- Hong Kong

- /

- Construction

- /

- SEHK:750

China Shuifa Singyes Energy Holdings Limited's (HKG:750) 49% Price Boost Is Out Of Tune With Revenues

China Shuifa Singyes Energy Holdings Limited (HKG:750) shareholders would be excited to see that the share price has had a great month, posting a 49% gain and recovering from prior weakness. Unfortunately, despite the strong performance over the last month, the full year gain of 7.3% isn't as attractive.

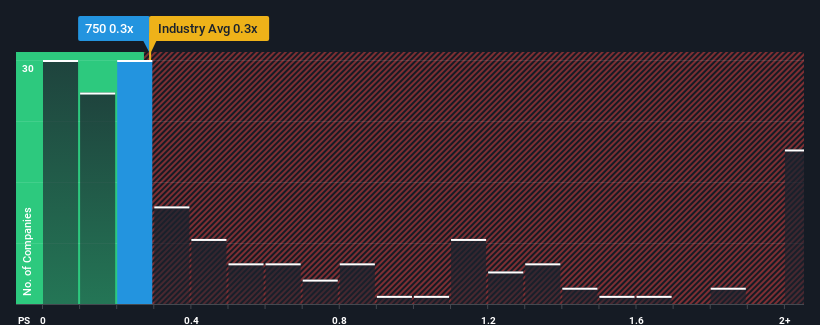

Although its price has surged higher, you could still be forgiven for feeling indifferent about China Shuifa Singyes Energy Holdings' P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Construction industry in Hong Kong is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for China Shuifa Singyes Energy Holdings

What Does China Shuifa Singyes Energy Holdings' Recent Performance Look Like?

For example, consider that China Shuifa Singyes Energy Holdings' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China Shuifa Singyes Energy Holdings will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

China Shuifa Singyes Energy Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. This means it has also seen a slide in revenue over the longer-term as revenue is down 41% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 10% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's somewhat alarming that China Shuifa Singyes Energy Holdings' P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On China Shuifa Singyes Energy Holdings' P/S

China Shuifa Singyes Energy Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at China Shuifa Singyes Energy Holdings revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

We don't want to rain on the parade too much, but we did also find 1 warning sign for China Shuifa Singyes Energy Holdings that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:750

China Shuifa Singyes Energy Holdings

An investment holding company, designs, fabricates, and installs conventional curtain walls in the People’s Republic of China.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives