- Hong Kong

- /

- Construction

- /

- SEHK:8053

We Think Pizu Group Holdings (HKG:8053) Can Manage Its Debt With Ease

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Pizu Group Holdings Limited (HKG:8053) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Pizu Group Holdings

What Is Pizu Group Holdings's Net Debt?

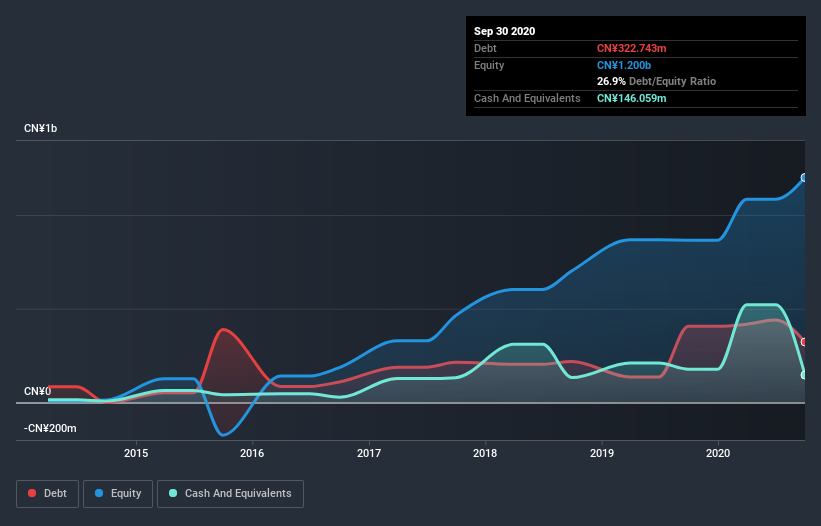

You can click the graphic below for the historical numbers, but it shows that Pizu Group Holdings had CN¥322.7m of debt in September 2020, down from CN¥406.2m, one year before. However, because it has a cash reserve of CN¥146.1m, its net debt is less, at about CN¥176.7m.

How Strong Is Pizu Group Holdings's Balance Sheet?

According to the last reported balance sheet, Pizu Group Holdings had liabilities of CN¥558.9m due within 12 months, and liabilities of CN¥60.7m due beyond 12 months. On the other hand, it had cash of CN¥146.1m and CN¥1.23b worth of receivables due within a year. So it can boast CN¥753.8m more liquid assets than total liabilities.

This surplus suggests that Pizu Group Holdings is using debt in a way that is appears to be both safe and conservative. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Pizu Group Holdings has a low net debt to EBITDA ratio of only 0.30. And its EBIT easily covers its interest expense, being 83.4 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. On top of that, Pizu Group Holdings grew its EBIT by 39% over the last twelve months, and that growth will make it easier to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Pizu Group Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Looking at the most recent three years, Pizu Group Holdings recorded free cash flow of 30% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

The good news is that Pizu Group Holdings's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But, on a more sombre note, we are a little concerned by its conversion of EBIT to free cash flow. Overall, we don't think Pizu Group Holdings is taking any bad risks, as its debt load seems modest. So we're not worried about the use of a little leverage on the balance sheet. Another factor that would give us confidence in Pizu Group Holdings would be if insiders have been buying shares: if you're conscious of that signal too, you can find out instantly by clicking this link.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Pizu Group Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:8053

Pizu Group Holdings

An investment holding company, engages in the manufactures, trades, and sales of civil explosives in the People's Republic of China and Tajikistan.

Good value with proven track record.

Market Insights

Community Narratives