthed 3,566 more companies for you to explore.Click here to unveil our expertly curated list of 3,569 Global Penny Stocks.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wee Hur Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:E3B

Wee Hur Holdings

An investment holding company, engages in general building and civil engineering construction business in Singapore and Australia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives