- Hong Kong

- /

- Construction

- /

- SEHK:8021

The one-year earnings decline has likely contributed toWLS Holdings' (HKG:8021) shareholders losses of 61% over that period

The nature of investing is that you win some, and you lose some. And there's no doubt that WLS Holdings Limited (HKG:8021) stock has had a really bad year. The share price has slid 61% in that time. The silver lining (for longer term investors) is that the stock is still 3.0% higher than it was three years ago. Shareholders have had an even rougher run lately, with the share price down 39% in the last 90 days.

Since WLS Holdings has shed HK$57m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for WLS Holdings

WLS Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In just one year WLS Holdings saw its revenue fall by 29%. That looks pretty grim, at a glance. The share price drop of 61% is understandable given the company doesn't have profits to boast of. Having said that, if growth is coming in the future, the stock may have better days ahead. We have a natural aversion to companies that are losing money and shrinking revenue. But perhaps that is being too careful.

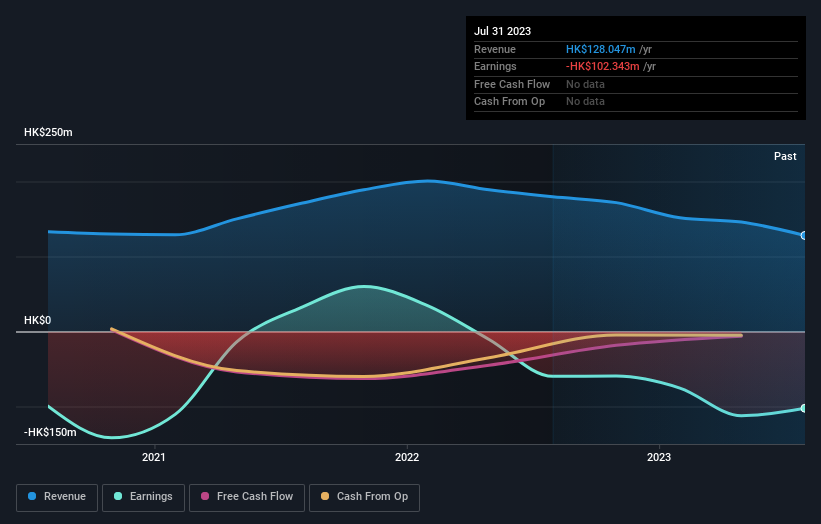

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on WLS Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

WLS Holdings shareholders are down 61% for the year, but the market itself is up 11%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 2% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for WLS Holdings (of which 1 doesn't sit too well with us!) you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if WLS Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8021

WLS Holdings

An investment holding company, provides scaffolding, fitting out, and other auxiliary services for the construction and building works businesses in Hong Kong.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives