- Hong Kong

- /

- Healthcare Services

- /

- SEHK:718

How Much Did Tai United Holdings'(HKG:718) Shareholders Earn From Share Price Movements Over The Last Three Years?

As every investor would know, not every swing hits the sweet spot. But you want to avoid the really big losses like the plague. So consider, for a moment, the misfortune of Tai United Holdings Limited (HKG:718) investors who have held the stock for three years as it declined a whopping 91%. That'd be enough to cause even the strongest minds some disquiet. And over the last year the share price fell 33%, so we doubt many shareholders are delighted.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Tai United Holdings

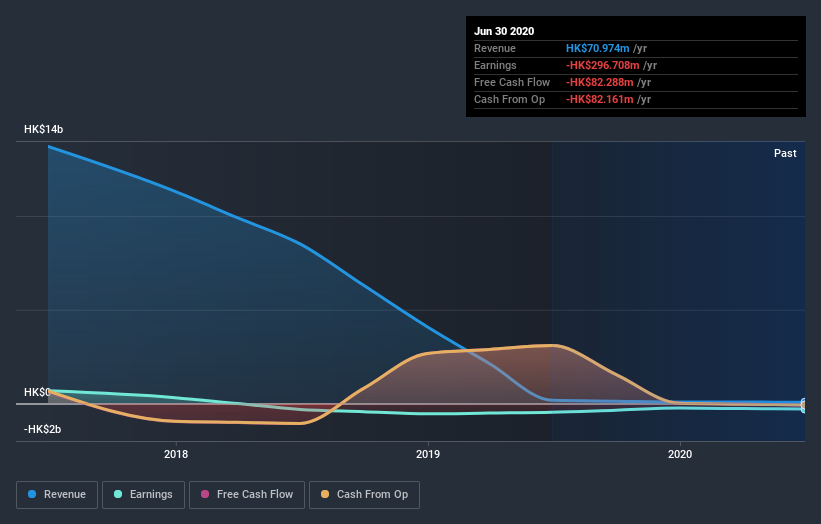

Because Tai United Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last three years Tai United Holdings saw its revenue shrink by 110% per year. That's definitely a weaker result than most pre-profit companies report. And as you might expect the share price has been weak too, dropping at a rate of 24% per year. We prefer leave it to clowns to try to catch falling knives, like this stock. There is a good reason that investors often describe buying a sharply falling stock price as 'trying to catch a falling knife'. Think about it.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Tai United Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Tai United Holdings' total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Tai United Holdings' TSR, which was a 77% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

Investors in Tai United Holdings had a tough year, with a total loss of 33%, against a market gain of about 26%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Tai United Holdings has 2 warning signs (and 1 which is concerning) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade Tai United Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Tai United Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tai United Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:718

Tai United Holdings

An investment holding company, primarily invests in properties in the People’s Republic of China, Singapore, the United States, the United Kingdom, the Republic of Mongolia, Australia, and Belgium.

Low with imperfect balance sheet.

Market Insights

Community Narratives